Question: Savings institutions often state a nominal rate, which can be thought of as a simple annual interest rate, and the effective interest rate, which

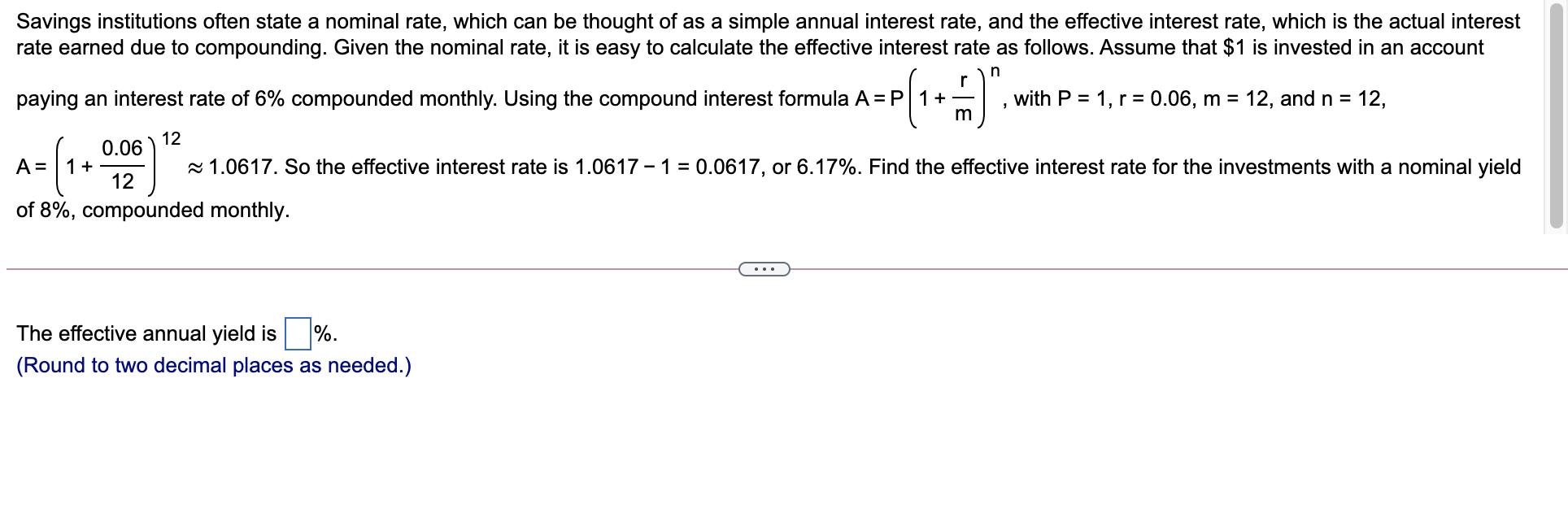

Savings institutions often state a nominal rate, which can be thought of as a simple annual interest rate, and the effective interest rate, which is the actual interest rate earned due to compounding. Given the nominal rate, it is easy to calculate the effective interest rate as follows. Assume that $1 is invested in an account n paying an interest rate of 6% compounded monthly. Using the compound interest formula A = P + m 3 The effective annual yield is %. (Round to two decimal places as needed.) with P = 1, r = 0.06, m = 12, and n = 12, 12 0.06 A = 1+ 1.0617. So the effective interest rate is 1.0617-1 = 0.0617, or 6.17%. Find the effective interest rate for the investments with a nominal yield 12 of 8%, compounded monthly.

Step by Step Solution

There are 3 Steps involved in it

To find the effective interest rate for an investment with a nominal yield of 8 comp... View full answer

Get step-by-step solutions from verified subject matter experts