Question: SCHEDULE C ASSIGNMENTChoose one ? 2 pointsTo obtain your answer for this question, you will need to complete Part III of the form.After your calculations,

SCHEDULE C ASSIGNMENTChoose one ? 2 pointsTo obtain your answer for this question, you will need to complete Part III of the form.After your calculations, what figure belongs on LINE 4?$15,000$165,000$10,000$10,500

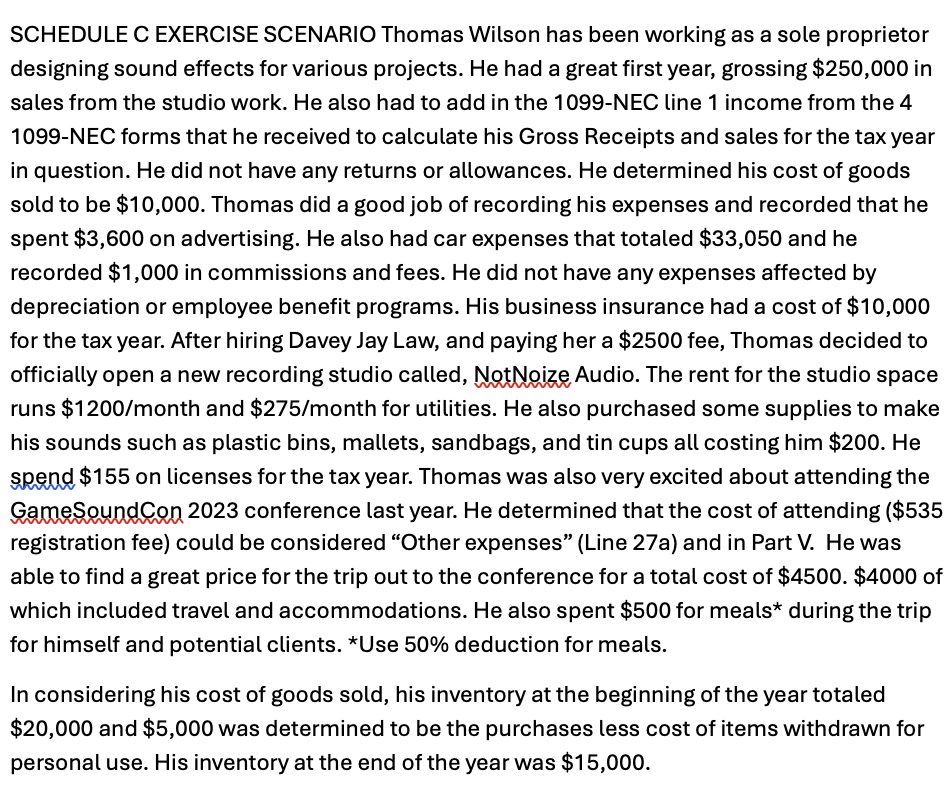

SCHEDULE C EXERCISE SCENARIO Thomas Wilson has been working as a sole proprietor designing sound effects for various projects. He had a great first year, grossing $250,000 in sales from the studio work. He also had to add in the 1099-NEC line 1 income from the 4 1099-NEC forms that he received to calculate his Gross Receipts and sales for the tax year in question. He did not have any returns or allowances. He determined his cost of goods sold to be $10,000. Thomas did a good job of recording his expenses and recorded that he spent $3,600 on advertising. He also had car expenses that totaled $33,050 and he recorded $1,000 in commissions and fees. He did not have any expenses affected by depreciation or employee benefit programs. His business insurance had a cost of $10,000 for the tax year. After hiring Davey Jay Law, and paying her a $2500 fee, Thomas decided to officially open a new recording studio called, NotNoize Audio. The rent for the studio space runs $1200/month and $275/month for utilities. He also purchased some supplies to make his sounds such as plastic bins, mallets, sandbags, and tin cups all costing him $200. He spend $155 on licenses for the tax year. Thomas was also very excited about attending the GameSoundCon 2023 conference last year. He determined that the cost of attending ($535 registration fee) could be considered \"Other expenses\" (Line 27a) and in Part V. He was able to find a great price for the trip out to the conference for a total cost of $4500. $4000 of which included travel and accommodations. He also spent $500 for meals* during the trip for himself and potential clients. *Use 50% deduction for meals. In considering his cost of goods sold, his inventory at the beginning of the year totaled $20,000 and $5,000 was determined to be the purchases less cost of items withdrawn for personal use. His inventory at the end of the year was $15,000