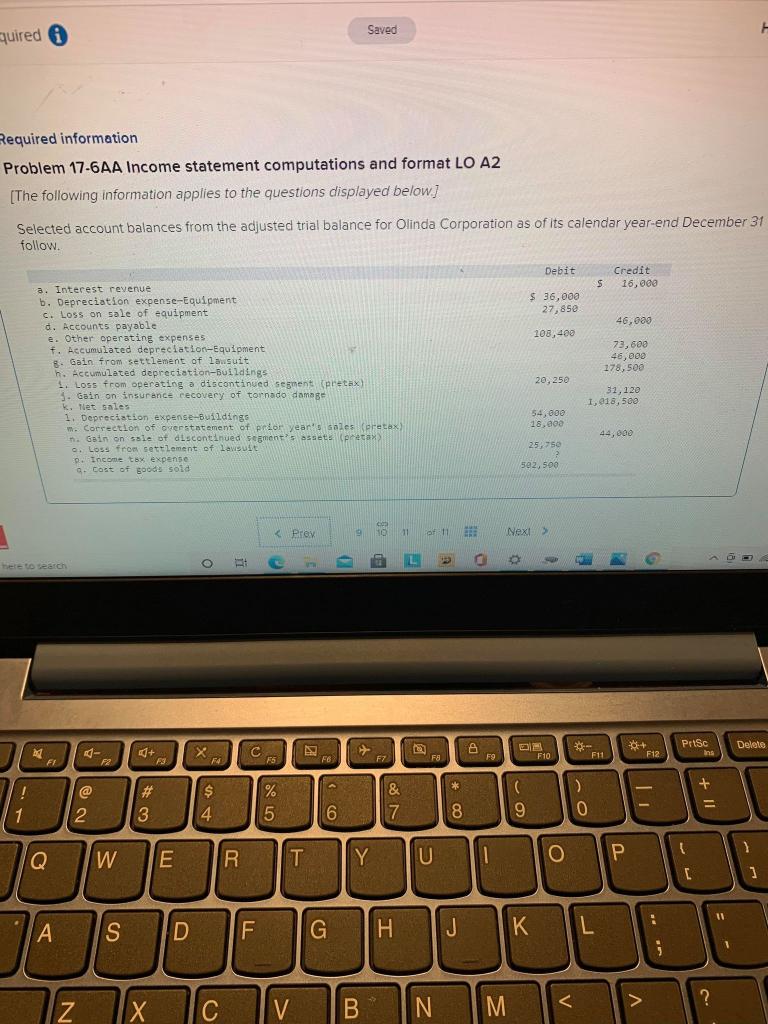

Question: Saved quired Required information Problem 17-6AA Income statement computations and format LO A2 [The following information applies to the questions displayed below] Selected account balances

![LO A2 [The following information applies to the questions displayed below] Selected](https://s3.amazonaws.com/si.experts.images/answers/2024/09/66dccdebab64c_66766dccdeb2978b.jpg)

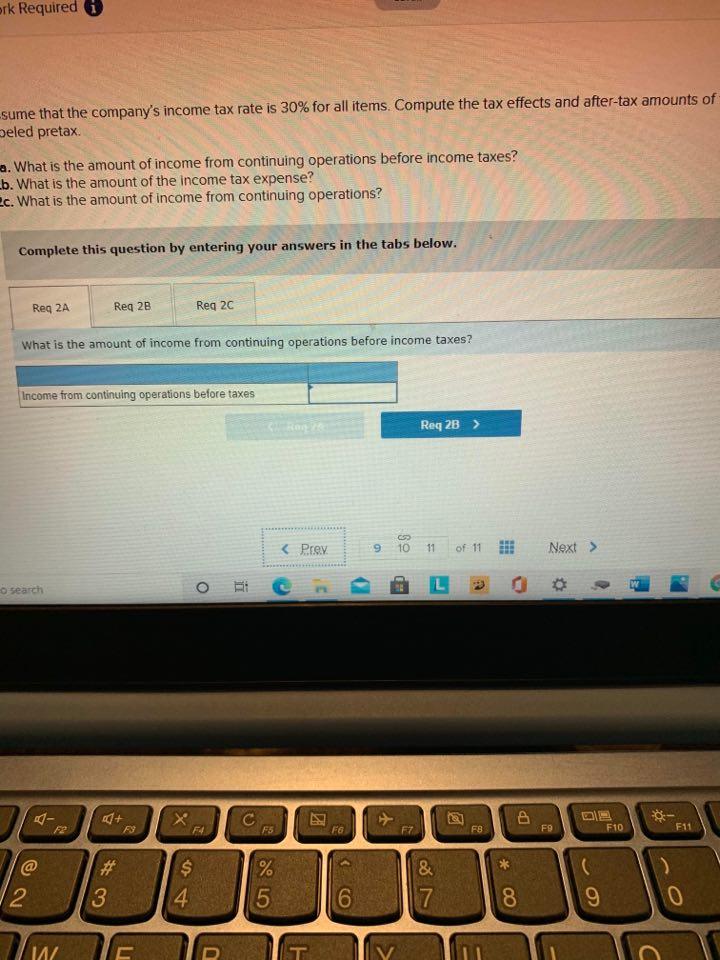

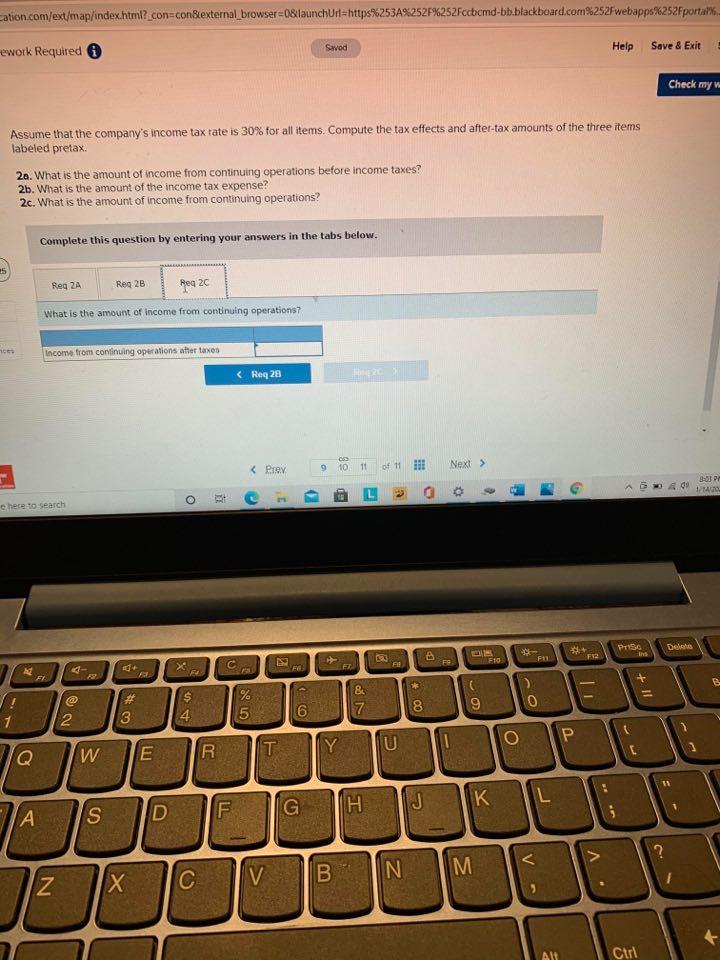

Saved quired Required information Problem 17-6AA Income statement computations and format LO A2 [The following information applies to the questions displayed below] Selected account balances from the adjusted trial balance for Olinda Corporation as of its calendar year-end December 31 follow Debit Credit 16,000 S $ 36,000 27,850 46,000 108, 400 73,600 46,000 178,500 a. Interest revenue b. Depreciation expense-Equipment c. Loss on sale of equipment d. Accounts payable e. Other operating expenses f. Accumulated depreciation Equipment 8. Gain from settlement of lawsuit h. Accumulated depreciation-Buildings 1. Loss from operating a discontinued segment Caretax) 5. Gain on insurance cecovery of tornado damage k. Tet sales 1. Depreciation expense-Buildings m. Correction of overstatement of prior year's sales (pretex) nh. Gain on sale of discontinued segments assets preta 2. Los from settlement of Lawsuit Income tax expense 9. Cost of goods sold 20, 250 31,120 1, 218,500 54,000 18,000 44,000 25,750 502, 500 A PISC CS Delete + F6 F9 P2 F10 F11 F F12 * + @ # 3 $ 4 % 5 16 & 17 ) O "T 1 2 8 9 ) Q W E R T Y 1 O [ ] : A S D F G H J K L j 1 Z X B ? M N ork Required sume that the company's income tax rate is 30% for all items. Compute the tax effects and after-tax amounts of Deled pretax a. What is the amount of income from continuing operations before income taxes? b. What is the amount of the income tax expense? Ec. What is the amount of income from continuing operations? Complete this question by entering your answers in the tabs below. Req 2A Reg 26 Req 2c What is the amount of income from continuing operations before income taxes? Income from continuing operations before taxes Copy Req 2B > o search - X F A 12 F5 F G F7 F8 F9 F10 F11 . $ * $ 4 % 5 & 7 2 3 6 8 9 0 T ork Required sume that the company's income tax rate is 30% for all items. Compute the tax effects and after-tax amounts of Deled pretax a. What is the amount of income from continuing operations before income taxes? b. What is the amount of the income tax expense? Ec. What is the amount of income from continuing operations? Complete this question by entering your answers in the tabs below. Req 2A Reg 26 Req 2c What is the amount of income from continuing operations before income taxes? Income from continuing operations before taxes Copy Req 2B > o search - X F A 12 F5 F G F7 F8 F9 F10 F11 . $ * $ 4 % 5 & 7 2 3 6 8 9 0 T Cation.com/ext/map/index.html?_con=conexternal_browser=0&launchUrl=https%253A%252F%252Fccbcmd-bb.blackboard.com%252Fwebapps%252Fportar%. Help Savod ework Required Save & Exit Check my w Assume that the company's income tax rate is 30% for all items. Compute the tax effects and after-tax amounts of the three items labeled pretax 20. What is the amount of income from continuing operations before income taxes? 2b. What is the amount of the income tax expense? 2c. What is the amount of income from continuing operations? Complete this question by entering your answers in the tabs below. 25 Reg 2A Reg 2B Reg 2C What is the amount of income from continuing operations? Income from continuing operations after taxes . G de BODE 1.140 o here to search PSC Dials F10 F12 F X F @ % 5 0 ) + 11 W* & 7 COM 8 0 4 1 2 P T Y U O Q W R E J K H G D S F > A PISC CS Delete + F6 F9 P2 F10 F11 F F12 * + @ # 3 $ 4 % 5 16 & 17 ) O "T 1 2 8 9 ) Q W E R T Y 1 O [ ] : A S D F G H J K L j 1 Z X B ? M N ork Required sume that the company's income tax rate is 30% for all items. Compute the tax effects and after-tax amounts of Deled pretax a. What is the amount of income from continuing operations before income taxes? b. What is the amount of the income tax expense? Ec. What is the amount of income from continuing operations? Complete this question by entering your answers in the tabs below. Req 2A Reg 26 Req 2c What is the amount of income from continuing operations before income taxes? Income from continuing operations before taxes Copy Req 2B > o search - X F A 12 F5 F G F7 F8 F9 F10 F11 . $ * $ 4 % 5 & 7 2 3 6 8 9 0 T ork Required sume that the company's income tax rate is 30% for all items. Compute the tax effects and after-tax amounts of Deled pretax a. What is the amount of income from continuing operations before income taxes? b. What is the amount of the income tax expense? Ec. What is the amount of income from continuing operations? Complete this question by entering your answers in the tabs below. Req 2A Reg 26 Req 2c What is the amount of income from continuing operations before income taxes? Income from continuing operations before taxes Copy Req 2B > o search - X F A 12 F5 F G F7 F8 F9 F10 F11 . $ * $ 4 % 5 & 7 2 3 6 8 9 0 T Cation.com/ext/map/index.html?_con=conexternal_browser=0&launchUrl=https%253A%252F%252Fccbcmd-bb.blackboard.com%252Fwebapps%252Fportar%. Help Savod ework Required Save & Exit Check my w Assume that the company's income tax rate is 30% for all items. Compute the tax effects and after-tax amounts of the three items labeled pretax 20. What is the amount of income from continuing operations before income taxes? 2b. What is the amount of the income tax expense? 2c. What is the amount of income from continuing operations? Complete this question by entering your answers in the tabs below. 25 Reg 2A Reg 2B Reg 2C What is the amount of income from continuing operations? Income from continuing operations after taxes . G de BODE 1.140 o here to search PSC Dials F10 F12 F X F @ % 5 0 ) + 11 W* & 7 COM 8 0 4 1 2 P T Y U O Q W R E J K H G D S F >

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts