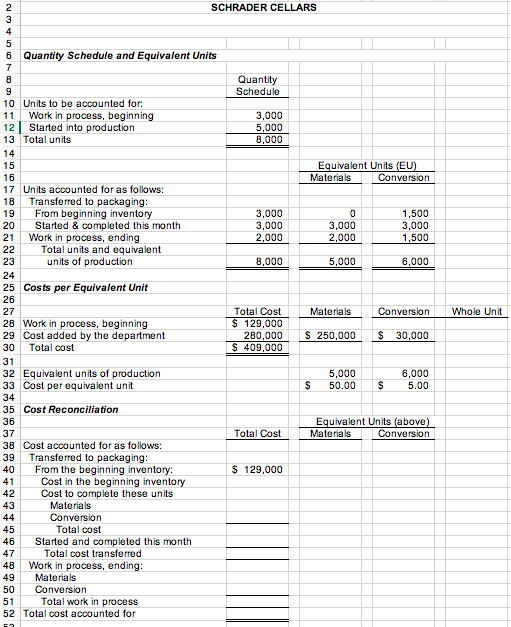

Question: Schrader Cellars uses the FIFO method in its two department process costing system: Fermenting (g... Schrader Cellars uses the FIFO method in its two department

Schrader Cellars uses the FIFO method in its two department process costing system: Fermenting (g... Schrader Cellars uses the FIFO method in its two department process costing system: Fermenting (grape sorting is part of the fermentation process) and Packaging. Direct materials (grapes) are added at the beginning of the fermenting process and at the end of the packaging process (bottles). Conversion costs are added evenly throughout each process. Data from the month of March for the Fermenting Department are below:

Beginning work in process inventory:

Units in beginning work in process inventory 3,000 gallons

Materials costs $122,000

Conversion costs $7,000

Percentage complete with respect to materials 100%

Percentage complete with respect to conversion 50%

Units started into production during the month 5,000 gallons

Materials costs added during the month $250,000

Conversion costs added during the month $30,000

Ending work in process inventory:

Units in ending work in process 2,000 gallons

Percentage complete with respect to materials 100%

Percentage complete with respect to conversion 75%

REQUIRED: Prepare a FIFO production report for the Fermentation Department for Schrader Cellars for the month ended December 31, 2018.

*Please show the cell reference*

SCHRADER CELLARS 6 Quantity Schedule and Equivalent Units Quantity Schedule 10 Units to be accounted for 1 Work in process, beginning 12 Started into production 13 Total units 3,000 5,000 15 16 17 Units accounted for as follows: 18 Transferred to packaging 19 From beginning inventory 20 Started & completed this month 21 Work in process, ending Equivalent Units Material:s Conversion 3,000 3,000 2,000 3,000 2,000 1,500 3,000 1,500 Total units and equivalent units of production 23 24 25 Costs per Equivalent Unit 26 27 28 Work in process, beginning 29 Cost added by the department 30 Total cost 31 32 Equivalent units of production 33 Cost per equivalent unit 34 35 Cost Reconciliation 36 37 38 Cost accounted for as follows: 39 Transferred to packaging 40From the beginning inventory: 41 Cost in the beginning inventory 42 43 Conversion Whole Unit Total Cost 129,000 Materias 280,000$ 250,000 30,000 409,000 5,000 6,000 S 50.00 5.00 Equivalent Units (above Material:s Total Cost Conversion $ 129,000 Cost to complete these units Materials Conversion 45 46 Started and completed this month 47 48 Work in process, ending 49 Materials 50 Conversion 51 52 Total cost accounted for Total cost Total cost transferred Total work in process

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts