Question: Saved This question will be sent to your instructor for grading. 1 AI / CT 2 0 - 8 3 ( LO 2 0 -

Saved

This question will be sent to your instructor for grading.

AICTLO

points

Skipped

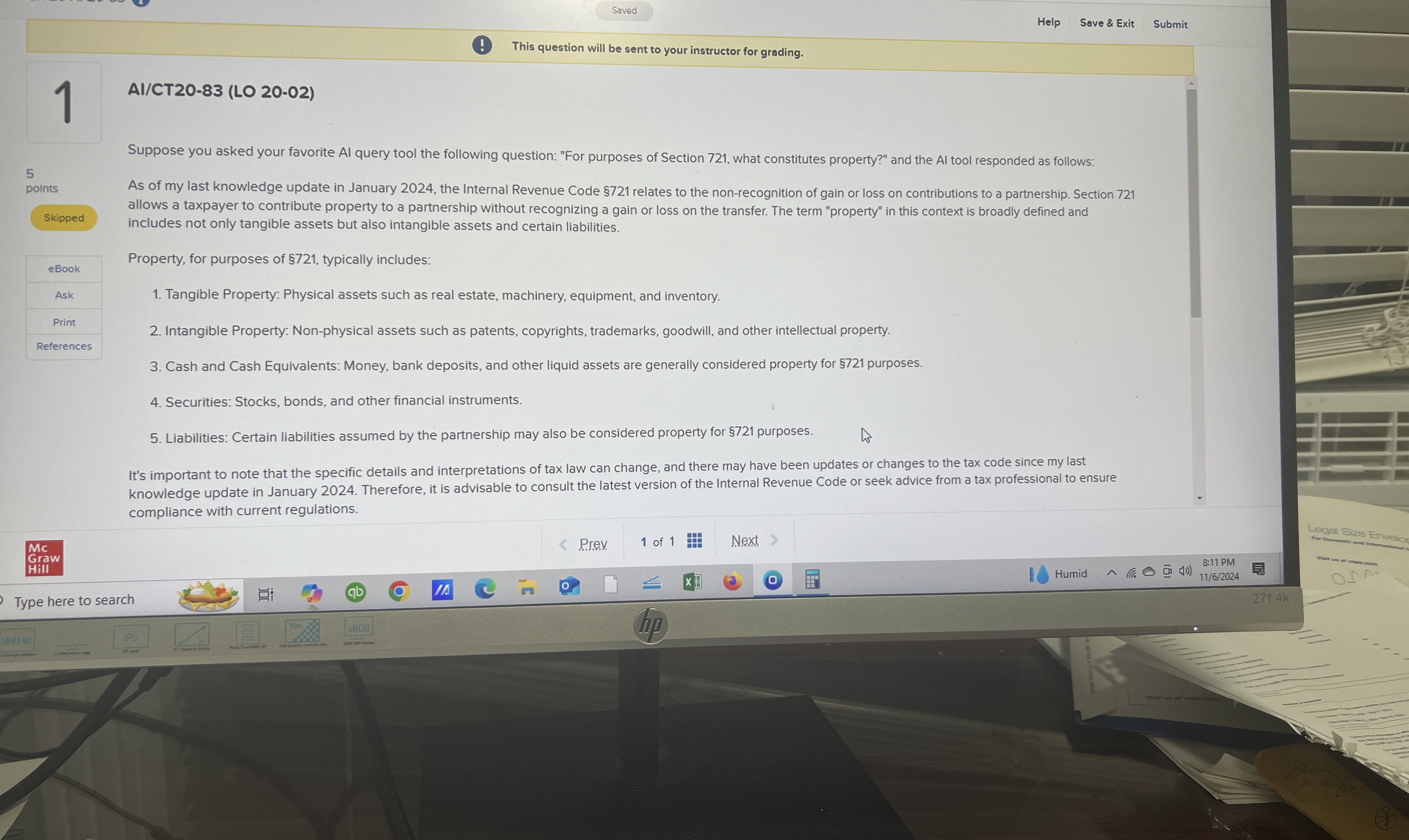

Suppose you asked your favorite AI query tool the following question: "For purposes of Section what constitutes property?" and the Al tool responded as follows:

eBook

Ask

Print

References

As of my last knowledge update in January the Internal Revenue Code relates to the nonrecognition of gain or loss on contributions to a partnership. Section allows a taxpayer to contribute property to a partnership without recognizing a gain or loss on the transfer. The term "property" in this context is broadly defined and includes not only tangible assets but also intangible assets and certain liabilities.

Property, for purposes of $ typically includes:

Tangible Property: Physical assets such as real estate, machinery, equipment, and inventory.

Intangible Property: Nonphysical assets such as patents, copyrights, trademarks, goodwill, and other intellectual property.

Cash and Cash Equivalents: Money, bank deposits, and other liquid assets are generally considered property for purposes.

Securities: Stocks, bonds, and other financial instruments.

Liabilities: Certain liabilities assumed by the partnership may also be considered property for purposes.

It's important to note that the specific details and interpretations of tax law can change, and there may have been updates or changes to the tax code since my last knowledge update in January Therefore, it is advisable to consult the latest version of the Internal Revenue Code or seek advice from a tax professional to ensure compliance with current regulations.

Mc

Graw

Prev.

of

Next

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock