Question: SCENARIO: A client comes to you for some advice. This client has $ 2 4 0 0 saved for a car in an investment and

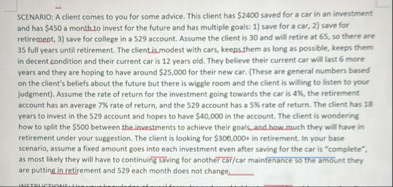

SCENARIO: A client comes to you for some advice. This client has $ saved for a car in an investment and has $ a month to invest for the future and has multiple goals: save for a car, save for retiremeot, save for college in a account. Assume the client is and will retire at so there are full years untili retirement. The clientismodest with cars, keeps.them as long as possible, keeps them in decent condition and their current car is years old. They believe their current car will last more years and they are hoping to have around $ for their new car. These are general numbers based on the client's beliefs about the future but there is wigele room and the client is witing to listen to your judgment Assume the rate of return for the investment going towards the car is the retirement account has an average rate of return, and the account has a rate of return. The client has years to invest in the account and hopes to have $ in the account. The client is wondering how to split the $ between the imestments to achieve their goals, and how much they will have in retirement under your suggestion. The client is looking for $ in retirement. In your base scenario, assume a fixed amount goes into each investment even after saving for the car is "complete", as most likely they will have to continuirglaving for another carcar mainfenance so the amoint they are putting in retirement and each month does not changt

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock