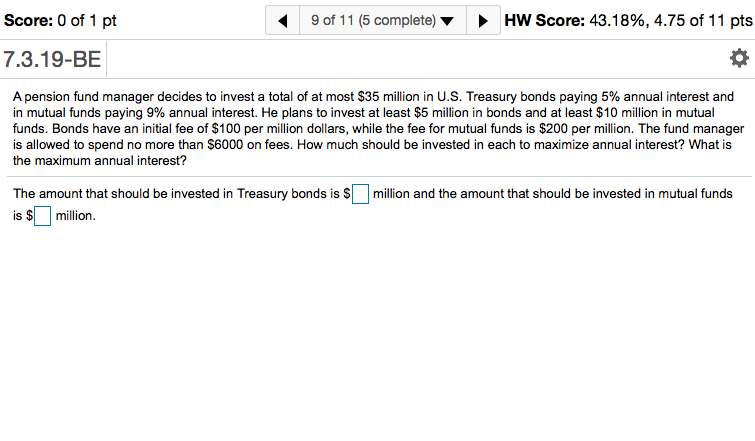

Question: Score: D of1 pt 4 Bof'l'l (5 complete}? ) HWScore: 43.13%, 4.?5 of 11 pts 7.3.19-BE it! A pension fund manager decides to invest a

Score: D of1 pt 4 Bof'l'l (5 complete}? ) HWScore: 43.13%, 4.?5 of 11 pts 7.3.19-BE it! A pension fund manager decides to invest a total of at most $35 million in U3. Treasury bonds paying 5% annual interest and in mutual funds paying 9% annual interest He plans to invest at least$5 million in bonds and at least$1 million in mutual funds. Bends have an initial fee of $10!] per million dollars, while the fee for mutual funds is $20G per million. The fund manager is allowed to spend no more than $6000 on fees. How much should be invested in each to maximize annual interest? What is the maximum annual interest? The amount that should be invested in Treasury bonds is SD million and the amount that should be invested in mutual funds is sD million

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts