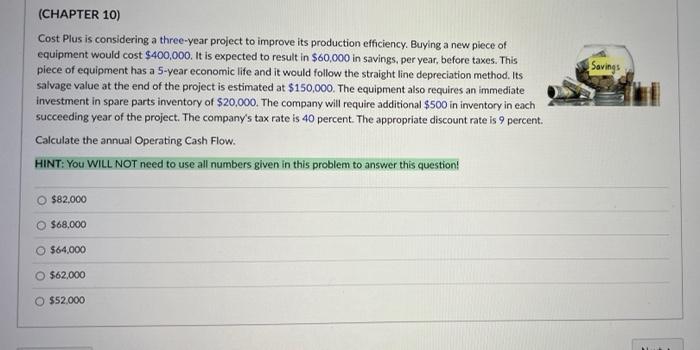

Question: Savings (CHAPTER 10) Cost Plus is considering a three-year project to improve its production efficiency. Buying a new plece of equipment would cost $400,000. It

Savings (CHAPTER 10) Cost Plus is considering a three-year project to improve its production efficiency. Buying a new plece of equipment would cost $400,000. It is expected to result in $60,000 in savings. per year, before taxes. This piece of equipment has a 5-year economic life and it would follow the straight line depreciation method. Its salvage value at the end of the project is estimated at $150,000. The equipment also requires an immediate investment in spare parts inventory of $20,000. The company will require additional $500 in inventory in each succeeding year of the project. The company's tax rate is 40 percent. The appropriate discount rate is 9 percent. Calculate the annual Operating Cash Flow. HINT: YOU WILL NOT need to use all numbers given in this problem to answer this question! $82,000 O $68,000 $64.000 O $62,000 $52.000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts