Question: Scenario: You are a registered BAS agent working for a large accounting firm NSW Tax Specialists P/L You are preparing to renew your registration with

Scenario:You are a registered BAS agent working for a large accounting firm NSW Tax Specialists P/L

- You are preparing to renew your registration with the Tax PractitionersBoardand you are required to submit a log of your continuing professional education. You have undertaken the following professional development activities over 2020:

- A partner at your firm who specialises in FBT gave a one-hour presentation on 13 April to staff regarding the changes to FBT legislation, followed by a one-hour interactive discussion and consideration of a complex hypothetical case study. This session was advertised internally on your PDcalendarand you received a certificate of attendance.

- A two-hour online webinar delivered by the Australian Bookkeepers Association Ltd on Tax Assistance for North Queensland floods, including fringe benefits tax (FBT) exemptions apply to employers who assist their employees in emergencies, such as natural disasters. You have a receipt for the payment and a certificate of completion. You completed the course over two days - 15-16 July.

- The NSW Annual Tax Forum, a two-day event hosted by The Tax Institute on September 20-21 which provides 14 structured CPD hours. You have a receipt for the payment, a registrationticketand a certificate of attendance. You attended the keynotes on Superannuation and Estate Planning, Property Investments and Uncommon Transactions in SMSFs, CGT Concessions, and Potential Changes to Tax Laws with a Change of Government.

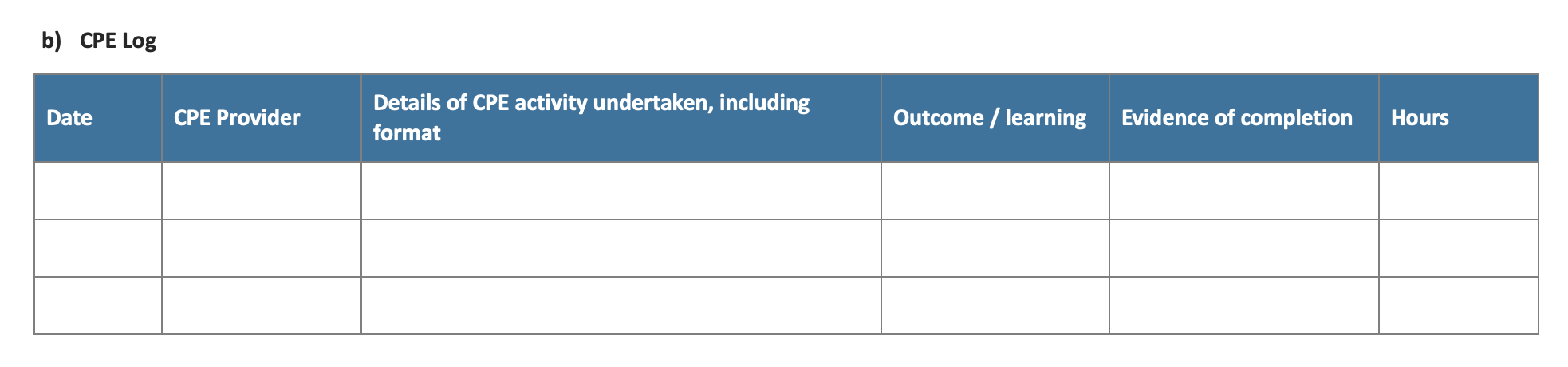

Update your CPE Log to document these activities.

b) CPE Log Details of CPE activity undertaken, including Date CPE Provider Outcome / learning Evidence of completion Hours format

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts