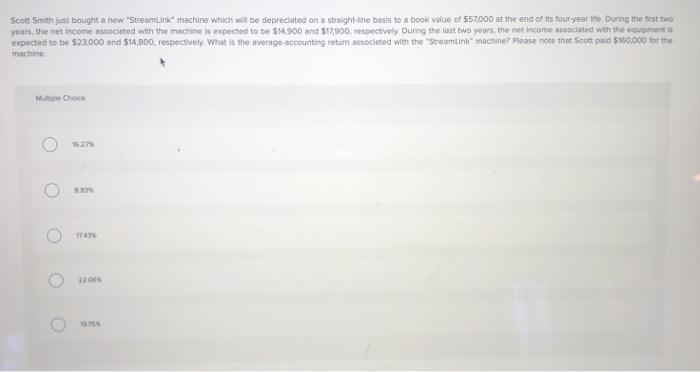

Question: Scott Smith just bought a new StreamLink machine which will be deprecated on a straight-line basis to a book value of $57000 at the end

Scott Smith just bought a new StreamLink machine which will be deprecated on a straight-line basis to a book value of $57000 at the end of its four year ite During the best two years, the net income associated with the machine is expected to be $14,900 and $17,900, respectively. During the last two years, the net income associated with the cuipment is expected to be $23.000 and $14,800, respectively What is the average accounting retum associated with the Starting machine Pease note that Scott paid 5160,000 for the machine Mut Choice 162 1741 2200

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts