Question: Score Name Section Problem (10 points). Wagner Company is considering the possibility of replacing one of its current machines used in production with a new

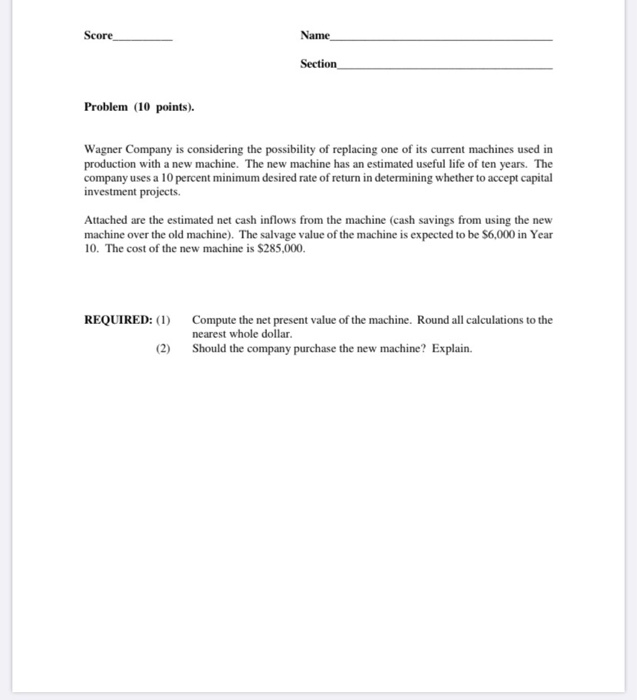

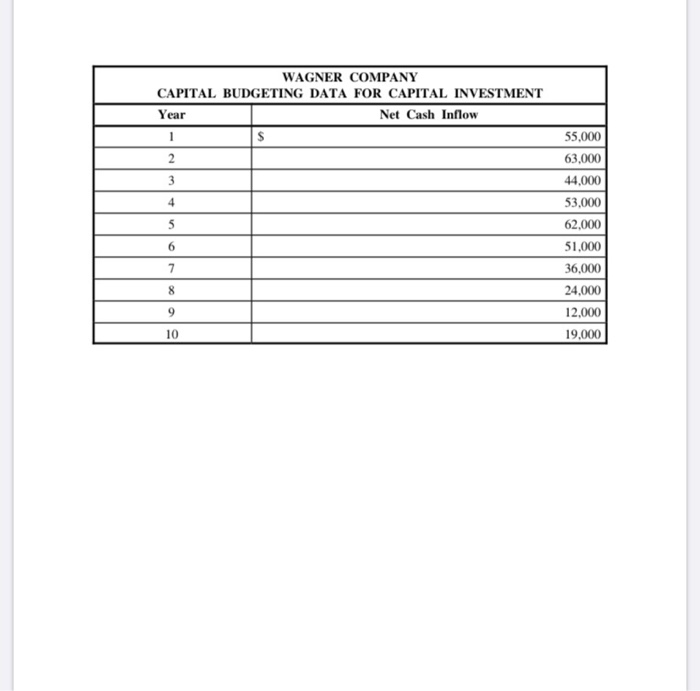

Score Name Section Problem (10 points). Wagner Company is considering the possibility of replacing one of its current machines used in production with a new machine. The new machine has an estimated useful life of ten years. The company uses a 10 percent minimum desired rate of return in determining whether to accept capital investment projects. Attached are the estimated net cash inflows from the machine (cash savings from using the new machine over the old machine). The salvage value of the machine is expected to be $6,000 in Year 10. The cost of the new machine is $285,000. REQUIRED: (1) Compute the net present value of the machine. Round all calculations to the nearest whole dollar. Should the company purchase the new machine? Explain. (2) WAGNER COMPANY CAPITAL BUDGETING DATA FOR CAPITAL INVESTMENT Year Net Cash Inflow 55,000 63,000 44,000 53,000 62,000 51,000 36,000 24,000 12,000 19,000 10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts