Question: Scenario Analysis Setup: Your CFO is considering whether to spend $1000 to on a new sales person to generate increased sales for next year. They

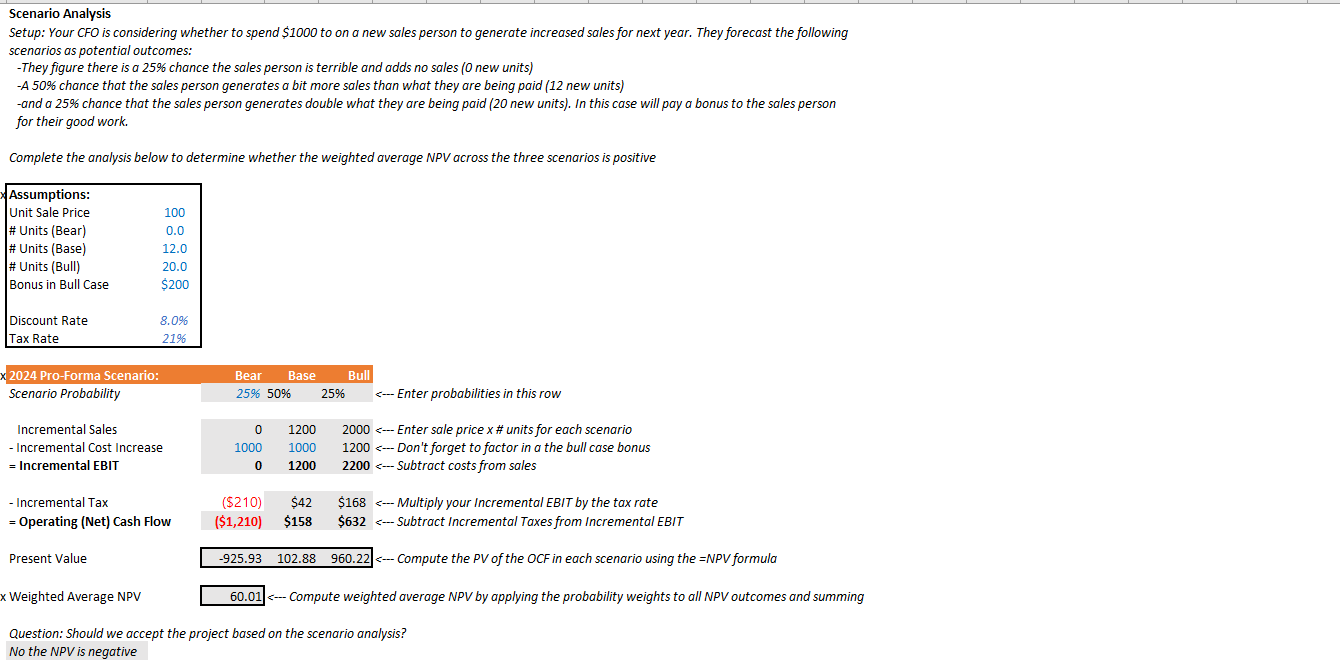

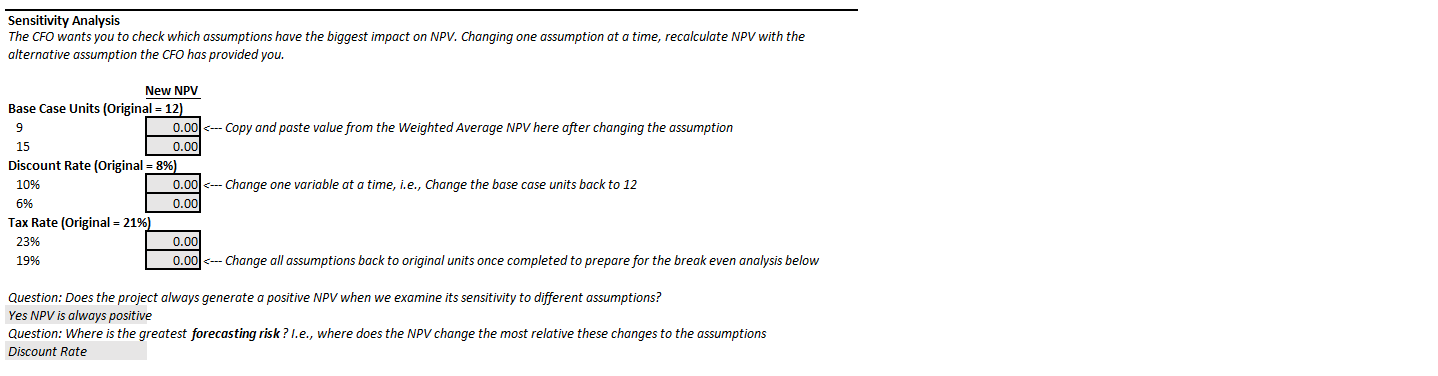

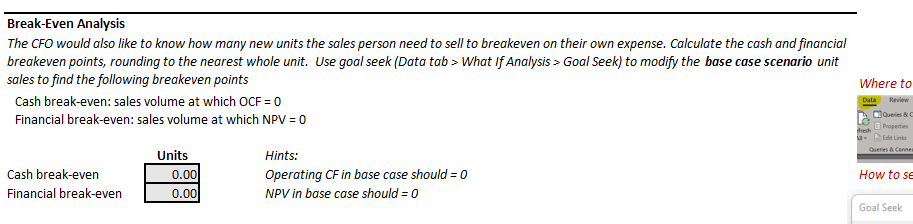

Scenario Analysis Setup: Your CFO is considering whether to spend $1000 to on a new sales person to generate increased sales for next year. They forecast the following scenarios as potential outcomes: -They figure there is a 25% chance the sales person is terrible and adds no sales ( 0 new units) -A 50\% chance that the sales person generates a bit more sales than what they are being paid (12 new units) -and a 25% chance that the sales person generates double what they are being paid (20 new units). In this case will pay a bonus to the sales person for their good work. Complete the analysis below to determine whether the weighted average NPV across the three scenarios is positive W Weighted Average NPV --- Compute weighted average NPV by applying the probability weights to all NPV outcomes and summing Question: Should we accept the project based on the scenario analysis? No the NPV is negative Sensitivity Analysis The CFO wants you to check which assumptions have the biggest impact on NPV. Changing one assumption at a time, recalculate NPV with the alternative assumption the CFO has provided you. -- Copy and paste value from the Weighted Average NPV here after changing the assumption - Change one variable at a time, i.e., Change the base case units back to 12 -- Change all assumptions back to original units once completed to prepare for the break even analysis below Question: Does the project always generate a positive NPV when we examine its sensitivity to different assumptions? Yes NPV is always positive Question: Where is the areatest forecasting risk? I.e., where does the NPV change the most relative these changes to the assumptions Break-Even Analysis The CFO would also like to know how many new units the sales person need to sell to breakeven on their own expense. Calculate the cash and financial breakeven points, rounding to the nearest whole unit. Use goal seek (Data tab > What If Analysis > Goal Seek) to modify the base case scenario unit sales to find the following breakeven points Cash break-even: sales volume at which OCF=0 Financial break-even: sales volume at which NPV =0 Scenario Analysis Setup: Your CFO is considering whether to spend $1000 to on a new sales person to generate increased sales for next year. They forecast the following scenarios as potential outcomes: -They figure there is a 25% chance the sales person is terrible and adds no sales ( 0 new units) -A 50\% chance that the sales person generates a bit more sales than what they are being paid (12 new units) -and a 25% chance that the sales person generates double what they are being paid (20 new units). In this case will pay a bonus to the sales person for their good work. Complete the analysis below to determine whether the weighted average NPV across the three scenarios is positive W Weighted Average NPV --- Compute weighted average NPV by applying the probability weights to all NPV outcomes and summing Question: Should we accept the project based on the scenario analysis? No the NPV is negative Sensitivity Analysis The CFO wants you to check which assumptions have the biggest impact on NPV. Changing one assumption at a time, recalculate NPV with the alternative assumption the CFO has provided you. -- Copy and paste value from the Weighted Average NPV here after changing the assumption - Change one variable at a time, i.e., Change the base case units back to 12 -- Change all assumptions back to original units once completed to prepare for the break even analysis below Question: Does the project always generate a positive NPV when we examine its sensitivity to different assumptions? Yes NPV is always positive Question: Where is the areatest forecasting risk? I.e., where does the NPV change the most relative these changes to the assumptions Break-Even Analysis The CFO would also like to know how many new units the sales person need to sell to breakeven on their own expense. Calculate the cash and financial breakeven points, rounding to the nearest whole unit. Use goal seek (Data tab > What If Analysis > Goal Seek) to modify the base case scenario unit sales to find the following breakeven points Cash break-even: sales volume at which OCF=0 Financial break-even: sales volume at which NPV =0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts