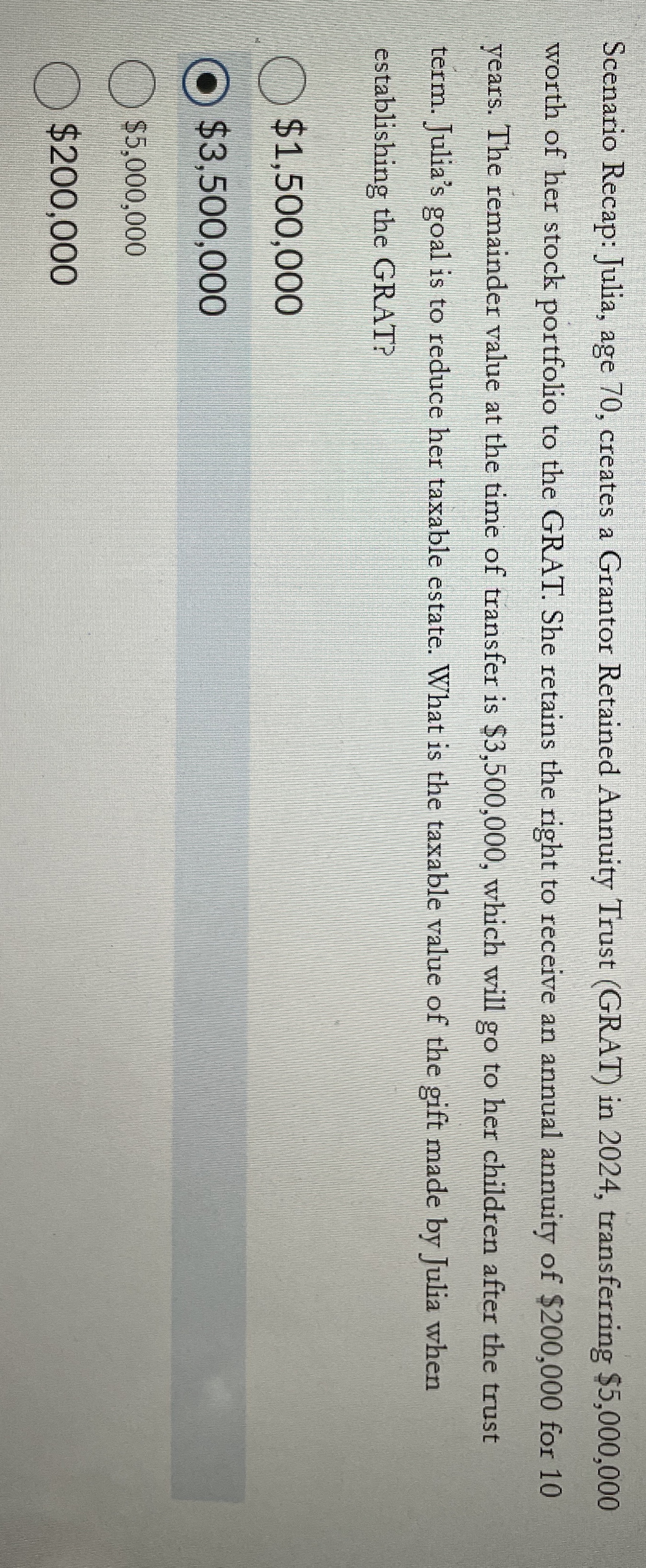

Question: Scenario Recap: Julia, age 7 0 , creates a Grantor Retained Annuity Trust ( GRAT ) in 2 0 2 4 , transferring $ 5

Scenario Recap: Julia, age creates a Grantor Retained Annuity Trust GRAT in transferring $ worth of her stock portfolio to the GRAT. She retains the right to receive an annual annuity of $ for years. The remainder value at the time of transfer is $ which will go to her children after the trust term. Julia's goal is to reduce her taxable estate. What is the taxable value of the gift made by Julia when establishing the GRAT?

$

$

$

$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock