Question: Savo Homework: Chapter 5 Homework . . . Score: 0 of 3 pts 8 of 6 (5 completo) HW Score: 76.92%, 10 of 13 pts

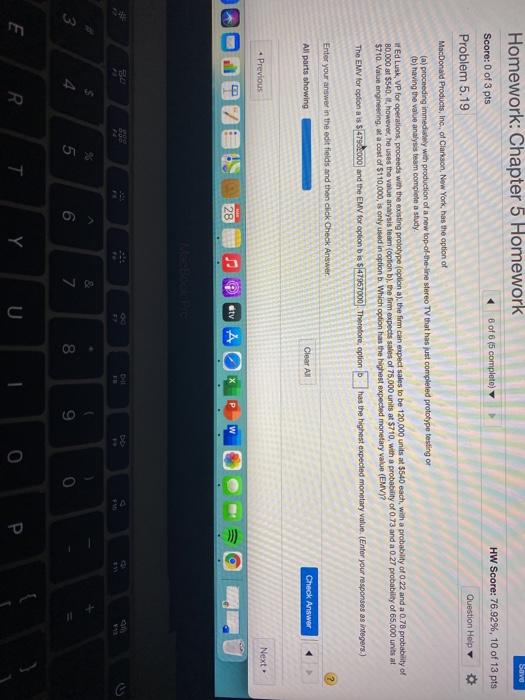

Savo Homework: Chapter 5 Homework . . . Score: 0 of 3 pts 8 of 6 (5 completo) HW Score: 76.92%, 10 of 13 pts Problem 5.19 Question Help MacDonald Products, Inc. of Clarkson, New York, has the option of (a) proceeding immediately with production of a new top-of-the-line storeo TV that has just completed prototype testing or (b) having the value analysis team complete a study of Ed Lusk, VP for operations, proceeds with the existing prototype (optiona), the firm can expect sales to be 120,000 units at $540 each with a probability of 0 22 and a 0.78 probability of B0,000 at $540. however, he uses the value analysis team (option b), the firm expects sales of 75,000 units at $710, with a probability of 0.73 and a 0 27 probability of 65,000 units at $710. Value engineering, at a cost of $110,000, is only used in option b. Which option has the highest expected monetary value (EMV)? The EMV for option als $47902000 and the EMV for option is $47957000) Therefore, option has the highest expected monetary value. (Enter your responses as integers.) Enter your answer in the edit fields and then click Check Answer All parts showing Clear All Check Answer Previous Next 28 atv A DI 3 5 3: 7 6 00 9 0 E R. T Y 0 P

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts