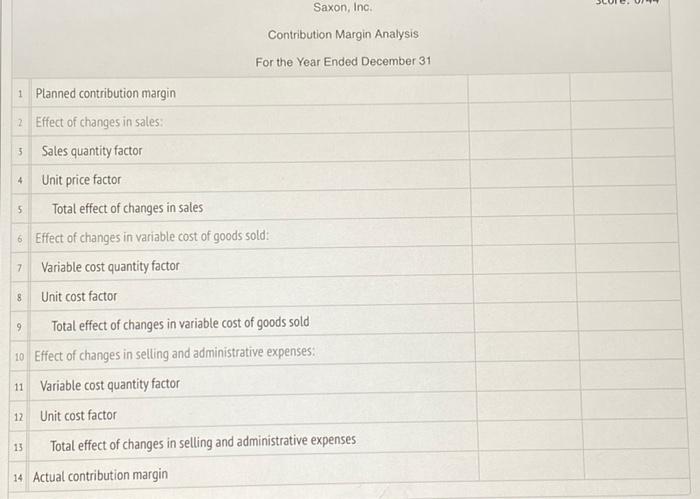

Question: Saxon, Inc Contribution Margin Analysis For the Year Ended December 31 5 1 Planned contribution margin 2 Effect of changes in sales: 5 Sales quantity

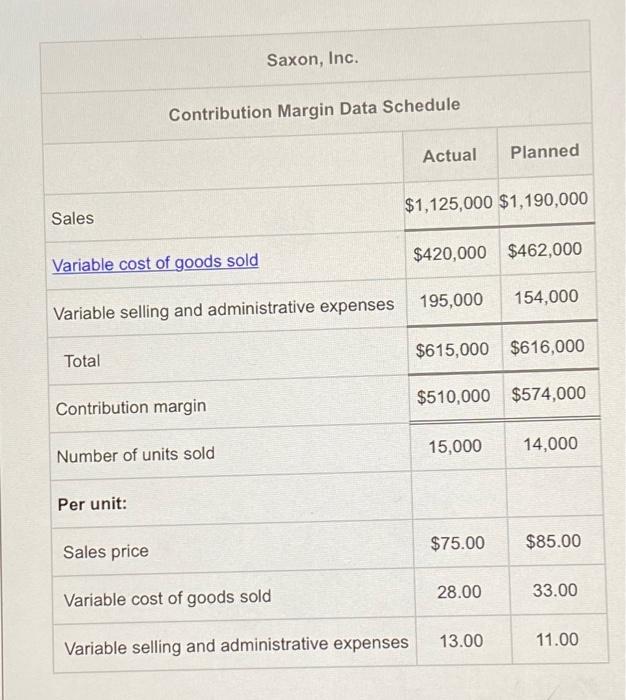

Saxon, Inc Contribution Margin Analysis For the Year Ended December 31 5 1 Planned contribution margin 2 Effect of changes in sales: 5 Sales quantity factor * Unit price factor Total effect of changes in sales 6 Effect of changes in variable cost of goods sold: Variable cost quantity factor Unit cost factor Total effect of changes in variable cost of goods sold 10 Effect of changes in selling and administrative expenses: Variable cost quantity factor Unit cost factor Total effect of changes in selling and administrative expenses 7 8 11 12 13 14 Actual contribution margin Saxon, Inc. Contribution Margin Data Schedule Actual Planned $1,125,000 $1,190,000 Sales Variable cost of goods sold $420,000 $462,000 195,000 154,000 Variable selling and administrative expenses $615,000 $616,000 Total Contribution margin $510,000 $574,000 15,000 14,000 Number of units sold Per unit: $75.00 $85.00 Sales price 28.00 33.00 Variable cost of goods sold 13.00 11.00 Variable selling and administrative expenses

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts