Saville Sdn. Bhd. is a resident manufacturing company with a share capital of RM1 million. The...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

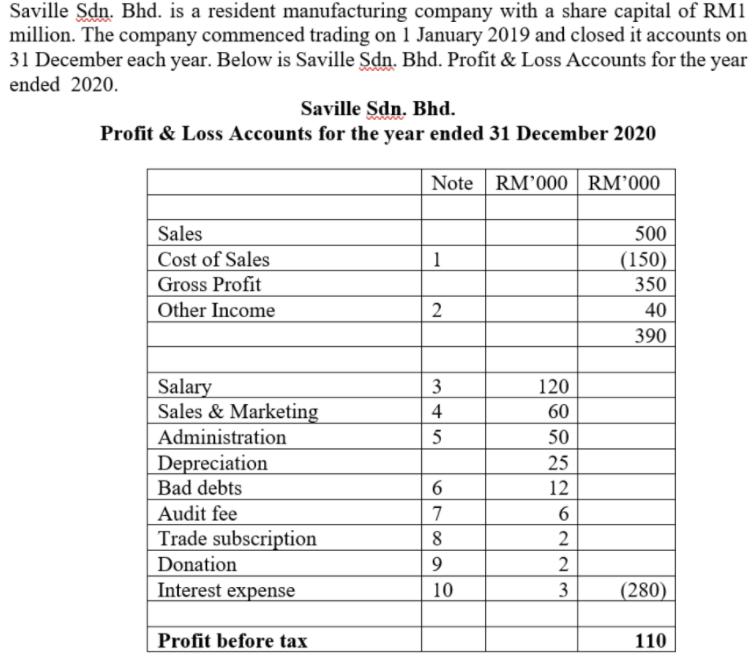

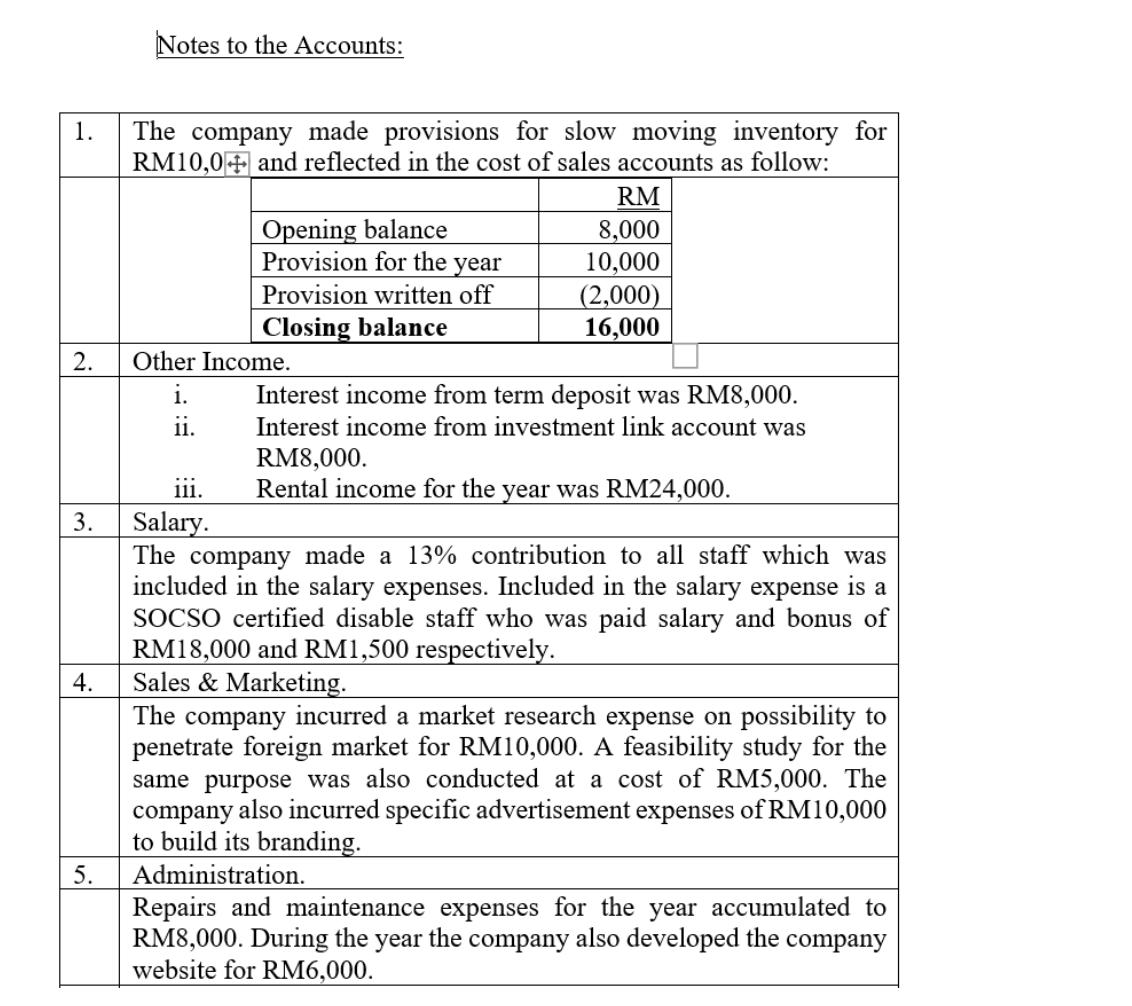

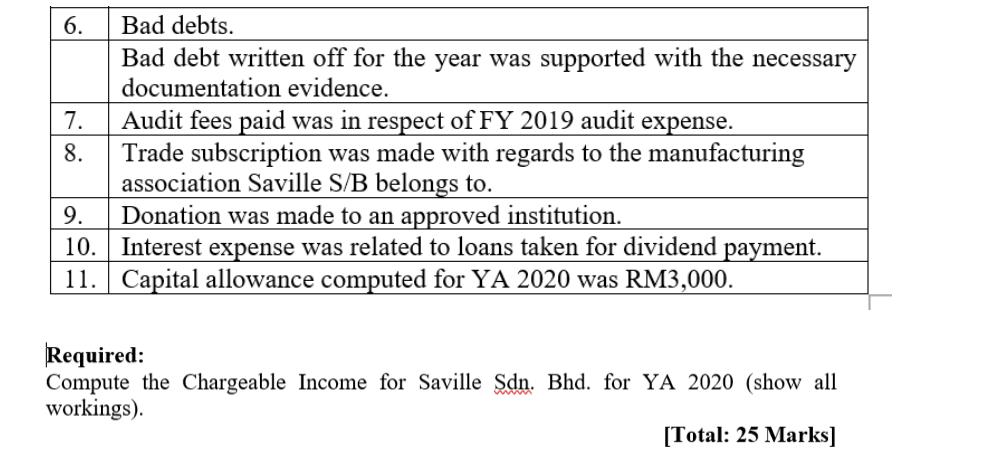

Saville Sdn. Bhd. is a resident manufacturing company with a share capital of RM1 million. The company commenced trading on 1 January 2019 and closed it accounts on 31 December each year. Below is Saville Sdn. Bhd. Profit & Loss Accounts for the year ended 2020. Saville Sdn. Bhd. Profit & Loss Accounts for the year ended 31 December 2020 Note RM'000 RM'000 Sales 500 Cost of Sales 1 (150) Gross Profit 350 Other Income 2 40 390 Salary Sales & Marketing Administration Depreciation Bad debts Audit fee Trade subscription Donation Interest expense Profit before tax 345 3 679 6 8 9 10 120 60 50 25 12 6 2 2 3 (280) 110 Notes to the Accounts: 1. The company made provisions for slow moving inventory for RM10,0 and reflected in the cost of sales accounts as follow: RM 8,000 Opening balance Provision for the year 10,000 Provision written off (2,000) Closing balance 16,000 Other Income. 1. 11. Interest income from term deposit was RM8,000. Interest income from investment link account was RM8,000. 111. Rental income for the year was RM24,000. Salary. The company made a 13% contribution to all staff which was included in the salary expenses. Included in the salary expense is a SOCSO certified disable staff who was paid salary and bonus of RM18,000 and RM1,500 respectively. 4. Sales & Marketing. The company incurred a market research expense on possibility to penetrate foreign market for RM10,000. A feasibility study for the same purpose was also conducted at a cost of RM5,000. The company also incurred specific advertisement expenses of RM10,000 to build its branding. Administration. Repairs and maintenance expenses for the year accumulated to RM8,000. During the the year company also developed the company website for RM6,000. 2. 3. 6. Bad debts. Bad debt written off for the year was supported with the necessary documentation evidence. 7. Audit fees paid was in respect of FY 2019 audit expense. 8. Trade subscription was made with regards to the manufacturing association Saville S/B belongs to. 9. Donation was made to an approved institution. 10. Interest expense was related to loans taken for dividend payment. 11. Capital allowance computed for YA 2020 was RM3,000. Required: Compute the Chargeable Income for Saville Sdn. Bhd. for YA 2020 (show all workings). [Total: 25 Marks] Saville Sdn. Bhd. is a resident manufacturing company with a share capital of RM1 million. The company commenced trading on 1 January 2019 and closed it accounts on 31 December each year. Below is Saville Sdn. Bhd. Profit & Loss Accounts for the year ended 2020. Saville Sdn. Bhd. Profit & Loss Accounts for the year ended 31 December 2020 Note RM'000 RM'000 Sales 500 Cost of Sales 1 (150) Gross Profit 350 Other Income 2 40 390 Salary Sales & Marketing Administration Depreciation Bad debts Audit fee Trade subscription Donation Interest expense Profit before tax 345 3 679 6 8 9 10 120 60 50 25 12 6 2 2 3 (280) 110 Notes to the Accounts: 1. The company made provisions for slow moving inventory for RM10,0 and reflected in the cost of sales accounts as follow: RM 8,000 Opening balance Provision for the year 10,000 Provision written off (2,000) Closing balance 16,000 Other Income. 1. 11. Interest income from term deposit was RM8,000. Interest income from investment link account was RM8,000. 111. Rental income for the year was RM24,000. Salary. The company made a 13% contribution to all staff which was included in the salary expenses. Included in the salary expense is a SOCSO certified disable staff who was paid salary and bonus of RM18,000 and RM1,500 respectively. 4. Sales & Marketing. The company incurred a market research expense on possibility to penetrate foreign market for RM10,000. A feasibility study for the same purpose was also conducted at a cost of RM5,000. The company also incurred specific advertisement expenses of RM10,000 to build its branding. Administration. Repairs and maintenance expenses for the year accumulated to RM8,000. During the the year company also developed the company website for RM6,000. 2. 3. 6. Bad debts. Bad debt written off for the year was supported with the necessary documentation evidence. 7. Audit fees paid was in respect of FY 2019 audit expense. 8. Trade subscription was made with regards to the manufacturing association Saville S/B belongs to. 9. Donation was made to an approved institution. 10. Interest expense was related to loans taken for dividend payment. 11. Capital allowance computed for YA 2020 was RM3,000. Required: Compute the Chargeable Income for Saville Sdn. Bhd. for YA 2020 (show all workings). [Total: 25 Marks] Saville Sdn. Bhd. is a resident manufacturing company with a share capital of RM1 million. The company commenced trading on 1 January 2019 and closed it accounts on 31 December each year. Below is Saville Sdn. Bhd. Profit & Loss Accounts for the year ended 2020. Saville Sdn. Bhd. Profit & Loss Accounts for the year ended 31 December 2020 Note RM'000 RM'000 Sales 500 Cost of Sales 1 (150) Gross Profit 350 Other Income 2 40 390 Salary Sales & Marketing Administration Depreciation Bad debts Audit fee Trade subscription Donation Interest expense Profit before tax 345 3 679 6 8 9 10 120 60 50 25 12 6 2 2 3 (280) 110 Notes to the Accounts: 1. The company made provisions for slow moving inventory for RM10,0 and reflected in the cost of sales accounts as follow: RM 8,000 Opening balance Provision for the year 10,000 Provision written off (2,000) Closing balance 16,000 Other Income. 1. 11. Interest income from term deposit was RM8,000. Interest income from investment link account was RM8,000. 111. Rental income for the year was RM24,000. Salary. The company made a 13% contribution to all staff which was included in the salary expenses. Included in the salary expense is a SOCSO certified disable staff who was paid salary and bonus of RM18,000 and RM1,500 respectively. 4. Sales & Marketing. The company incurred a market research expense on possibility to penetrate foreign market for RM10,000. A feasibility study for the same purpose was also conducted at a cost of RM5,000. The company also incurred specific advertisement expenses of RM10,000 to build its branding. Administration. Repairs and maintenance expenses for the year accumulated to RM8,000. During the the year company also developed the company website for RM6,000. 2. 3. 6. Bad debts. Bad debt written off for the year was supported with the necessary documentation evidence. 7. Audit fees paid was in respect of FY 2019 audit expense. 8. Trade subscription was made with regards to the manufacturing association Saville S/B belongs to. 9. Donation was made to an approved institution. 10. Interest expense was related to loans taken for dividend payment. 11. Capital allowance computed for YA 2020 was RM3,000. Required: Compute the Chargeable Income for Saville Sdn. Bhd. for YA 2020 (show all workings). [Total: 25 Marks] Saville Sdn. Bhd. is a resident manufacturing company with a share capital of RM1 million. The company commenced trading on 1 January 2019 and closed it accounts on 31 December each year. Below is Saville Sdn. Bhd. Profit & Loss Accounts for the year ended 2020. Saville Sdn. Bhd. Profit & Loss Accounts for the year ended 31 December 2020 Note RM'000 RM'000 Sales 500 Cost of Sales 1 (150) Gross Profit 350 Other Income 2 40 390 Salary Sales & Marketing Administration Depreciation Bad debts Audit fee Trade subscription Donation Interest expense Profit before tax 345 3 679 6 8 9 10 120 60 50 25 12 6 2 2 3 (280) 110 Notes to the Accounts: 1. The company made provisions for slow moving inventory for RM10,0 and reflected in the cost of sales accounts as follow: RM 8,000 Opening balance Provision for the year 10,000 Provision written off (2,000) Closing balance 16,000 Other Income. 1. 11. Interest income from term deposit was RM8,000. Interest income from investment link account was RM8,000. 111. Rental income for the year was RM24,000. Salary. The company made a 13% contribution to all staff which was included in the salary expenses. Included in the salary expense is a SOCSO certified disable staff who was paid salary and bonus of RM18,000 and RM1,500 respectively. 4. Sales & Marketing. The company incurred a market research expense on possibility to penetrate foreign market for RM10,000. A feasibility study for the same purpose was also conducted at a cost of RM5,000. The company also incurred specific advertisement expenses of RM10,000 to build its branding. Administration. Repairs and maintenance expenses for the year accumulated to RM8,000. During the the year company also developed the company website for RM6,000. 2. 3. 6. Bad debts. Bad debt written off for the year was supported with the necessary documentation evidence. 7. Audit fees paid was in respect of FY 2019 audit expense. 8. Trade subscription was made with regards to the manufacturing association Saville S/B belongs to. 9. Donation was made to an approved institution. 10. Interest expense was related to loans taken for dividend payment. 11. Capital allowance computed for YA 2020 was RM3,000. Required: Compute the Chargeable Income for Saville Sdn. Bhd. for YA 2020 (show all workings). [Total: 25 Marks] Saville Sdn. Bhd. is a resident manufacturing company with a share capital of RM1 million. The company commenced trading on 1 January 2019 and closed it accounts on 31 December each year. Below is Saville Sdn. Bhd. Profit & Loss Accounts for the year ended 2020. Saville Sdn. Bhd. Profit & Loss Accounts for the year ended 31 December 2020 Note RM'000 RM'000 Sales 500 Cost of Sales 1 (150) Gross Profit 350 Other Income 2 40 390 Salary Sales & Marketing Administration Depreciation Bad debts Audit fee Trade subscription Donation Interest expense Profit before tax 345 3 679 6 8 9 10 120 60 50 25 12 6 2 2 3 (280) 110 Notes to the Accounts: 1. The company made provisions for slow moving inventory for RM10,0 and reflected in the cost of sales accounts as follow: RM 8,000 Opening balance Provision for the year 10,000 Provision written off (2,000) Closing balance 16,000 Other Income. 1. 11. Interest income from term deposit was RM8,000. Interest income from investment link account was RM8,000. 111. Rental income for the year was RM24,000. Salary. The company made a 13% contribution to all staff which was included in the salary expenses. Included in the salary expense is a SOCSO certified disable staff who was paid salary and bonus of RM18,000 and RM1,500 respectively. 4. Sales & Marketing. The company incurred a market research expense on possibility to penetrate foreign market for RM10,000. A feasibility study for the same purpose was also conducted at a cost of RM5,000. The company also incurred specific advertisement expenses of RM10,000 to build its branding. Administration. Repairs and maintenance expenses for the year accumulated to RM8,000. During the the year company also developed the company website for RM6,000. 2. 3. 6. Bad debts. Bad debt written off for the year was supported with the necessary documentation evidence. 7. Audit fees paid was in respect of FY 2019 audit expense. 8. Trade subscription was made with regards to the manufacturing association Saville S/B belongs to. 9. Donation was made to an approved institution. 10. Interest expense was related to loans taken for dividend payment. 11. Capital allowance computed for YA 2020 was RM3,000. Required: Compute the Chargeable Income for Saville Sdn. Bhd. for YA 2020 (show all workings). [Total: 25 Marks] Saville Sdn. Bhd. is a resident manufacturing company with a share capital of RM1 million. The company commenced trading on 1 January 2019 and closed it accounts on 31 December each year. Below is Saville Sdn. Bhd. Profit & Loss Accounts for the year ended 2020. Saville Sdn. Bhd. Profit & Loss Accounts for the year ended 31 December 2020 Note RM'000 RM'000 Sales 500 Cost of Sales 1 (150) Gross Profit 350 Other Income 2 40 390 Salary Sales & Marketing Administration Depreciation Bad debts Audit fee Trade subscription Donation Interest expense Profit before tax 345 3 679 6 8 9 10 120 60 50 25 12 6 2 2 3 (280) 110 Notes to the Accounts: 1. The company made provisions for slow moving inventory for RM10,0 and reflected in the cost of sales accounts as follow: RM 8,000 Opening balance Provision for the year 10,000 Provision written off (2,000) Closing balance 16,000 Other Income. 1. 11. Interest income from term deposit was RM8,000. Interest income from investment link account was RM8,000. 111. Rental income for the year was RM24,000. Salary. The company made a 13% contribution to all staff which was included in the salary expenses. Included in the salary expense is a SOCSO certified disable staff who was paid salary and bonus of RM18,000 and RM1,500 respectively. 4. Sales & Marketing. The company incurred a market research expense on possibility to penetrate foreign market for RM10,000. A feasibility study for the same purpose was also conducted at a cost of RM5,000. The company also incurred specific advertisement expenses of RM10,000 to build its branding. Administration. Repairs and maintenance expenses for the year accumulated to RM8,000. During the the year company also developed the company website for RM6,000. 2. 3. 6. Bad debts. Bad debt written off for the year was supported with the necessary documentation evidence. 7. Audit fees paid was in respect of FY 2019 audit expense. 8. Trade subscription was made with regards to the manufacturing association Saville S/B belongs to. 9. Donation was made to an approved institution. 10. Interest expense was related to loans taken for dividend payment. 11. Capital allowance computed for YA 2020 was RM3,000. Required: Compute the Chargeable Income for Saville Sdn. Bhd. for YA 2020 (show all workings). [Total: 25 Marks]

Expert Answer:

Answer rating: 100% (QA)

Computation of chargeable income for Saville Sdu Bhd For the year of assessment 2020 Sr No Treatment ... View the full answer

Related Book For

Financial Accounting for Decision Makers

ISBN: 978-0273763451

6th Edition

Authors: Peter Atrill, Eddie McLaney

Posted Date:

Students also viewed these accounting questions

-

(a) Jacob commenced business on 1 January 2019 and acquired plant and machinery as follows: 1 April 2019 704,000 1 August 2019 388,000 Jacobs accounting policy is to charge a full years depreciation...

-

Bush, a sole trader, commenced trading on 1 January 20X2. a. Telephone expense details The quarterly rental payable in advance on 1 January, 1 April, 1 July and 1 October is 30. Telephone calls are...

-

Alkrom plc, an oil trader, commenced trading on 1 January and had the following opening statement of financial position. Statement of financial position as at 1 January m ASSETS Cash 20.0 EQUITY...

-

11. Identify the location of oxidation in an electrochemical cell. A) the salt bridge B) the socket C) the cathode D) the electrode E) the anode 12. Determine the cell notation for the redox reaction...

-

The provost at a major university would like to develop a model to examine the relationship between the salaries of full time associate professors at the institution and the following independent...

-

Describe the way a semantic differential scale could be constructed to measure the behavioral component of attitudes.

-

For each of the following sets of data, (1) calculate the mean of the scores \(\left(\mathrm{X}^{-} ight),(2)\) calculate the deviation of each score from the mean \(\mathrm{X}-\mathrm{X}^{-}\), and...

-

On January 1, 2016, Palo Company acquires 80% of the outstanding common stock of Sheila Company for $700,000. On January 1, 2018, Sheila Company sells 25,000 shares of common stock to the public at...

-

More generally, evaluate the new Federal Government policies: 1 What are the pros and the cons of the FDIC guarantee of debt? 2. Pros and cons of executive compensation restrictions? 3. Pros and cons...

-

In Exercise 3.108 on page 215, we see that the home team was victorious in 70 games out of a sample of 120 games in the FA premier league, a football (soccer) league in Great Britain. We wish to...

-

Three long wires perpendicular to the plane of paper carry currents I = 6.04 out of the plane, I = 10 A into the plane, and unknown current I,. The net magnetic field is zero at the point p shown in...

-

What are the most common project management risks?

-

What are some of the examples of pictorial charts?

-

List the steps in the traditional approach to change management with a brief description of each step.

-

Briefly describe the importance of people change management in BPM activities.

-

Name some of the challenges with this traditional approach.

-

Suppose that the price of a pair of Lee jeans is $40 in the United States and 400 pesos in Mexico. What is the nominal exchange rate under the assumption of purchasing power parity?

-

Let (X. A. p) be a measure space. Show that for any A,B A, we have the equality: (AUB)+(An B) = (A) + (B).

-

Assume that the chairman of the board of directors of a large public listed company has asked you to develop a set of criteria against which the performance of a non-executive director could be...

-

Thor plc has the following events occur between the end of the reporting period and the date the financial statements were authorised for issue: 1 The discovery that, during the reporting period, an...

-

The following is the statement of financial position of Davids business at 1 January of last year. The following is a summary of the transactions that took place during the year: 1 Inventories were...

-

Plaintiffs purchased stock warrants (rights to purchase) for blocks of Osborne Computer Corp., the manufacturer of the first mass-market portable personal computer. Because of inability to produce a...

-

Lynn Goldsmith is a photographer known for her photographs of famous musicians. In 1981, Goldsmith had a photography session with the singer Prince. Three years later, Vanity Fair obtained a license...

-

Stone Brewing Co. is a San Diego brewer that has sold its beers for over two decades. Stone has maintained its trademark and brand from the beginning, registering the STONE mark in 1998. Stone has...

Study smarter with the SolutionInn App