Question: SCENARIO 1 : Base Case and Amortization Schedule for a 3 0 - year Loan Calculate the monthly rate that will be used to pay

SCENARIO : Base Case and Amortization Schedule for a year Loan

Calculate the monthly rate that will be used to pay your loan.

Number of Periods

What is the Effective Annual Rate EAR

Hint: Use the EFFECT Nominalrate, Npery function:

Nominalrate nominal interest rate, APR B

Npery number of compounding periods per year

Monthly Payment

Hint: Use the PMT Rate Nper, Pv Fv Type function:

Rate Monthly Rate cell B

Nper Number of Periods B

Pv present valueThe negative loan amount represents a cash outflow.

Fv future valueThe debt is fully paid off at the end.

Type payment timing or omitted for endofperiod payments

Construct a Loan Amortization Table considering monthly payments

How much will you pay in interest over the life of the loan ie total interest paid

What is the principal balance remaining ie Ending Balance halfway through the loan term years

Scenario Analysis

To save time and effort, the easiest way to do this is to copy your entire worksheet onto

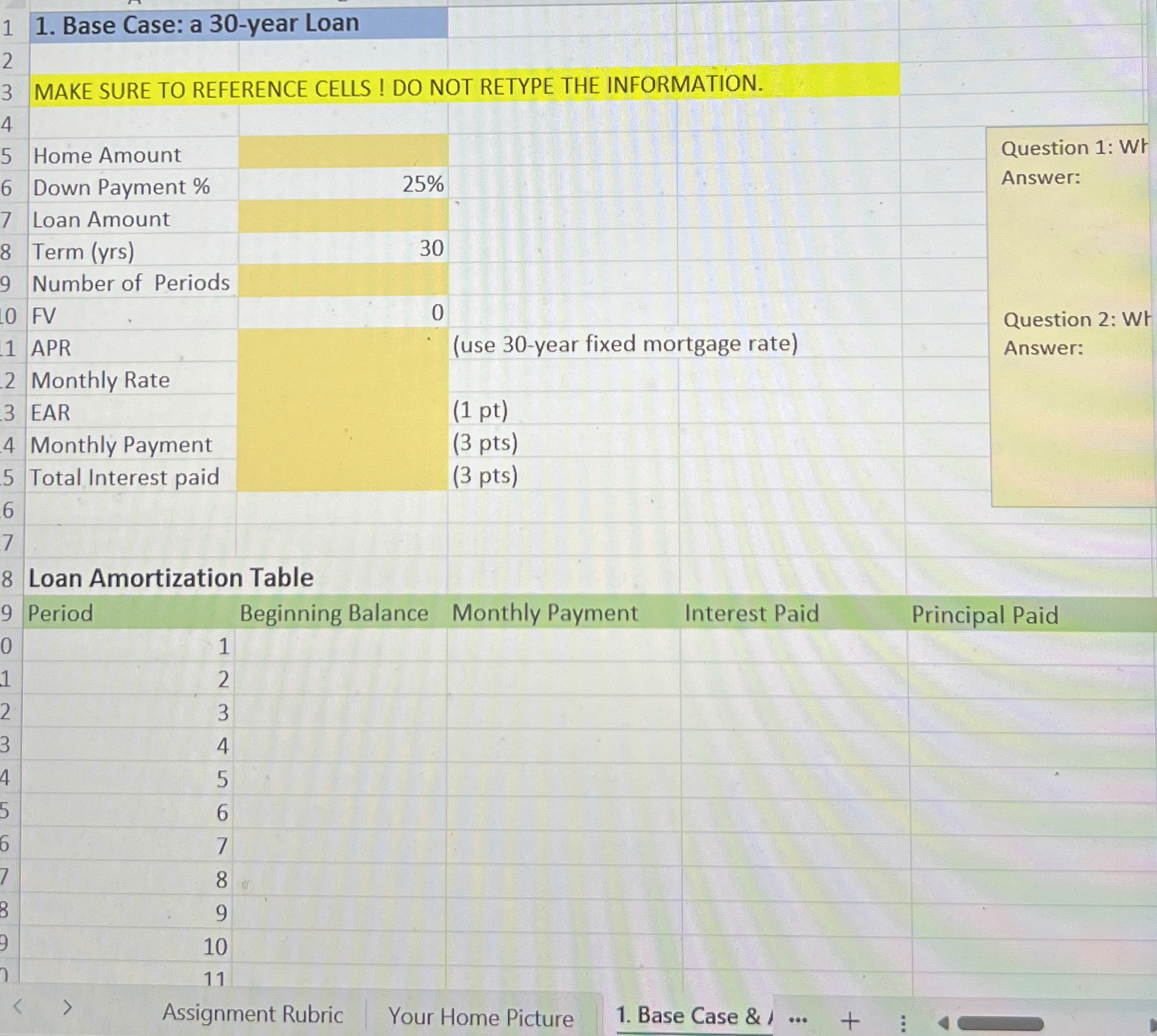

Base Case: a year Loan

MAKE SURE TO REFERENCE CELLS! DO NOT RETYPE THE INFORMATION.

Home Amount

Down Payment

Loan Amount

Term yrs

Number of Periods

FV

APR

use year fixed mortgage rate

Question : Wr

Answer:

Monthly Rate

EAR

pt

Monthly Payment

pts

Total Interest paid

pts

Question : Wr

Answer:

Question : Wr

Answer:

Loan Amortization Table

Period Beginning Balance

Monthly Payment

Interest Paid

Principal Paid

Assignment Rubric

Your Home Picture

Base Case &

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock