Question: Scroll down to complete all parts of this task. Two individual taxpayers are forming a new business together and must select the appropriate entity type

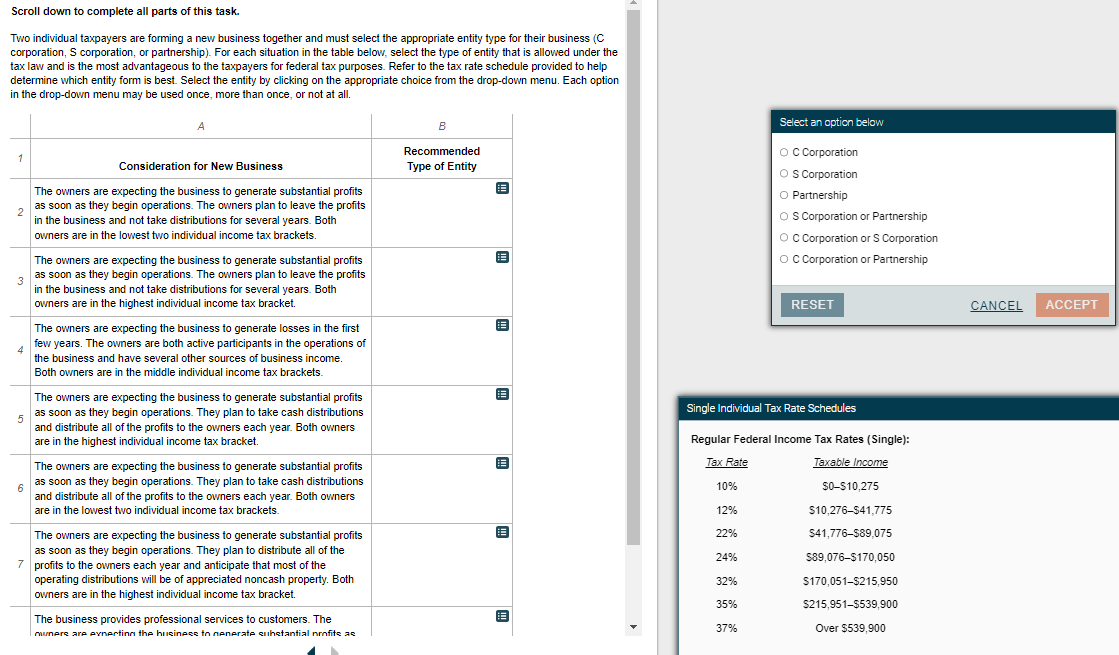

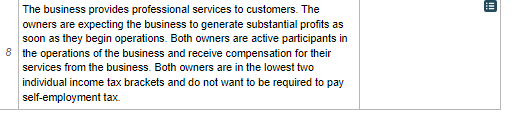

Scroll down to complete all parts of this task. Two individual taxpayers are forming a new business together and must select the appropriate entity type for their business (C corporation, S corporation, or partnership). For each situation in the table below, select the type of entity that is allowed under the tax law and is the most advantageous to the taxpayers for federal tax purposes. Refer to the tax rate schedule provided to help determine which entity form is best. Select the entity by clicking on the appropriate choice from the drop-down menu. Each option in the drop-down menu may be used once, more than once, or not at all. A B Select an option below Recommended O C Corporation Consideration for New Business Type of Entity O S Corporation The owners are expecting the business to generate substantial profits O Partnership 2 as soon as they begin operations. The owners plan to leave the profits in the business and not take distributions for several years. Both O S Corporation or Partnership owners are in the lowest two individual income tax brackets. C Corporation or S Corporation The owners are expecting the business to generate substantial profits O C Corporation or Partnership 3 as soon as they begin operations. The owners plan to leave the profits in the business and not take distributions for several years. Both owners are in the highest individual income tax bracket. RESET CANCEL ACCEPT The owners are expecting the business to generate losses in the first 4 few years. The owners are both active participants in the operations of the business and have several other sources of business income. Both owners are in the middle individual income tax brackets. The owners are expecting the business to generate substantial profits Single Individual Tax Rate Schedules 5 as soon as they begin operations. They plan to take cash distributions and distribute all of the profits to the owners each year. Both owners are in the highest individual income tax bracket. Regular Federal Income Tax Rates (Single): The owners are expecting the business to generate substantial profits Tax Rate Taxable Income 6 as soon as they begin operations. They plan to take cash distributions 10% $0-$10,275 and distribute all of the profits to the owners each year. Both owners are in the lowest two individual income tax brackets. 12% $10,276-$41,775 The owners are expecting the business to generate substantial profits 22% $41,776-$89,075 as soon as they begin operations. They plan to distribute all of the 24% 7 $89,076-$170,050 profits to the owners each year and anticipate that most of the operating distributions will be of appreciated noncash property. Both 32% $170,051-$215,950 owners are in the highest individual income tax bracket. 35% $215,951-$539,900 The business provides professional services to customers. The munare are avnerting the huliness in nenerate chetantial nmfite as 37% Over $539,900The business provides professional services to customers. The owners are expecting the business to generate substantial profits as soon as they begin operations. Both owners are active participants in 8 the operations of the business and receive compensation for their services from the business. Both owners are in the lowest two individual income tax brackets and do not want to be required to pay self-employment tax

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts