Question: Scenario project only(1) -Protected View Saved to this PC Victe Design Layout References Mailings Review View Tell me what you want to do Help O

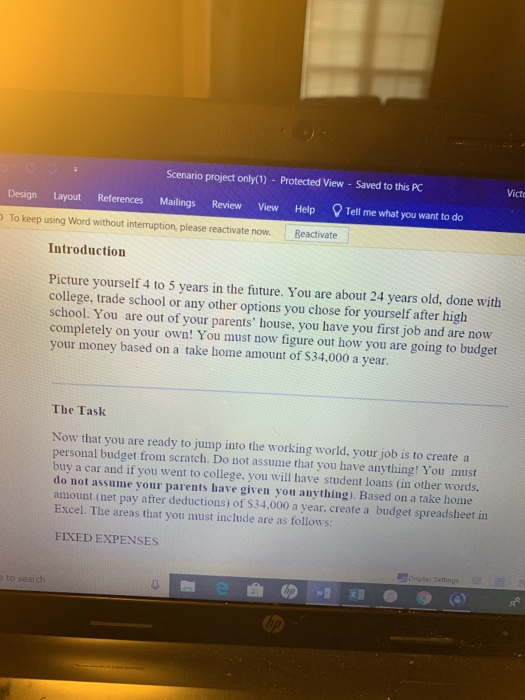

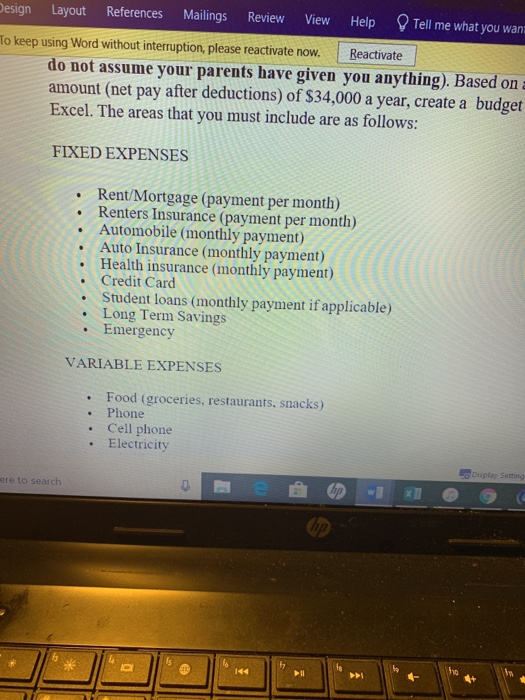

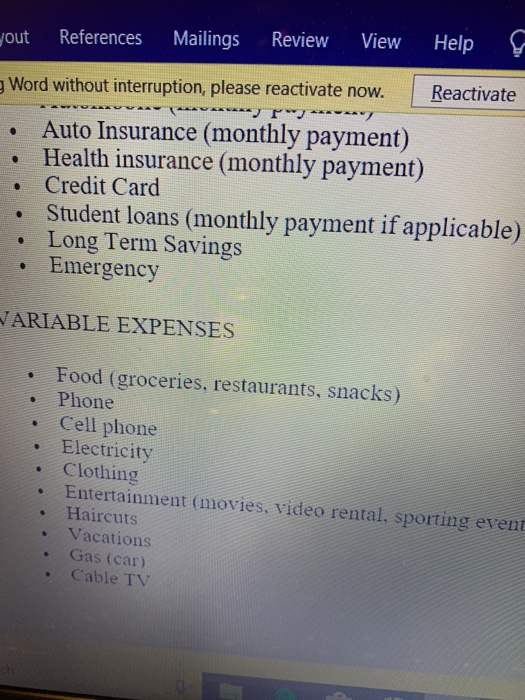

Scenario project only(1) -Protected View Saved to this PC Victe Design Layout References Mailings Review View Tell me what you want to do Help O To keep using Word without interruption, please reactivate now. Reactivate Introduction Picture yourself 4 to 5 years in the future. You are about 24 years old, done with college, trade school or any other options you chose for yourself after high school. You are out of your parents' house, you have you first job and are now completely on your own! You must now figure out how you are your money based on a take home amount of S34,000 a year. going to budget The Task Now that you are ready to jump into the working world, your job is to create a personal budget from scratch. Do not assume that you have anything! You must buy do not assume vour parents have given vou anvthing). Based on a take home amount (net pay after deductions) of S34.000 a vear, create a Excel. The areas that you must include are as follows: a car and if you went to college, you will have student loans (in other words. budget spreadsheet in FIXED EXPENSES Oisplay Setting to search hp Design Layout References Mailings Tell me what you wanz Review View Help To keep using Word without interruption, please reactivate now. Reactivate do not assume your parents have given you anything). Based on a amount (net pay after deductions) of $34,000 a year, create a budget Excel. The areas that you must include are as follows: FIXED EXPENSES Rent/Mortgage (payment per month) Renters Insurance (payment per month) Automobile (monthly payment) Auto Insurance (monthly payment) Health insurance (monthly payment) Credit Card Student loans (monthly payment if applicable) Long Term Savings Emergency VARIABLE EXPENSES Food (groceries, restaurants, snacks) Phone Cell phone Electricity Display Setting ere to search ho fs 144 Help View Review Mailings References yout Reactivate g Word without interruption, please reactivate now. Auto Insurance (monthly payment) Health insurance (monthly payment) Credit Card Student loans (monthly payment if applicable) Long Term Savings Emergency ARIABLE EXPENSES Food (groceries, restaurants, snacks) Phone Cell phone Electricity Clothing Entertainment (movies, video rental, sporting event Haircuts Vacations Gas (car) Cable TV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts