Question: Scenario Information You are interning at a physicians office, which is part of a physicians group. The group is thinking about implementing an electronic medical

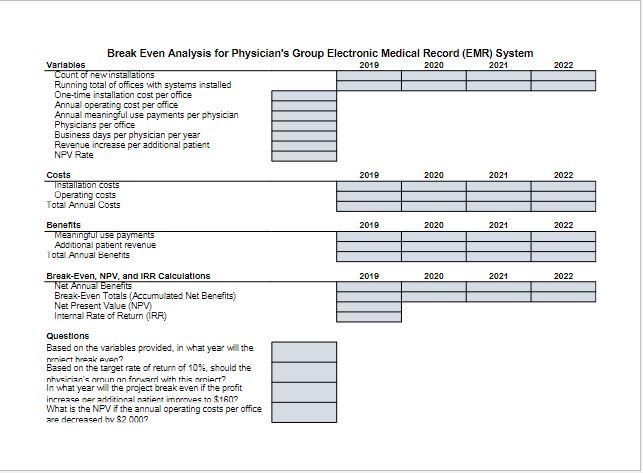

Scenario Information You are interning at a physicians office, which is part of a physicians group. The group is thinking about implementing an electronic medical record (EMR) system in all of their offices and because of your Excel skills learned during your college coursework, you have been asked to create a break-even analysis that will help the physicians decide if implementing this particular system will be financially beneficial to the group. Costs The physicians group consists of 15 offices and the plan is to install the system in three offices in 2019, five offices in 2020, and the remaining offices in 2021. There is a one-time installation cost of $102,000 per office in the year of installation. The annual operating costs will be $21,000 for each office with a system installed. Benefits The physicians group will also benefit from federal meaningful use payments designed to incentivize the adoption of EMR systems. Each physician in the group will be eligible for $6,000 in annual meaningful use payments for working in an office with an EMR. Each office has 2 physicians. Each physician sees patients 220 days per year. The system will improve efficiencies in assessing and treating patients so that each physician will be able to see one more patient each day. Each additional patient will increase revenue by an average of $110. The NPV Rate is 10% Calculations The break-even analysis will cover a 4-year period from 2019-2022. For each year: Calculate the system costs and benefits. Calculate the net benefits of the system and the break-even totals for the system. Break- even totals are simply the accumulated net benefits. The project breaks even when the accumulated net benefits value is positive. For the total 4-year period: Calculate the net present value (NPV) of the investment using a rate of 10%. Calculate the internal rate of return (IRR).

Answer the Questions Your last task for the tutorial is to answer the four questions at the bottom of the spreadsheet, which are: Based on the variables provided, in what year will the project break even? (Enter the year) Based on the target rate of return of 10%, should the physicians group go forward with this project? (Enter Yes or No) In what year will the project break even if the profit increase per additional patient improves to $160? (Enter the year) What is the NPV, if the annual operating costs per office are decreased by $2,000? (Enter the NPV value from cell C26)

2022 Break Even Analysis for Physician's Group Electronic Medical Record (EMR) System Variables 2019 2020 2021 Count of new installations Running total of offices with systems installed One-time installation cost per office Annual operating cost per office Annual meaningful use payments per physician Physicians per office Business days per physician per year Revenue increase per additional patient NPV Rate 2019 2020 2021 2022 Costs Installation costs Operating costs Total Annual Costs 2019 2020 2021 2022 Benefits meaningful use payment Additional patient revenue Total Annual Benefits 2019 2020 2021 2022 Break-Even, NPV, and IRR Calculations Net Annual Benefits Break-Even Totals (Accumulated Net Benefits) Net Present Value (NPV) Internal Rate of Return (RR) Questions Based on the variables provided, in what year will the niniert haak even? Based on the target rate of return of 10% should the nhvsirian's runnn inrward with this nmiert? In what year will the project break even if the profit increase ner additional patient improves to $1602 What is the NPV If the annual operating costs per office are decreased by $2000? 2022 Break Even Analysis for Physician's Group Electronic Medical Record (EMR) System Variables 2019 2020 2021 Count of new installations Running total of offices with systems installed One-time installation cost per office Annual operating cost per office Annual meaningful use payments per physician Physicians per office Business days per physician per year Revenue increase per additional patient NPV Rate 2019 2020 2021 2022 Costs Installation costs Operating costs Total Annual Costs 2019 2020 2021 2022 Benefits meaningful use payment Additional patient revenue Total Annual Benefits 2019 2020 2021 2022 Break-Even, NPV, and IRR Calculations Net Annual Benefits Break-Even Totals (Accumulated Net Benefits) Net Present Value (NPV) Internal Rate of Return (RR) Questions Based on the variables provided, in what year will the niniert haak even? Based on the target rate of return of 10% should the nhvsirian's runnn inrward with this nmiert? In what year will the project break even if the profit increase ner additional patient improves to $1602 What is the NPV If the annual operating costs per office are decreased by $2000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts