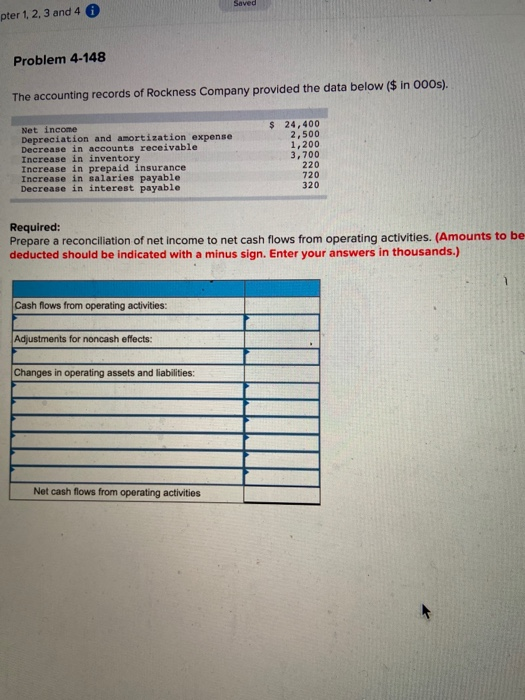

Question: Saved pter 1, 2, 3 and 4 Problem 4-148 The accounting records of Rockness Company provided the data below ($ in 000s). Net income Depreciation

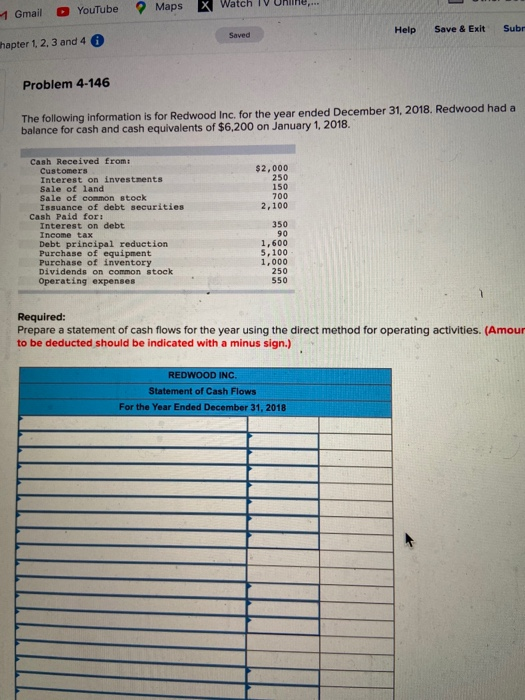

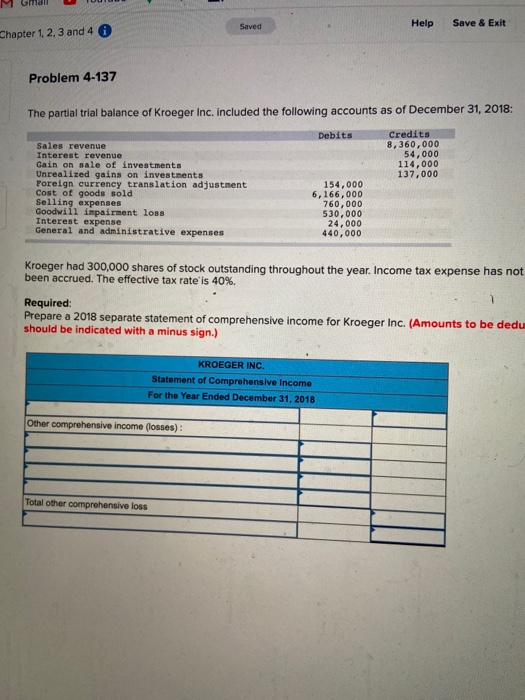

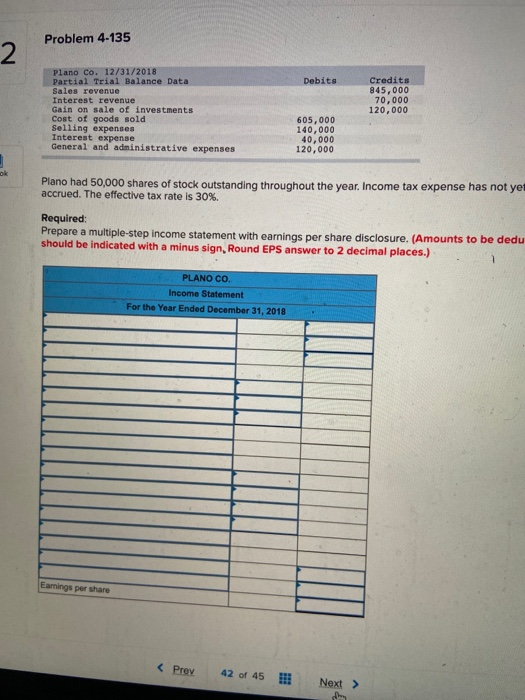

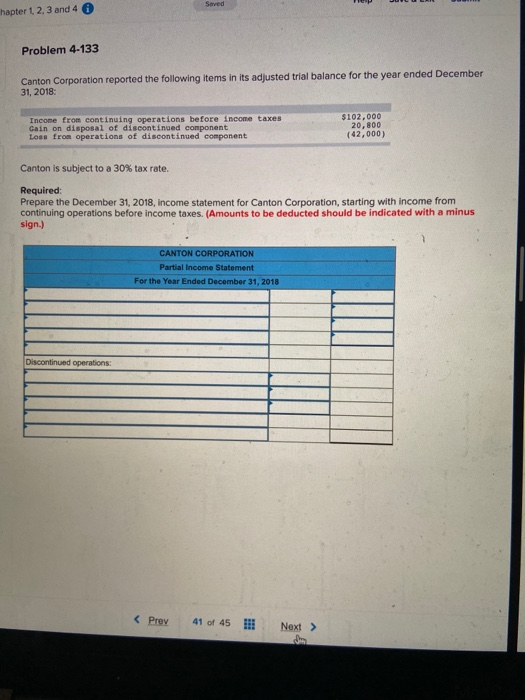

Saved pter 1, 2, 3 and 4 Problem 4-148 The accounting records of Rockness Company provided the data below ($ in 000s). Net income Depreciation and amortization expense Decrease in accounts receivable Increase in inventory Increase in prepaid insurance Increase in salaries payable Decrease in interest payable $ 24,400 2,500 1,200 3,700 220 720 320 Required: Prepare a reconciliation of net income to net cash flows from operating activities. (Amounts to be deducted should be indicated with a minus sign. Enter your answers in thousands.) Cash flows from operating activities: Adjustments for noncash effects: Changes in operating assets and liabilities: Net cash flows from operating activities D YouTube Maps 1 Gmail x Watch IV Help Save & Exit Subr Saved hapter 1 2. 3 and 4 Problem 4-146 The following information is for Redwood Inc. for the year ended December 31, 2018. Redwood had a balance for cash and cash equivalents of $6,200 on January 1, 2018. $2,000 250 150 700 2,100 Cash Received from Customers Interest on investments Sale of land Sale of common stock Issuance of debt securities Cash Paid for: Interest on debt Income tax Debt principal reduction Purchase of equipment Purchase of inventory Dividends on common stock Operating expenses 350 90 1,600 5,100 1,000 250 550 Required: Prepare a statement of cash flows for the year using the direct method for operating activities. (Amour to be deducted should be indicated with a minus sign.) REDWOOD INC Statement of Cash Flows For the Year Ended December 31, 2018 Saved Help Save & Exit Chapter 1 2,3 and 4 0 Problem 4-137 The partial trial balance of Kroeger Inc. included the following accounts as of December 31, 2018: Debits Credits 8,360,000 54,000 114,000 137,000 Sales revenue Interest revenue Gain on sale of investments Unrealized gains on investments Foreign currency translation adjustment Cost of goods sold Selling expenses Goodwill impairment loss Interest expense General and administrative expenses 154,000 6,166,000 760,000 530,000 24,000 440,000 Kroeger had 300,000 shares of stock outstanding throughout the year. Income tax expense has not been accrued. The effective tax rate'is 40%. Required: Prepare a 2018 separate statement of comprehensive income for Kroeger Inc. (Amounts to be dedu should be indicated with a minus sign.) KROEGER INC. Statement of Comprehensive Income For the Year Ended December 31, 2018 Other comprehensive income (losses): Total other comprehensive loss Problem 4-135 2 Debita Plano Co. 12/31/2018 Partial Trial Balance Data Sales revenue Interest revenue Gain on sale of investments Cost of goods sold Selling expenses Interest expense General and administrative expenses Credits 845,000 70,000 120,000 605,000 140,000 40,000 120,000 2 ok Plano had 50,000 shares of stock outstanding throughout the year. Income tax expense has not yet accrued. The effective tax rate is 30%. Required: Prepare a multiple-step income statement with earnings per share disclosure. (Amounts to be dedu should be indicated with a minus sign, Round EPS answer to 2 decimal places.) PLANO CO. Income Statement For the Year Ended December 31, 2018 Earings per share Saved hapter 1 2,3 and 4 Problem 4-133 Canton Corporation reported the following items in its adjusted trial balance for the year ended December 31, 2018 Income from continuing operations before income taxes Gain on disposal of discontinued component Loss from operations of discontinued component $102,000 20,800 (42,000) Canton is subject to a 30% tax rate. Required: Prepare the December 31, 2018, income statement for Canton Corporation, starting with income from continuing operations before income taxes. (Amounts to be deducted should be indicated with a minus sign.) CANTON CORPORATION Partial Income Statement For the Year Ended December 31, 2018 Discontinued operations:

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts