Question: SCC - Fall 2 0 2 3 - Acct 1 0 1 - Full Semester Dajahnai Watts ( ? ) - = Homework: Chapter 7

SCC Fall Acct Full Semester

Dajahnai Watts

Homework: Chapter Homework

Question list

xs Question

Question

Question

Question

Question

Question EFsimilar to

Part of

HW Score: of

points

Points: of

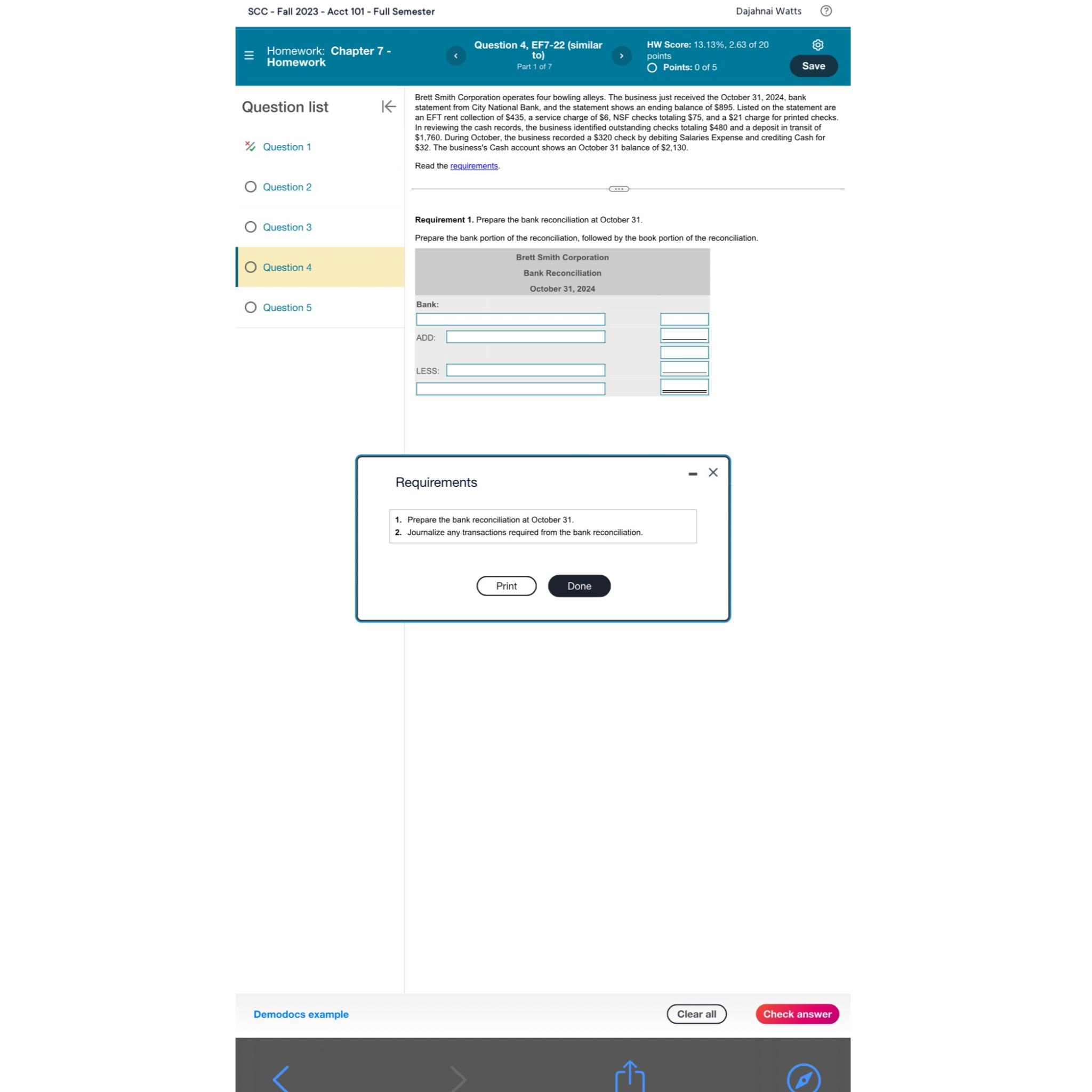

Brett Smith Corporation operates four bowling alleys. The business just received the October bank statement from City National Bank, and the statement shows an ending balance of $ Listed on the statement are an EFT rent collection of $ a service charge of $ checks totaling $ and a $ charge for printed checks. In reviewing the cash records, the business identified outstanding checks totaling $ and a deposit in transit of $ During October, the business recorded a $ check by debiting Salaries Expense and crediting Cash for $ The business's Cash account shows an October balance of $

Read the requirements.

Requirement Prepare the bank reconciliation at October

Prepare the bank portion of the reconciliation, followed by the book portion of the reconciliation.

Requirements

Prepare the bank reconciliation at October

Journalize any transactions required from the bank reconciliation.

Demodocs example

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock