SBS Company have received a contract to supply its product to a Health Care Service Hospital....

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

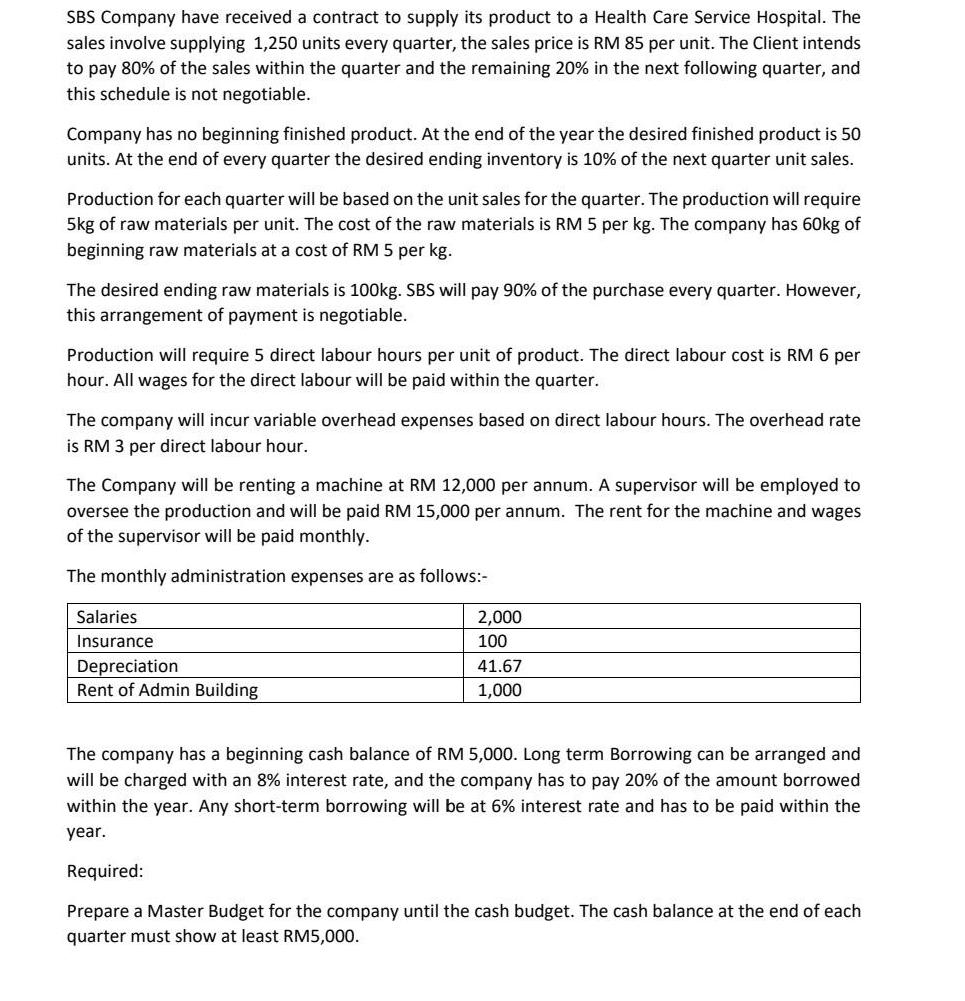

SBS Company have received a contract to supply its product to a Health Care Service Hospital. The sales involve supplying 1,250 units every quarter, the sales price is RM 85 per unit. The Client intends to pay 80% of the sales within the quarter and the remaining 20% in the next following quarter, and this schedule is not negotiable. Company has no beginning finished product. At the end of the year the desired finished product is 50 units. At the end of every quarter the desired ending inventory is 10% of the next quarter unit sales. Production for each quarter will be based on the unit sales for the quarter. The production will require 5kg of raw materials per unit. The cost of the raw materials is RM 5 per kg. The company has 60kg of beginning raw materials at a cost of RM 5 per kg. The desired ending raw materials is 100kg. SBS will pay 90% of the purchase every quarter. However, this arrangement of payment is negotiable. Production will require 5 direct labour hours per unit of product. The direct labour cost is RM 6 per hour. All wages for the direct labour will be paid within the quarter. The company will incur variable overhead expenses based on direct labour hours. The overhead rate is RM 3 per direct labour hour. The Company will be renting a machine at RM 12,000 per annum. A supervisor will be employed to oversee the production and will be paid RM 15,000 per annum. The rent for the machine and wages of the supervisor will be paid monthly. The monthly administration expenses are as follows:- Salaries Insurance Depreciation Rent of Admin Building 2,000 100 41.67 1,000 The company has a beginning cash balance of RM 5,000. Long term Borrowing can be arranged and will be charged with an 8% interest rate, and the company has to pay 20% of the amount borrowed within the year. Any short-term borrowing will be at 6% interest rate and has to be paid within the year. Required: Prepare a Master Budget for the company until the cash budget. The cash balance at the end of each quarter must show at least RM5,000. SBS Company have received a contract to supply its product to a Health Care Service Hospital. The sales involve supplying 1,250 units every quarter, the sales price is RM 85 per unit. The Client intends to pay 80% of the sales within the quarter and the remaining 20% in the next following quarter, and this schedule is not negotiable. Company has no beginning finished product. At the end of the year the desired finished product is 50 units. At the end of every quarter the desired ending inventory is 10% of the next quarter unit sales. Production for each quarter will be based on the unit sales for the quarter. The production will require 5kg of raw materials per unit. The cost of the raw materials is RM 5 per kg. The company has 60kg of beginning raw materials at a cost of RM 5 per kg. The desired ending raw materials is 100kg. SBS will pay 90% of the purchase every quarter. However, this arrangement of payment is negotiable. Production will require 5 direct labour hours per unit of product. The direct labour cost is RM 6 per hour. All wages for the direct labour will be paid within the quarter. The company will incur variable overhead expenses based on direct labour hours. The overhead rate is RM 3 per direct labour hour. The Company will be renting a machine at RM 12,000 per annum. A supervisor will be employed to oversee the production and will be paid RM 15,000 per annum. The rent for the machine and wages of the supervisor will be paid monthly. The monthly administration expenses are as follows:- Salaries Insurance Depreciation Rent of Admin Building 2,000 100 41.67 1,000 The company has a beginning cash balance of RM 5,000. Long term Borrowing can be arranged and will be charged with an 8% interest rate, and the company has to pay 20% of the amount borrowed within the year. Any short-term borrowing will be at 6% interest rate and has to be paid within the year. Required: Prepare a Master Budget for the company until the cash budget. The cash balance at the end of each quarter must show at least RM5,000.

Expert Answer:

Related Book For

Posted Date:

Students also viewed these accounting questions

-

A chemical company has a contract to supply annually 3600 tonnes of product A at 24 a tonne and 4000 tonnes of product B at 14.50 a tonne. The basic components for these products are obtained from a...

-

A manufacturing company has a contract to supply a customer with parts from April through September. However, the company does not have enough storage space to store the parts during this period, so...

-

1 - The discussion will be based on the following articles. Post at least one discussion point Supplemental Readings include: Stop Hiring Data Scientists until Youre Ready for Data Science by Greta...

-

Question 2 A company manufactures and sells x units of audio system per month. The cost function and the price function (in RM) are given as below. Cost: C(x) = 40,000 + 600 x Price: p(x) = 3,000 -...

-

Items 1 through 6 are common questions found in internal control questionnaires used by auditors to obtain an understanding of internal control for owners' equity. In using the questionnaire for a...

-

Looking just at the present, how will the changes in the way care is provided (delivery) change the needs of the patient who wants to be more involved in the decisions of their care?

-

How has the use of HRIS evolved over the past 10 years in organizations, and how might this influence an organizations evaluations of additional investments in new or updated HRIS functionality?

-

Connie Dell just won a lottery and received a cash award of $900,000 net of tax. She is 61 years old and would like to retire in four years. Weighing this important fact, she has found two possible...

-

3. (4 points) Consider the following algorithm to find the largest number in a given non-empty array, a, of size N. Give the exact, worst-case running time in terms of N, and the corresponding...

-

Fulcrum Industries manufactures dining chairs and tables. The following information is available: Dining Chairs Tables Total Cost 600 470 2,400 Machine setups Inspections Labor hours Problem 2. 200...

-

Record keeping requirements are: a) enforced by the US Government regarding the length of time that certain documents must be kept. b) revised each year by the HR manager. c) changed based on...

-

What is the purpose of a trustee?

-

What do we call the quantity force distance, and what quantity does it change?

-

How do the cash management practices of large and small businesses differ?

-

What are the two primary factors that affect a loans interest rate?

-

Identify a new fintech startup and describe its business model. What new services or features does it provide to its customers? How does it earn its revenue? How does it differ from traditional...

-

Describe the steps involved in the production of urine in mammalian kidneys.

-

Before the 1973 oil embargo and subsequent increases in the price of crude oil, gasoline usage in the United States had grown at a seasonally adjusted rate of 0.57 percent per month, with a standard...

-

The following profit reconciliation statement has been prepared by the management accountant of ABC Limited for March: The standard cost card for the company's only product is as follows: ()...

-

The following information relates to a manufacturing process for a period: 10 000 units of output were produced by the process in the period, of which 420 failed testing and were scrapped. Scrapped...

-

On 30 October the following were among the balances in the cost ledger of a company manufacturing a single product (Product X) in a single process operation: The raw material ledger comprised the...

-

KABU Enterprises Ltd. buys a building for the purpose of investment. It issues 1,00,000 equity shares of its company, which are quoted on the day of the deal at Rs. 155 per share at the NSE. The...

-

Shoppers Departmental Stores Ltd. furnishes the following details of purchase, sale etc. of its garments section for the year 200506. Determine the value of inventory of the garments section as on...

-

Usha Corporation Ltd. purchases 12,000 10% secured redeemable bonds of the face value of Rs. 100 each of Andhra Pradesh Power Finance Corporation Ltd. on 1st January for a consideration of Rs....

Study smarter with the SolutionInn App