Question: Saved Save & Exit Su Ch6 - LT Asset Purchase (DON'T... O Help Refer to the OLA - Chapter 6 - Question Information posted in

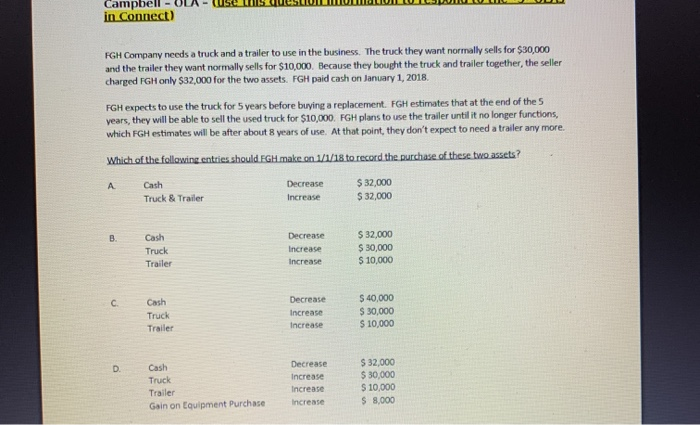

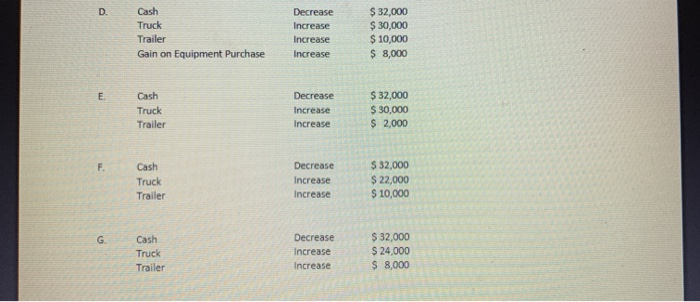

Saved Save & Exit Su Ch6 - LT Asset Purchase (DON'T... O Help Refer to the "OLA - Chapter 6 - Question Information" posted in D2L. Think about what you learned in the early chapters about recording the purchase of assets such as Land or Supplies. Then select the letter that matches the choice on the question sheet that you think is the correct entry to be made in the situation described. Multiple Choice A B Campbell in Connect) KGH Company needs a truck and a trailer to use in the business. The truck they want normally sells for $30,000 and the trailer they want normally sells for $10,000. Because they bought the truck and trailer together, the seller charged FGH only $32,000 for the two assets. FGH paid cash on January 1, 2018. FGH expects to use the truck for 5 years before buying a replacement. FGH estimates that at the end of the years, they will be able to sell the used truck for $10,000 EGH plans to use the trailer until it no longer functions, which FGH estimates will be after about 8 years of use. At that point, they don't expect to need a trailer any more. Which of the following entries should. EGH.make on 1/1/18 to record the purchase of these two assets? Cash Truck & Trailer Decrease Increase $ 32,000 $ 32,000 Cash Truck Trailer Decrease Increase Increase $ 32,000 $ 30,000 $ 10,000 Cash Truck Trailer Decrease Increase Increase $ 40,000 $ 30,000 $ 10,000 D Cash Truck Trailer Gain on Equipment Purchase Decrease Increase Increase Increase $ 32,000 $ 30,000 $ 10,000 $ 8,000 D Cash Truck Trailer Gain on Equipment Purchase Decrease Increase Increase Increase $ 32,000 $ 30,000 $ 10,000 $ 8,000 E Cash Truck Trailer Decrease Increase Increase $ 32,000 $ 30,000 $ 2,000 F Cash Truck Trailer Decrease Increase Increase $ 32,000 $ 22,000 $ 10,000 G Cash Truck Trailer Decrease Increase Increase $ 32,000 $ 24,000 $ 8,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts