Question: Scott Bean is a computer programmer and incurred the following transactions last year. table [ [ , Sales Price,Basis,Purchased,Sold ] , [ Provo City

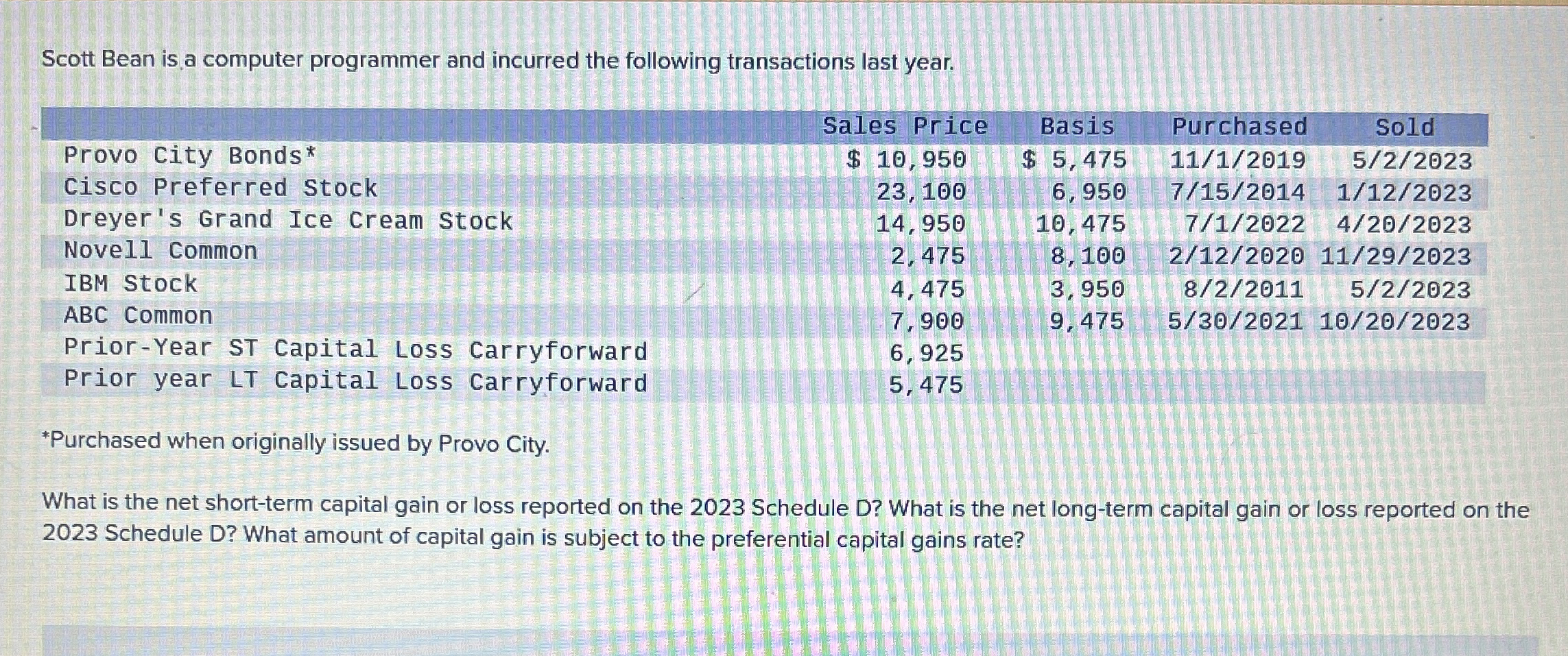

Scott Bean is a computer programmer and incurred the following transactions last year.

tableSales Price,Basis,Purchased,SoldProvo City Bonds$ $ Cisco Preferred Stock,Dreyers Grand Ice Cream Stock,Novell Common,IBM Stock,ABC Common,PriorYear ST Capital Loss Carryforward,Prior year LT Capital Loss Carryforward,

Purchased when originally issued by Provo City.

What is the net shortterm capital gain or loss reported on the Schedule D What is the net longterm capital gain or loss reported on the Schedule D What amount of capital gain is subject to the preferential capital gains rate?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock