Question: Scott, a mechanic earns $ 1 0 0 , 0 0 0 a year, but has always wanted to be a nurse. Trisha, a neighbor

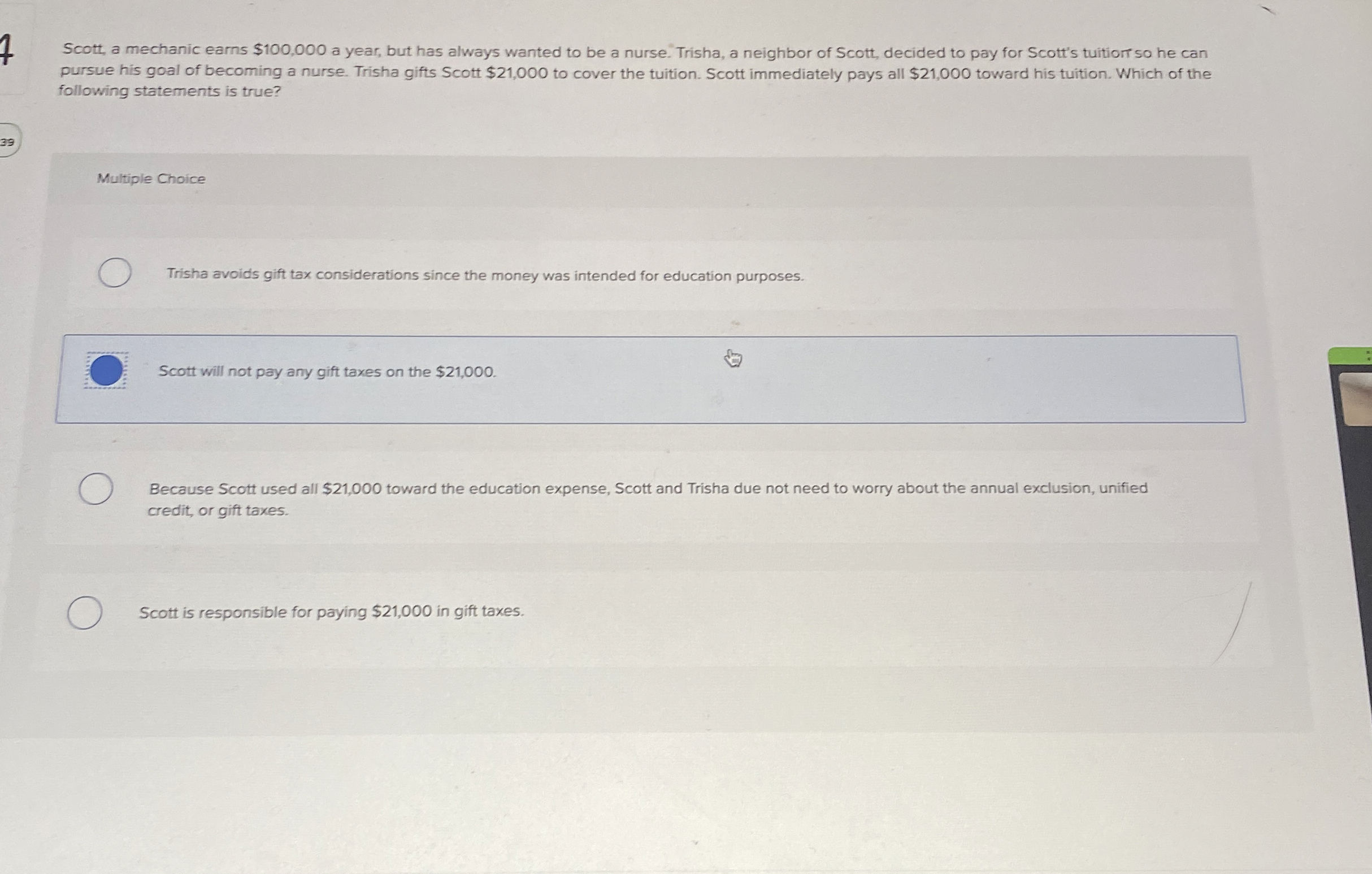

Scott, a mechanic earns $ a year, but has always wanted to be a nurse. Trisha, a neighbor of Scott, decided to pay for Scott's tuitiortso he can

pursue his goal of becoming a nurse. Trisha gifts Scott $ to cover the tuition. Scott immediately pays all $ toward his tuition. Which of the

following statements is true?

Multiple Choice

Trisha avoids gift tax considerations since the money was intended for education purposes.

Scott will not pay any gift taxes on the $

Because Scott used all $ toward the education expense, Scott and Trisha due not need to worry about the annual exclusion, unified

credit, or gift taxes.

Scott is responsible for paying $ in gift taxes.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock