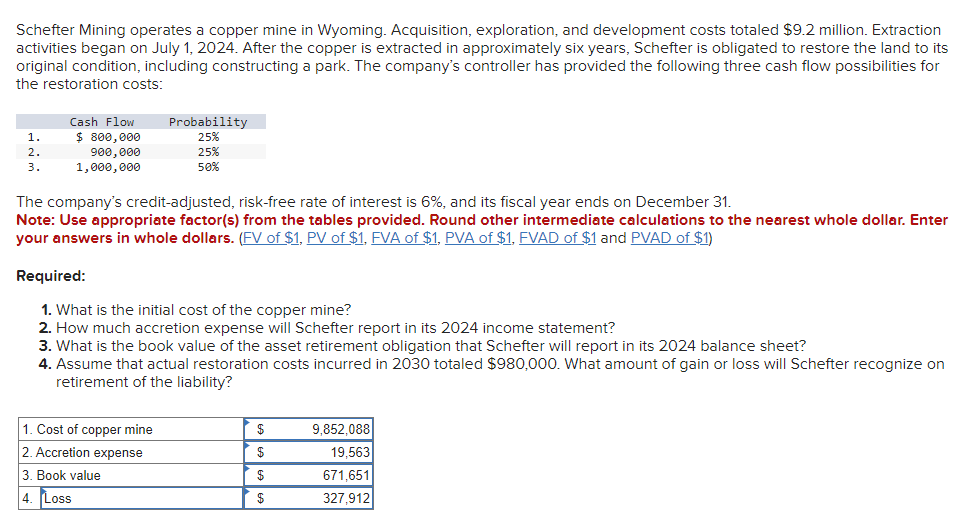

Question: Schefter Mining operates a copper mine in Wyoming. Acquisition, exploration, and development costs totaled $ 9 . 2 million. Extraction activities began on July 1

Schefter Mining operates a copper mine in Wyoming. Acquisition, exploration, and development costs totaled $ million. Extraction

activities began on July After the copper is extracted in approximately six years, Schefter is obligated to restore the land to its

original condition, including constructing a park. The company's controller has provided the following three cash flow possibilities for

the restoration costs:

The company's creditadjusted, riskfree rate of interest is and its fiscal year ends on December

Note: Use appropriate factors from the tables provided. Round other intermediate calculations to the nearest whole dollar. Enter

your answers in whole dollars. FV of $ PV of $ FVA of $ PVA of $ FVAD of $ and PVAD of $

Required:

What is the initial cost of the copper mine?

How much accretion expense will Schefter report in its income statement?

What is the book value of the asset retirement obligation that Schefter will report in its balance sheet?

Assume that actual restoration costs incurred in totaled $ What amount of gain or loss will Schefter recognize on

retirement of the liability?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock