Question: Saveu Help Save & EXIT Submit Check my work E8-21 Computing and Reporting the Acquisition and Amortization of Three Different Intangible Assets LO8-6 Springer Company

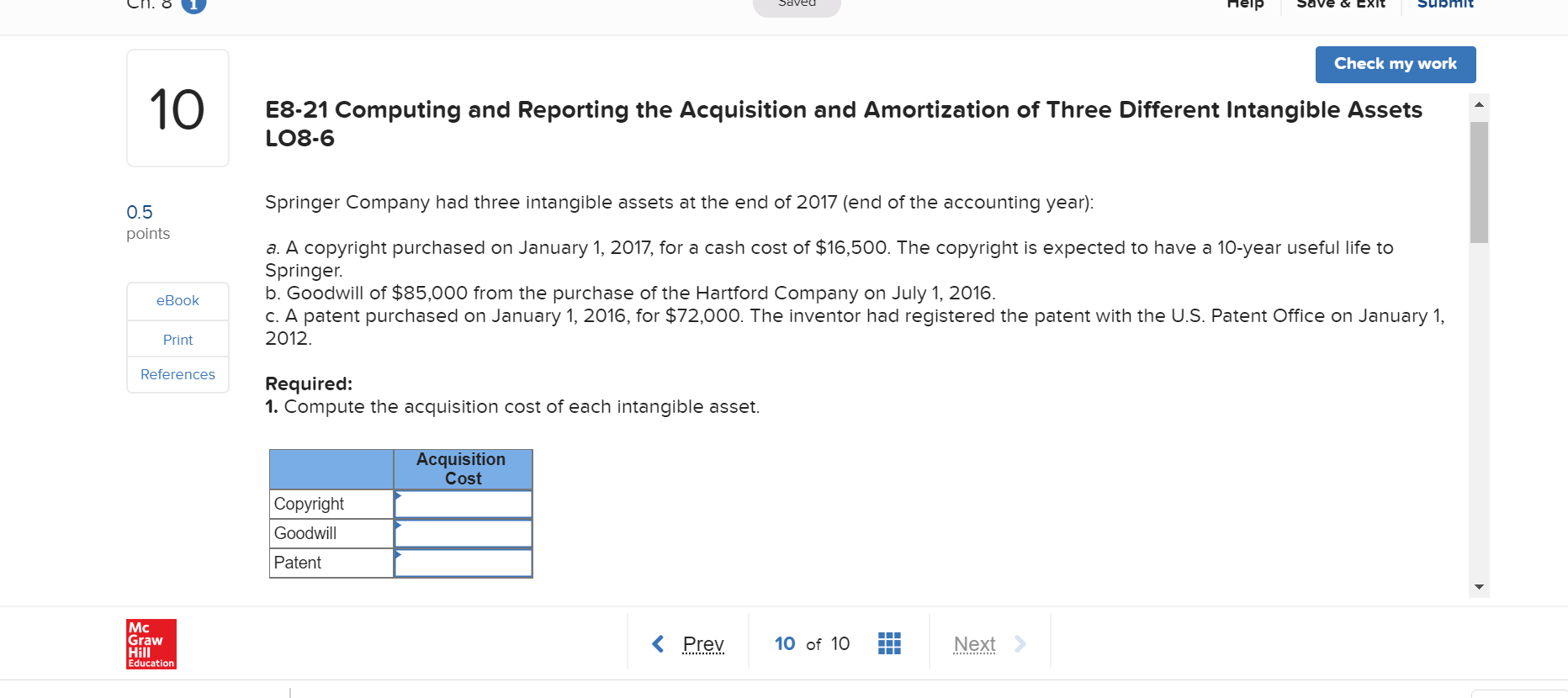

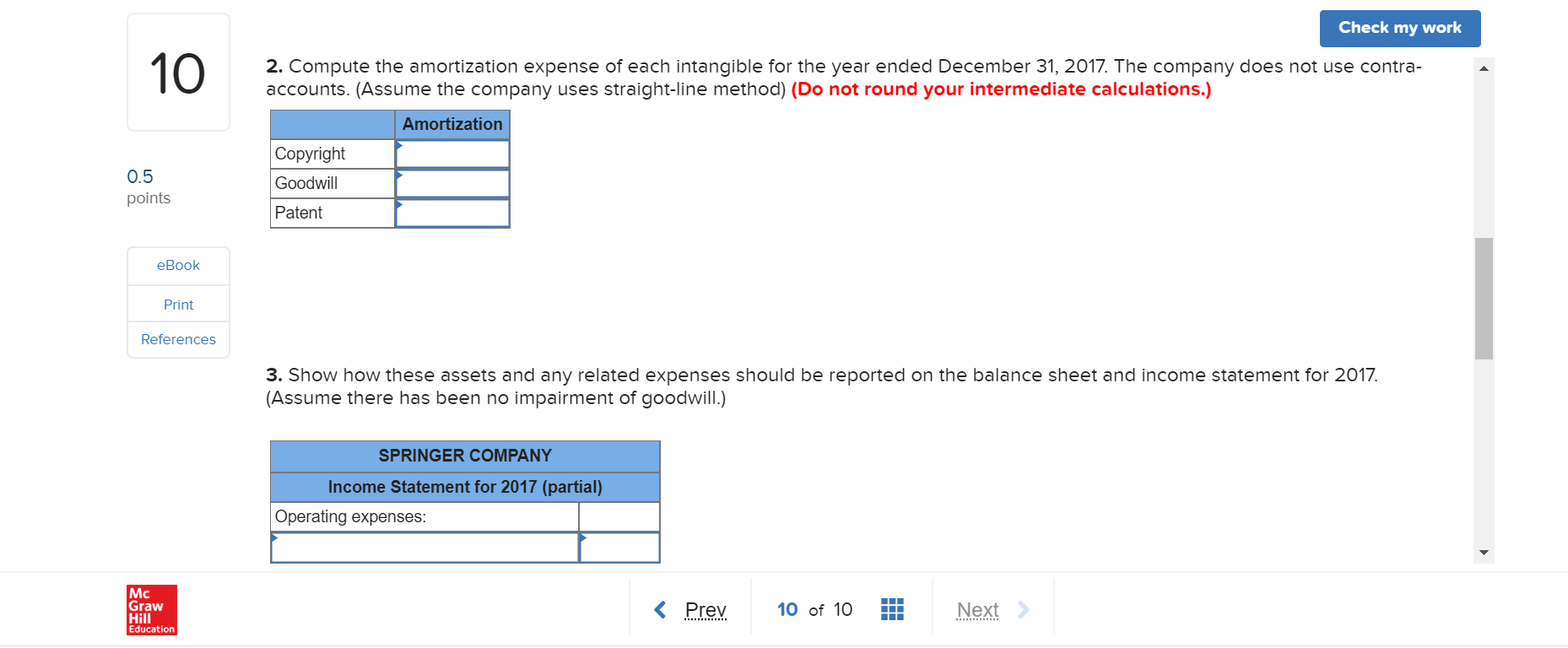

Saveu Help Save & EXIT Submit Check my work E8-21 Computing and Reporting the Acquisition and Amortization of Three Different Intangible Assets LO8-6 Springer Company had three intangible assets at the end of 2017 (end of the accounting year): 0.5 points a. A copyright purchased on January 1, 2017, for a cash cost of $16,500. The copyright is expected to have a 10-year useful life to Springer. b. Goodwill of $85,000 from the purchase of the Hartford Company on July 1, 2016. c. A patent purchased on January 1, 2016, for $72,000. The inventor had registered the patent with the U.S. Patent Office on January 1, 2012. eBook Print References Required: 1. Compute the acquisition cost of each intangible asset. Acquisition Cost Copyright Goodwill Patent Mc Graw Hill Education Check my work 2. Compute the amortization expense of each intangible for the year ended December 31, 2017. The company does not use contra- accounts. (Assume the company uses straight-line method) (Do not round your intermediate calculations.) Amortization 0.5 points Copyright Goodwill Patent eBook Print References 3. Show how these assets and any related expenses should be reported on the balance sheet and income statement for 2017. (Assume there has been no impairment of goodwill.) SPRINGER COMPANY Income Statement for 2017 (partial) Operating expenses: Mc Graw Hill Education

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts