Question: scenario ) into your answer and complete each question there. Federal Tax Code Assumptions , Tax Base = All income from whatever source derived Standard

scenario into your answer and complete each question there.

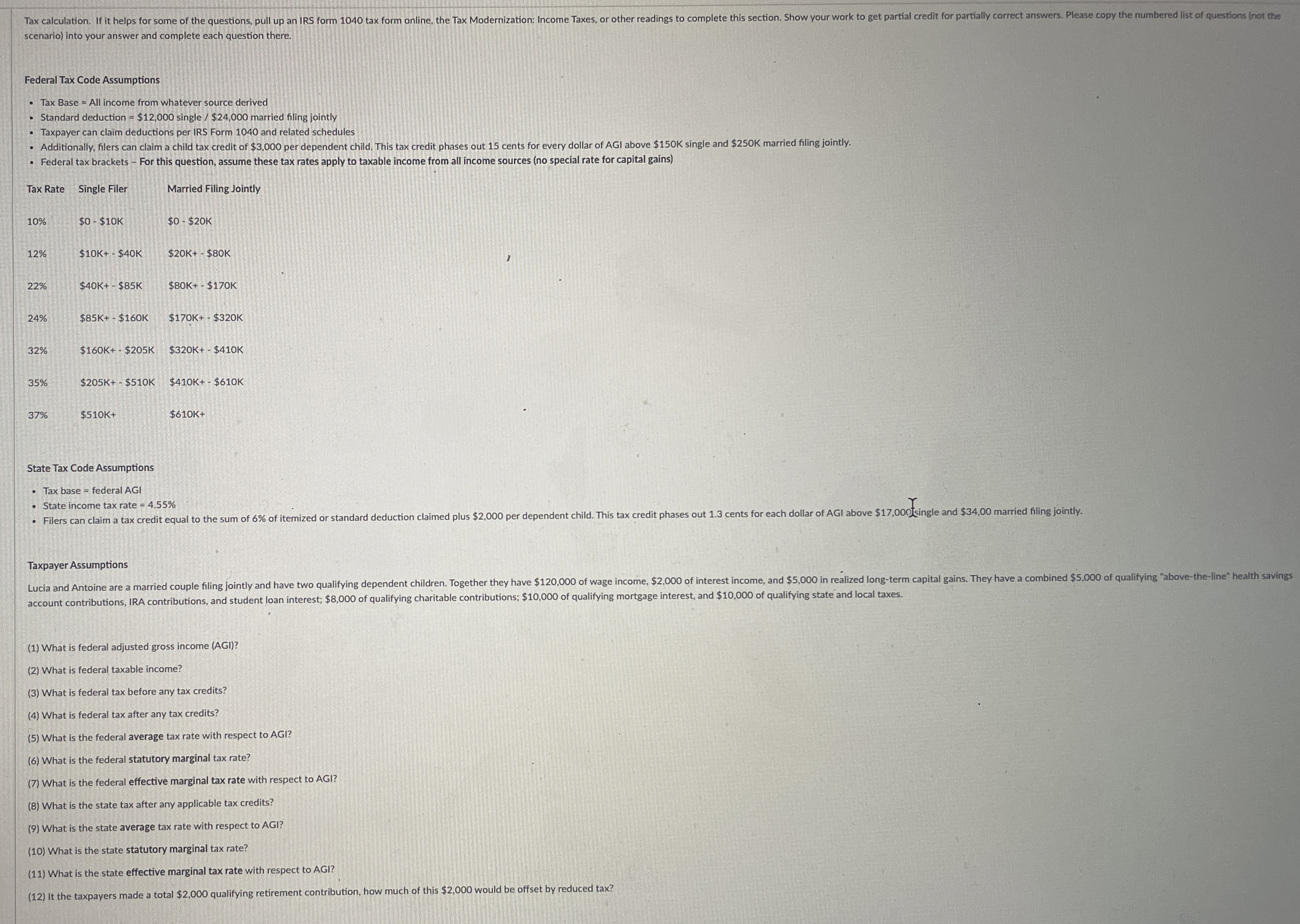

Federal Tax Code Assumptions

Tax Base All income from whatever source derived

Standard deduction $ single $ married filing jointly

Taxpayer can claim deductions per IRS Form and related schedules

Additionally, filers can claim a child tax credit of $ per dependent child. This tax credit phases out cents for every dollar of AGI above $ single and $ married filing jointly.

Federal tax brackets For this question, assume these tax rates apply to taxable income from all income sources no special rate for capital gains

tableTax Rate,Single Filer,Married Filing Jointl$ $K$$K$K$K$K $K$K $K$K $K$$$K $K$K $K$K $K$K$K$K $K$K$K

State Tax Code Assumptions

Tax base federal AGI

State income tax rate

Taxpayer Assumptions

What is federal adjusted gross income AGI

What is federal taxable income?

What is federal tax before any tax credits?

What is federal tax after any tax credits?

What is the federal average tax rate with respect to AGI?

What is the federal statutory marginal tax rate?

What is the federal effective marginal tax rate with respect to AGI?

What is the state tax after any applicable tax credits?

What is the state average tax rate with respect to AGI?

What is the state statutory marginal tax rate?

What is the state effective marginal tax rate with respect to AGI?

It the taxpayers made a total $ qualifying retirement contribution, how much of this $ would be offset by reduced tax?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock