Question: Saved On May 1, 2021, Varga Tech Services signed a $117,000 consulting contract with Shaffer Holdings. The contract requires Varga to provide computer technology support

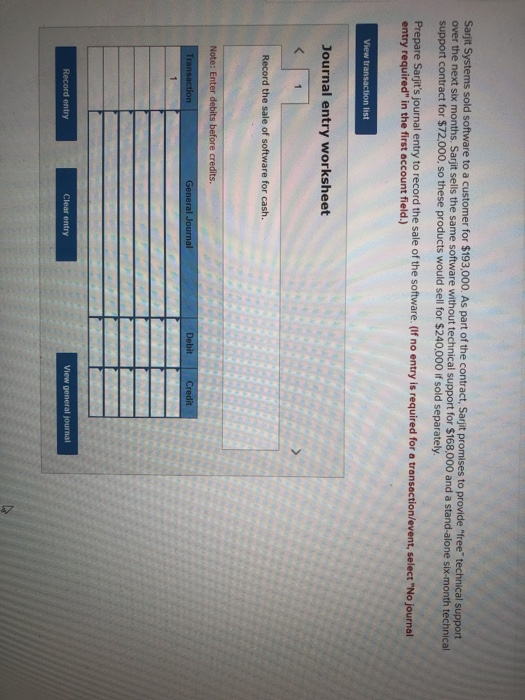

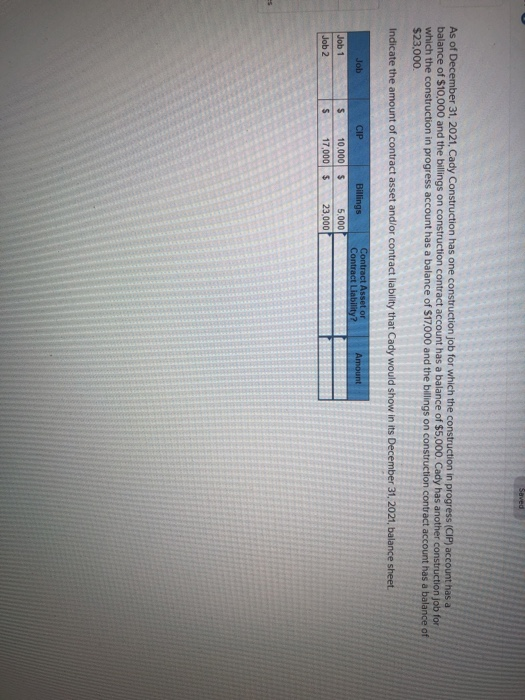

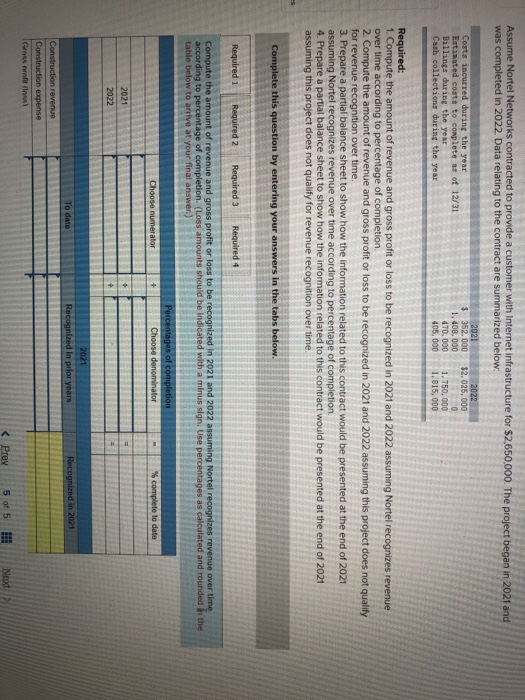

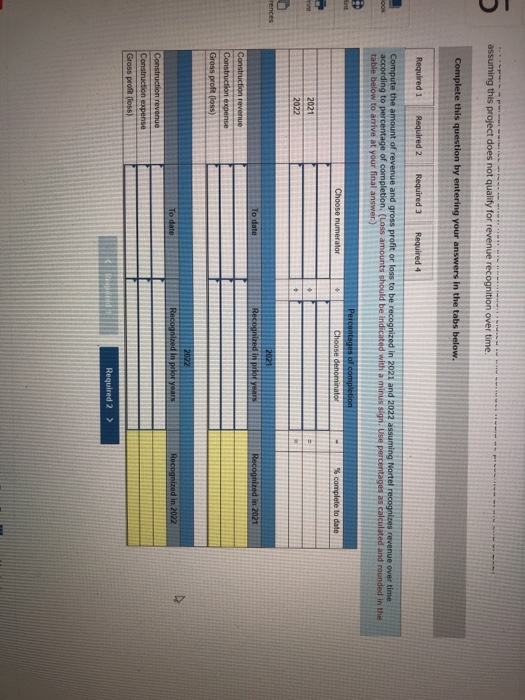

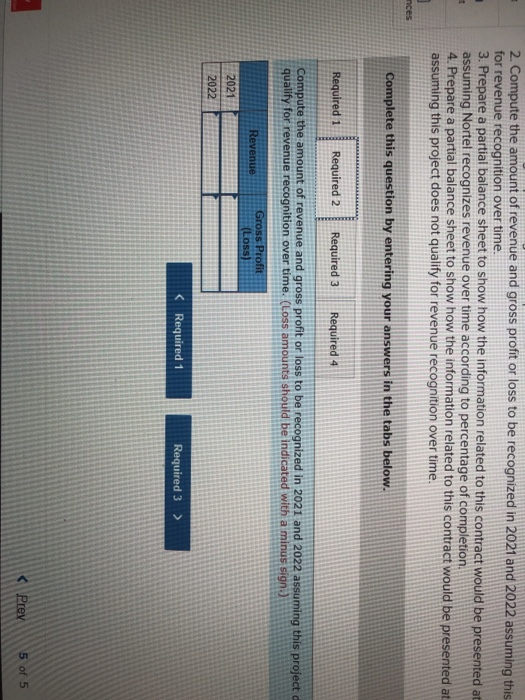

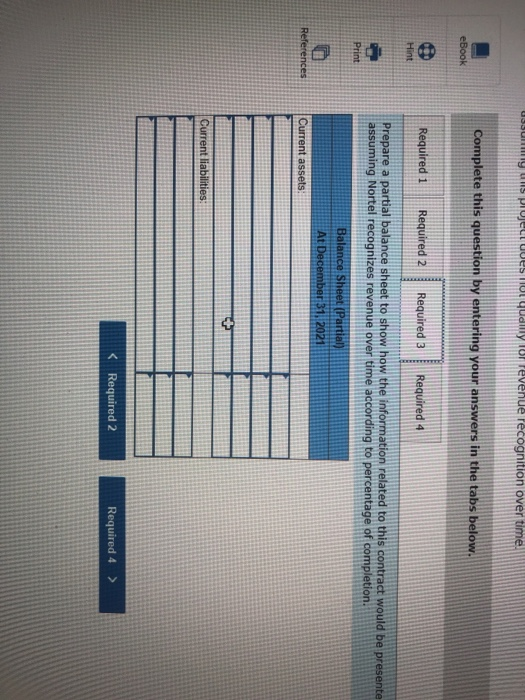

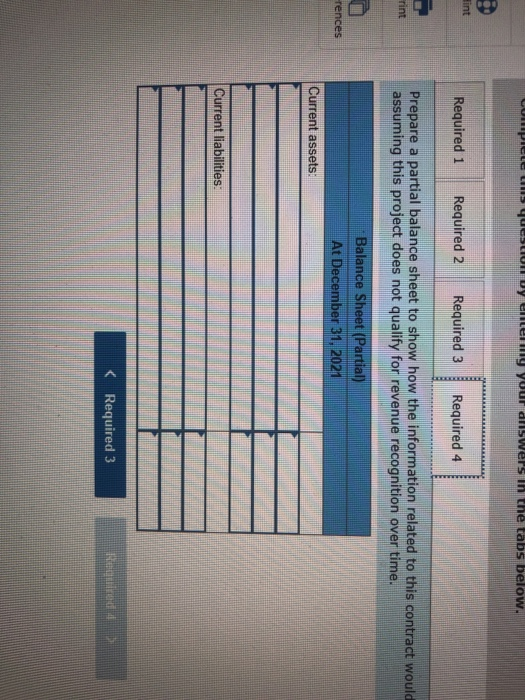

Saved On May 1, 2021, Varga Tech Services signed a $117,000 consulting contract with Shaffer Holdings. The contract requires Varga to provide computer technology support services whenever requested over the period from May 1, 2021, to April 30, 2022 with Shaffer paying the entire $117,000 on May 1, 2021. How much revenue should Varga recognize in 2021? (Do not round intermediate calculation.) Revenue Sarjit Systems sold software to a customer for $193,000. As part of the contract, Sarjit promises to provide "free" technical support over the next six months. Sarjit sells the same software without technical support for $168,000 and a stand-alone six-month technical support contract for $72,000, so these products would sell for $240,000 if sold separately. Prepare Sarjit's journal entry to record the sale of the software. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet Record the sale of software for cash. Note: Enter debits before credits. Transaction General Journal Debit Credit Record entry Clear entry View general journal Assume that Amazon.com sells the MacBook Pro, a computer produced by Apple, for a retail price of $1,530. Amazon arranges its operations such that customers receive products directly from Apple Stores rather than Amazon. Customers purchase from Amazon using credit cards, and Amazon forwards cash to Apple equal to the retail price minus a $153 commission that Amazon keeps In this arrangement, how much revenue will Amazon recognize for the sale of one MacBook Pro? Revenue Soved As of December 31, 2021. Cady Construction has one construction job for which the construction in progress (CIP) account has a balance of $10,000 and the billings on construction contract account has a balance of $5,000. Cady has another construction job for which the construction in progress account has a balance of $17.000 and the billings on construction contract account has a balance of $23,000 Indicate the amount of contract asset and/or contract liability that Cady would show in its December 31, 2021, balance sheet. Job CIP Contract Asset or Contract Liability Amount Job 1 5 10 000 $ 17,000 $ Billings 5,000 23,000 Job 2 $ Assume Nortel Networks contracted to provide a customer with Internet infrastructure for $2,650,000. The project began in 2021 and was completed in 2022. Data relating to the contract are summarized below: Costs incurred during the year Estimated costs to complete as of 12/31 Billings during the year Cash collections during the year 2021 $ 352.000 1,408.000 470.000 405.000 2022 $2.025.000 0 1.750.000 1.815,000 Required: 1. Compute the amount of revenue and gross profit or loss to be recognized in 2021 and 2022 assuming Nortel recognizes revenue over time according to percentage of completion. 2. Compute the amount of revenue and gross profit or loss to be recognized in 2021 and 2022 assuming this project does not quality for revenue recognition over time. 3. Prepare a partial balance sheet to show how the information related to this contract would be presented at the end of 2021 assuming Nortel recognizes revenue over time according to percentage of completion 4. Prepare a partial balance sheet to show how the information related to this contract would be presented at the end of 2021 assuming this project does not qualify for revenue recognition over time. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Compute the amount of revenue and gross profit or loss to be recognized in 2021 and 2022 assuming Nortel recognizes revenue over time according to percentage of completion. (Loss amounts should be indicated with a minus sign. Use percentages as calculated and rounded in the table below to arrive at your final answer.) Percentages of completion Choose denominator Choose numerator + % complete to date + = 2021 2022 2021 Recognized in prior years To date Recognized in 2021 Construction revenue Construction expense Gross mit den 2. Compute the amount of revenue and gross profit or loss to be recognized in 2021 and 2022 assuming this for revenue recognition over time. 3. Prepare a partial balance sheet to show how the information related to this contract would be presented at assuming Nortel recognizes revenue over time according to percentage of completion. 4. Prepare a partial balance sheet to show how the information related to this contract would be presented at assuming this project does not qualify for revenue recognition over time. t nces Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Compute the amount of revenue and gross profit or loss to be recognized in 2021 and 2022 assuming this project qualify for revenue recognition over time. (Loss amounts should be indicated with a minus sign.) Revenue Gross Profit (Loss) 2021 2022 Complete us quebun Dy lleny your diiswers in the tabs below. Hint Required 1 Required 2 Required 3 Required 4 Tint Prepare a partial balance sheet to show how the information related to this contract would assuming this project does not qualify for revenue recognition over time. Balance Sheet (Partial) At December 31, 2021 rences Current assets: Current liabilities:

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts