Question: Saved QUESTION 82 1 points Volusia, Inc. is a U.S.-based exporting firm that expects to receive payments denominated in both euros and Canadian dollars in

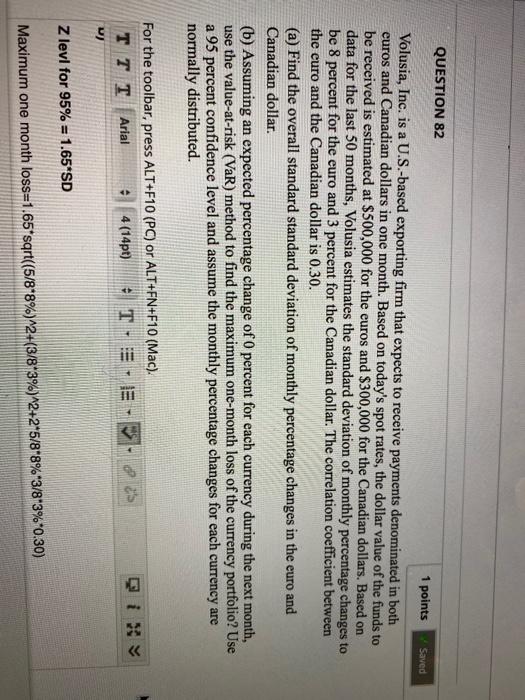

Saved QUESTION 82 1 points Volusia, Inc. is a U.S.-based exporting firm that expects to receive payments denominated in both euros and Canadian dollars in one month. Based on today's spot rates, the dollar value of the funds to be received is estimated at $500,000 for the curos and $300,000 for the Canadian dollars. Based on data for the last 50 months, Volusia estimates the standard deviation of monthly percentage changes to be 8 percent for the euro and 3 percent for the Canadian dollar. The correlation coefficient between the curo and the Canadian dollar is 0.30. (a) Find the overall standard standard deviation of monthly percentage changes in the euro and Canadian dollar. (b) Assuming an expected percentage change of 0 percent for each currency during the next month, use the value-at-risk (VaR) method to find the maximum one-month loss of the currency portfolio? Use a 95 percent confidence level and assume the monthly percentage changes for each currency are normally distributed For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). TT T Arial 4 (14pt) TE Z levi for 95% = 1.65*SD Maximum one month loss=1.65 sqrt((5/8*8%)^2+(3/8*3%)^2+25/8*8% 3/8-3%0.30)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts