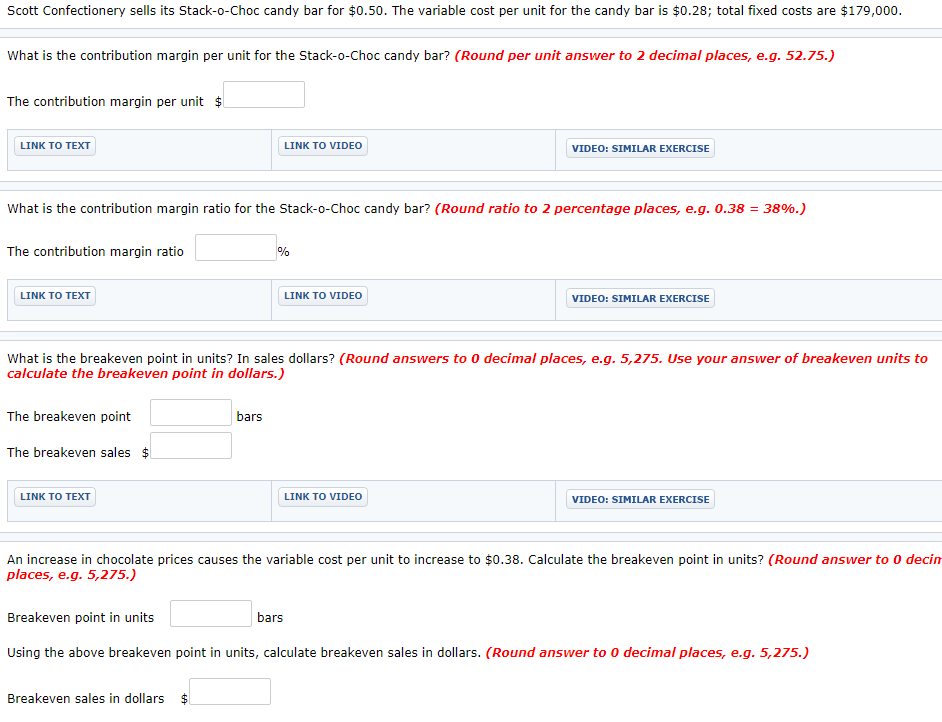

Question: Scott Confectionery sells its Stack-o-Choc candy bar for $0.50. The variable cost per unit for the candy bar is $0.28; total fixed costs are $179,000

Scott Confectionery sells its Stack-o-Choc candy bar for $0.50. The variable cost per unit for the candy bar is $0.28; total fixed costs are $179,000 What is the contribution margin per unit for the Stack-o-Choc candy bar? (Round per unit answer to 2 decimal places, e.g. 52.75.) The contribution margin per unit $ LINK TO TEXT LINK TO VIDEO VIDEO: SIMILAR EXERCISE What is the contribution margin ratio for the Stack-o-Choc candy bar? (Round ratio to 2 percentage places, e.g. 0.38 38%.) The contribution margin ratio % LINK TO TEXT LINK TO VIDEO VIDEO: SIMILAR EXERCISE What is the breakeven point in units? In sales dollars? (Round answers to 0 decimal places, e.g. 5,275. Use your answer of breakeven units to calculate the breakeven point in dollars.) The breakeven point bars The breakeven sales $ LINK TO TEXT LINK TO VIDEO VIDEO: SIMILAR EXERCISE An increase in chocolate prices causes the variable cost per unit to increase to $0.38. Calculate the breakeven point in units? (Round answer to 0 decim places, e.g. 5,275.) Breakeven point in units bars Using the above breakeven point in units, calculate breakeven sales in dollars. (Round answer to 0 decimal places, e.g. 5,275.) Breakeven sales in dollars

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts