Question: Dave Sanders does computer consulting work on the side. He received a 1099 from his largest client showing that he made $25,300 from his

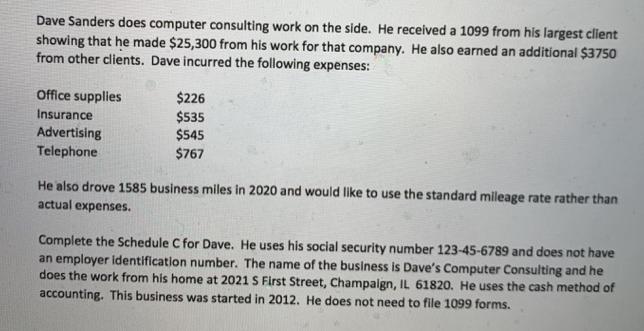

Dave Sanders does computer consulting work on the side. He received a 1099 from his largest client showing that he made $25,300 from his work for that company. He also earned an additional $3750 from other clients. Dave incurred the following expenses: Office supplies Insurance Advertising Telephone: $226 $535 $545 $767 He also drove 1585 business miles in 2020 and would like to use the standard mileage rate rather than actual expenses. Complete the Schedule C for Dave. He uses his social security number 123-45-6789 and does not have an employer identification number. The name of the business is Dave's Computer Consulting and he does the work from his home at 2021 S First Street, Champaign, IL 61820. He uses the cash method of accounting. This business was started in 2012. He does not need to file 1099 forms.

Step by Step Solution

3.47 Rating (163 Votes )

There are 3 Steps involved in it

Schedule C ... View full answer

Get step-by-step solutions from verified subject matter experts