Question: Saw this was already posted here, but the answer got a thumbs down and no thumbs up. Assuming it is wrong, I would love the

Saw this was already posted here, but the answer got a thumbs down and no thumbs up. Assuming it is wrong, I would love the correction (the thumbs down answer put $1,600). [This is in reference to the first question, not the final one]

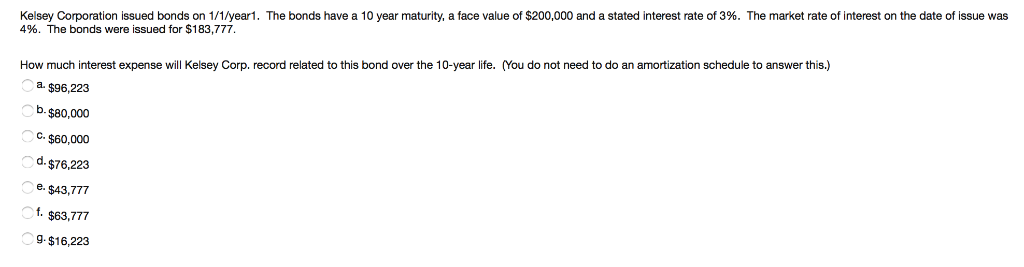

Kelsey Corporation issued bonds on 1/1/year1. The bonds have a 10 year maturity, a face value of $200,000 and a stated interest rate of 3%. The market rate of interest on the date of issue was 4%. The bonds were issued for $183,777. How much interest expense will Kelsey Corp. record related to this bond over the 10-year life. (You do not need to do an amortization schedule to answer this.) a $96,223 b. $80,000 C. $60,000 d. $76,223 e. $43,777 f. $63,777 9. $16,223 Kelsey Corporation issued bonds on 1/1/year. The bonds have a 10 year maturity, a face value of $200,000 and a stated interest rate of 3%. The market rate of interest on the date of issue was 4%. The bonds were issued for $183,777. How much interest expense will Kelsey Corp. record related to this bond over the 10-year life. (You do not need to do an amortization schedule to answer this.) ca. $96,223 b. $80,000 C. $60,000 d. $76,223 C. 543,777 f. $63,777 9. $16,223

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts