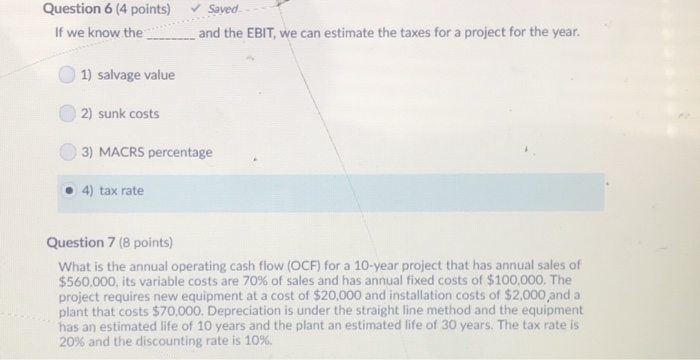

Question: Saved Question 6(4 points) and the EBIT, we can estimate the taxes for a project for the year. If we know the 1) salvage value

Saved Question 6(4 points) and the EBIT, we can estimate the taxes for a project for the year. If we know the 1) salvage value 2) sunk costs 3) MACRS percentage 4) tax rate Question 7 (8 points) What is the annual operating cash flow (OCF) for a 10-year project that has annual sales of $560,000, its variable costs are 70 % of sales and has annual fixed costs of $100,000. The project requires new equipment at a cost of $20,000 and installation costs of $2,000 and plant that costs $70,000. Depreciation is under the straight line method and the equipment has an estimated life of 10 years and the plant an estimated life of 30 years. The tax rate is 20% and the discounting rate is 10 % a

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts