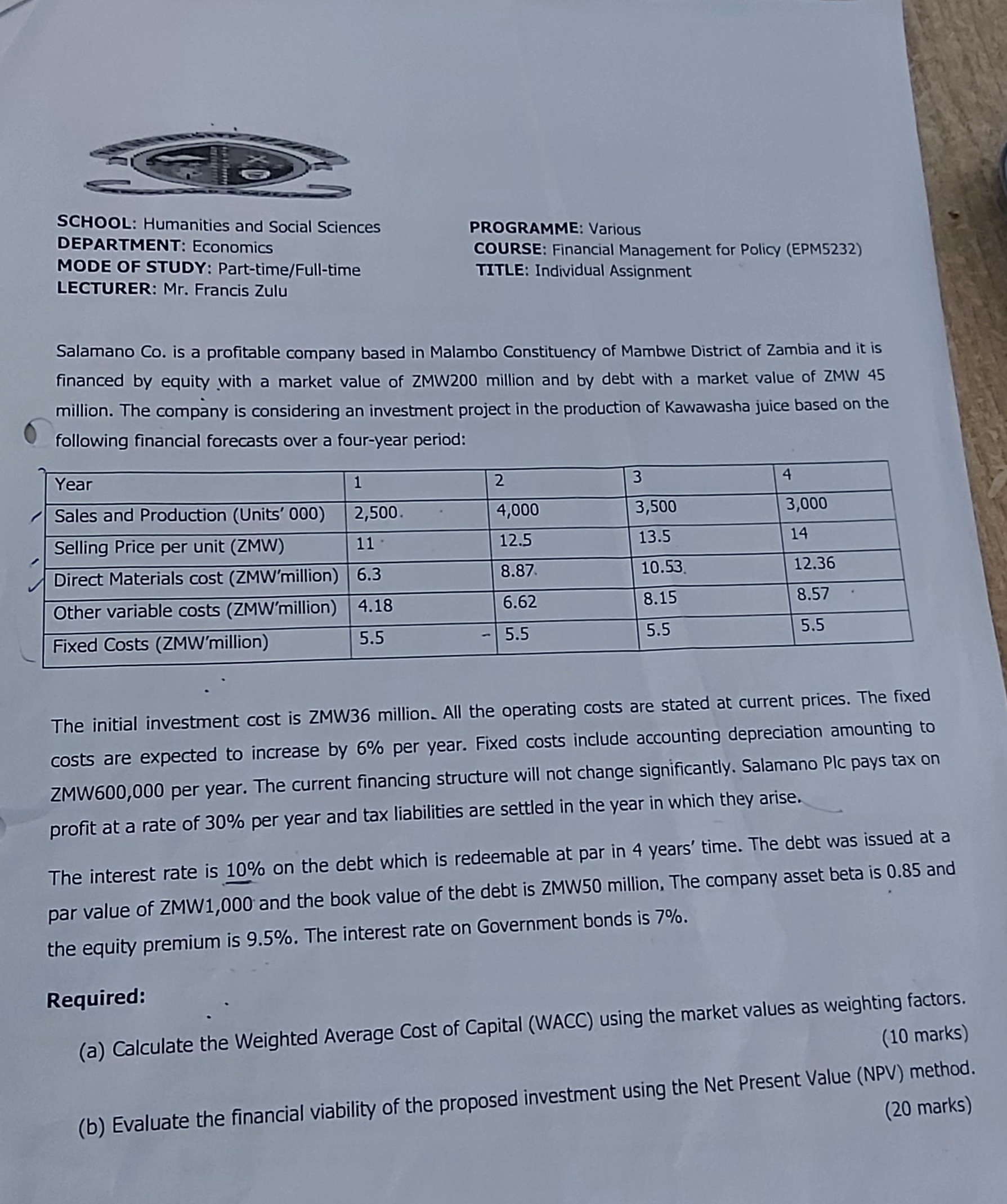

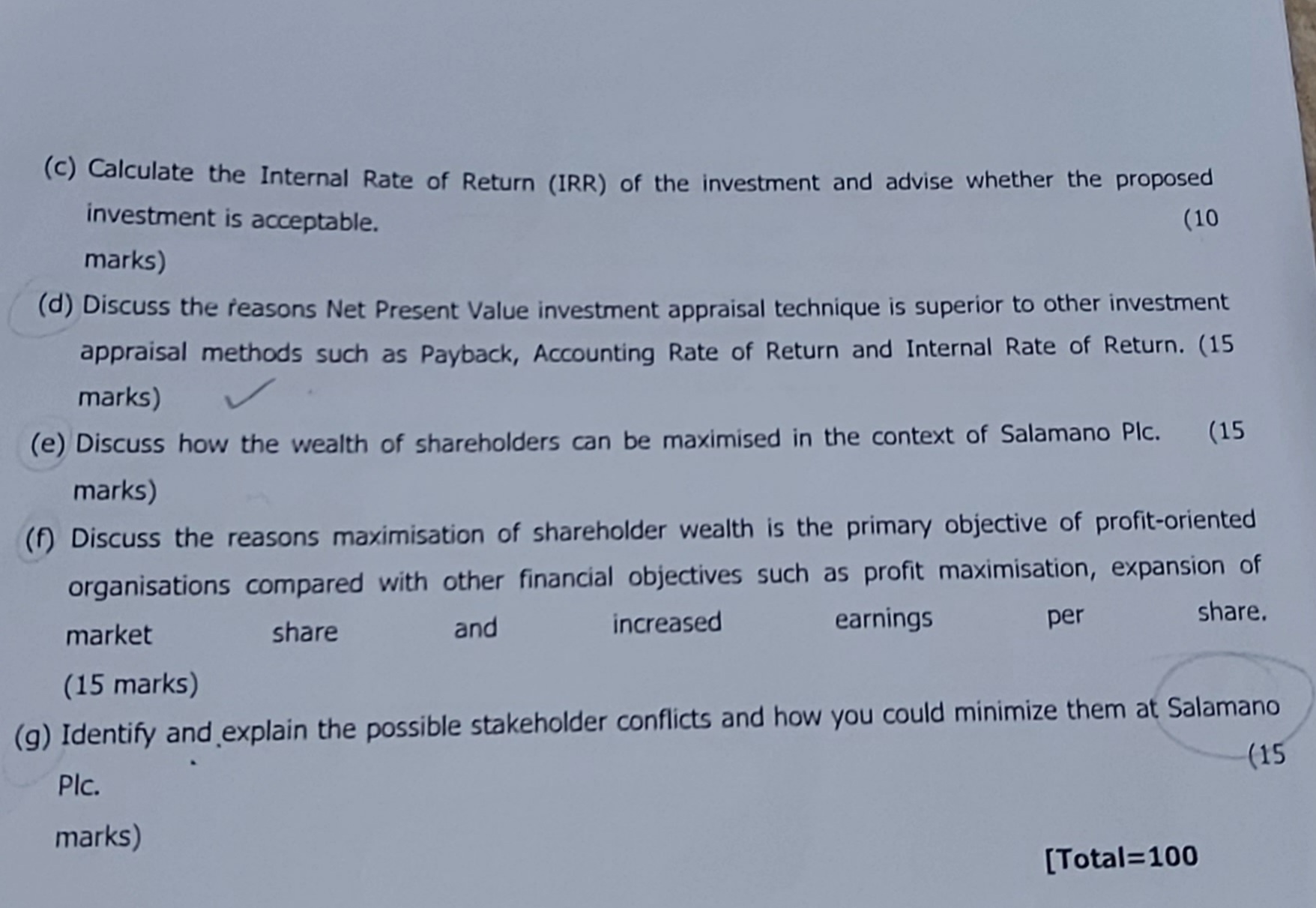

Question: SCHOOL: Humanities and Social Sciences DEPARTMENT: Economics PROGRAMME: Various MODE OF STUDY: Part-time/Full-time COURSE: Financial Management for Policy (EPM5232) LECTURER: Mr. Francis Zulu TITLE: Individual

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock