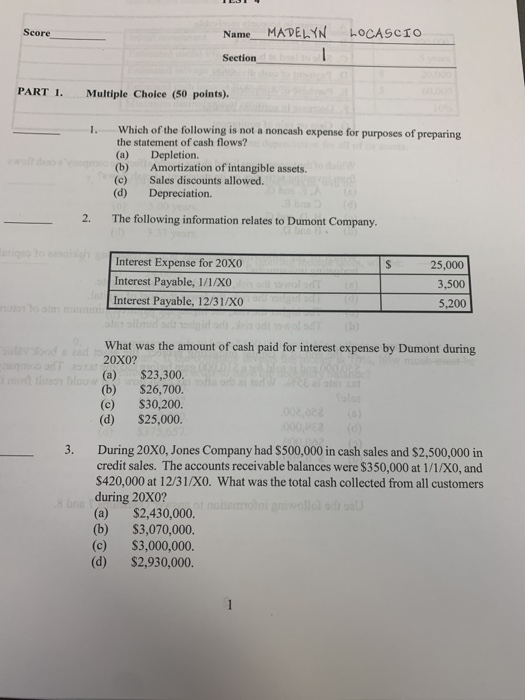

Question: Score LOCASCIO Name_ MADELYN Section PART I. Multiple Choice (50 points). Which of the following is not a noncash expense for purposes of preparing the

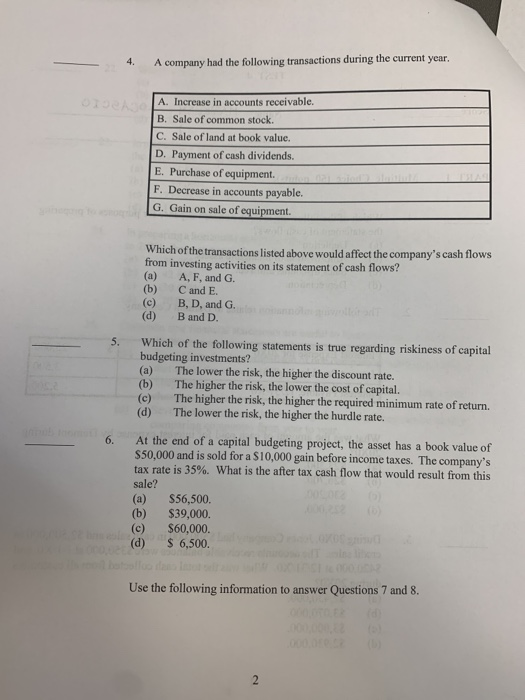

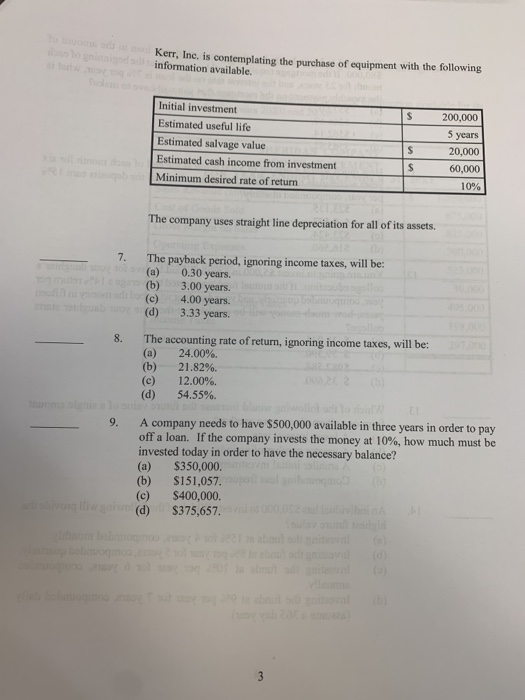

Score LOCASCIO Name_ MADELYN Section PART I. Multiple Choice (50 points). Which of the following is not a noncash expense for purposes of preparing the statement of cash flows? (a) Depletion. (b) Amortization of intangible assets. Sales discounts allowed. (d) Depreciation. (e) 2. The following information relates to Dumont Company. S Interest Expense for 20X0 Interest Payable, 1/1/XO Interest Payable, 12/31/XO o 25,000 3,500 5,200 What was the amount of cash paid for interest expense by Dumont during 20X0? (a) $23,300. (b) $26,700. (e) $30,200. (d) $25,000. 3. During 20X0, Jones Company had $500,000 in cash sales and $2,500,000 in credit sales. The accounts receivable balances were $350,000 at 1/1/XO, and $420,000 at 12/31/XO. What was the total cash collected from all customers during 20X0? $2,430,000 (b) $3,070,000 (c) $3,000,000 (d) $2,930,000. 4. A company had the following transactions during the current year. A. Increase in accounts receivable. B. Sale of common stock. C. Sale of land at book value. D. Payment of cash dividends. E. Purchase of equipment. F. Decrease in accounts payable. G. Gain on sale of equipment. Which of the transactions listed above would affect the company's cash flows from investing activities on its statement of cash flows? (a) A, F, and G. (b) C and E. (c) B, D, and G. (d) B and D. Which of the following statements is true regarding riskiness of capital budgeting investments? (a) The lower the risk, the higher the discount rate. (b) The higher the risk, the lower the cost of capital. (c) The higher the risk, the higher the required minimum rate of return. (d) The lower the risk, the higher the hurdle rate. 6. At the end of a capital budgeting project, the asset has a book value of $50,000 and is sold for a S10,000 gain before income taxes. The company's tax rate is 35%. What is the after tax cash flow that would result from this sale? (a) S56,500 (b) $39,000 (c) $60,000 (d) $ 6,500. Use the following information to answer Questions 7 and 8. Kerr, Inc. is contemplating the purchase of equipment with the following information available. 200,000 5 years Initial investment s Estimated useful life Estimated salvage value Estimated cash income from investment Minimum desired rate of return S 20,000 60,000 10% The company uses straight line depreciation for all of its assets. 7. The payback period, ignoring income taxes, will be: (a) 0.30 years. (b) 3.00 years. (c) 4.00 years. (d) 3.33 years The accounting rate of return, ignoring income taxes, will be: (a) 24.00% (b) 21.82% (c) 12.00% (d) 54.55% A company needs to have $500,000 available in three years in order to pay off a loan. If the company invests the money at 10%, how much must be invested today in order to have the necessary balance? (a) $350,000 (b) S151,057. (c) $400,000. (d) $375.657

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts