Question: Scenario 2: Using the data on page 12, analyse the ability to pay current liabilities, Big Bend Picture Frames Pty Ltd have asked you to

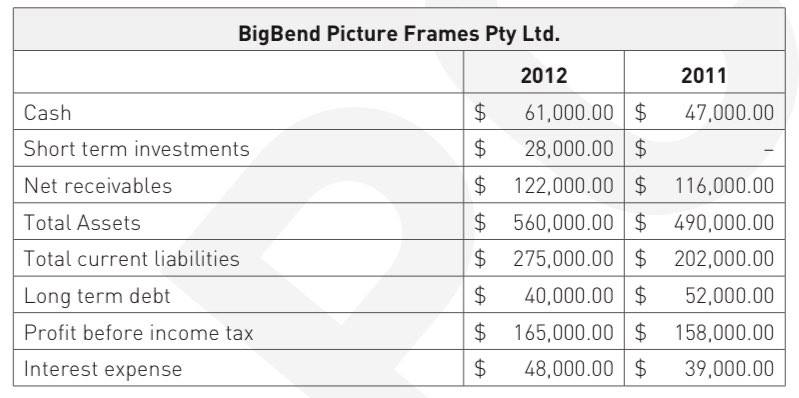

Scenario 2: Using the data on page 12, analyse the ability to pay current liabilities, Big Bend Picture Frames Pty Ltd have asked you to determine whether the company's ability to pay liabilities and total liabilities improved or deteriorated during the 2012 a. Current ratio b. Acid-test Ratio c. Debt ratio d. Times interested earned ratio Summarise the results of your analysis in a written report.

https://onedrive.live.com/view.aspx?resid=719DB1FB7D4FCD7!849&ithint=file%2cxlsx&authkey=!AAmJXdtDaEreXzU

Please click link to see the spreadsheet.

BigBend Picture Frames Pty Ltd. 2012 2011 Cash $ 61,000.00 47,000.00 Short term investments $ 28,000.00 Net receivables 122,000.00 $ 116,000.00 Total Assets $ 560,000.00 $ 490,000.00 Total current liabilities $ 275,000.00 $ 202,000.00 Long term debt $ 40,000.00 $ 52,000.00 Profit before income tax 165,000.00 $ 158,000.00 Interest expense $ 48,000.00 $ 39,000.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts