Question: Sayer Tool Co. is considering investing in specialized equipment costing $620,000. The equipment has a useful life of five years and a residual value of

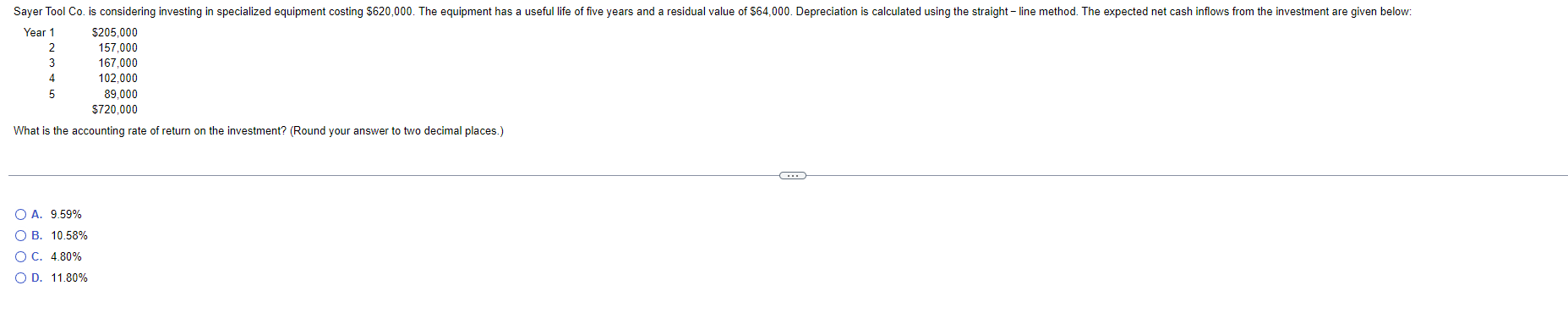

Sayer Tool Co. is considering investing in specialized equipment costing $620,000. The equipment has a useful life of five years and a residual value of $64,000. Depreciation is calculated using the straightline method. The expected net cash inflows from the investment are given below:

Sayer Tool Co. is considering investing in specialized equipment costing $620,000. The equipment has a useful life of five years and a residual value of $64,000. Depreciation is calculated using the straight-line method. The expected net cash inflows from the investment are given below: Year 1 $205,000 2 157,000 3 167,000 4 102,000 5 89,000 $720,000 What is the accounting rate of return on the investment? (Round your answer to two decimal places.) C O A. 9.59% O B. 10.58% O C. 4.80% O D. 11.80%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts