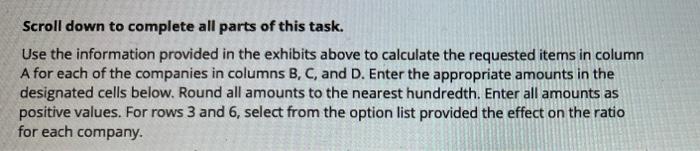

Question: Scroll down to complete all parts of this task. Use the information provided in the exhibits above to calculate the requested items in column A

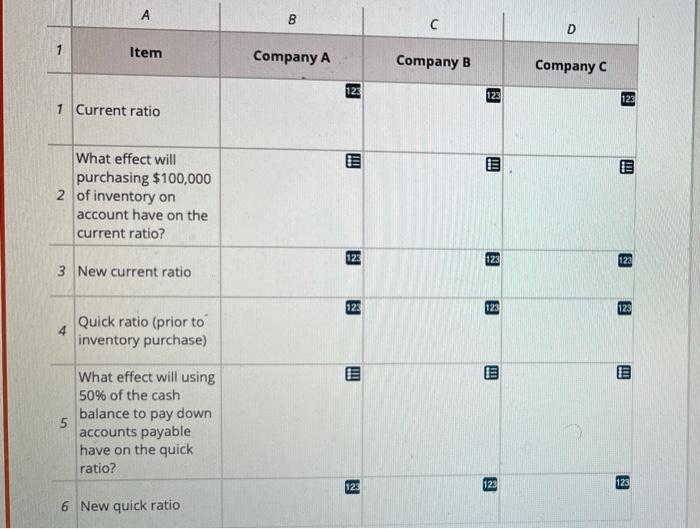

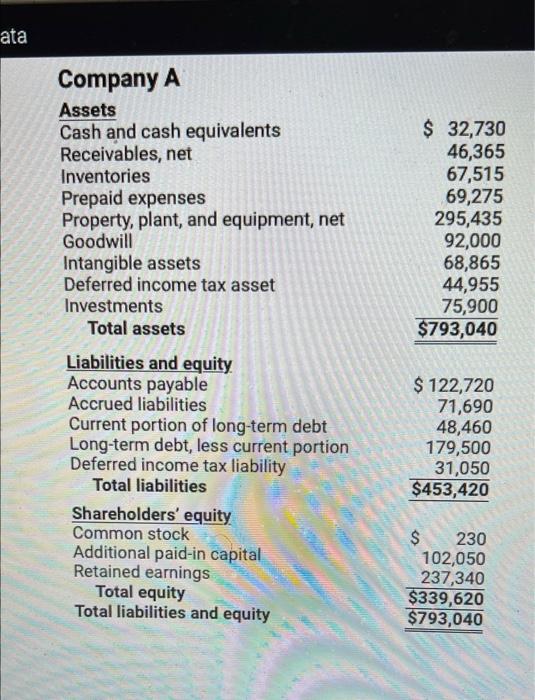

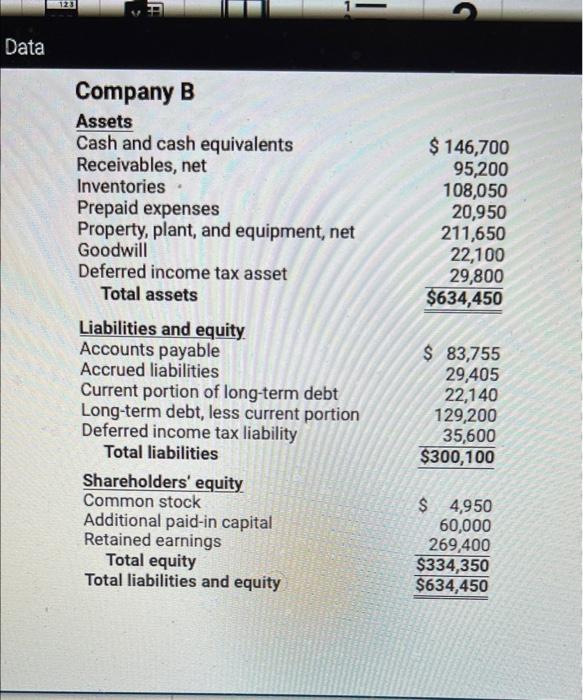

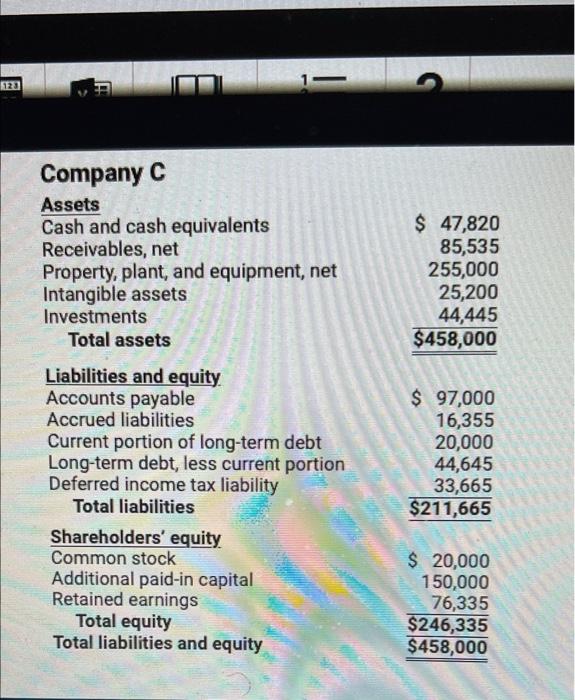

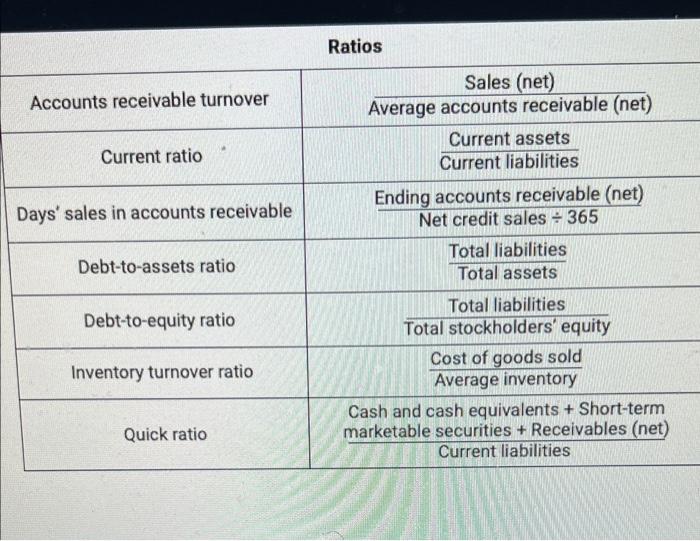

Scroll down to complete all parts of this task. Use the information provided in the exhibits above to calculate the requested items in column A for each of the companies in columns B, C, and D. Enter the appropriate amounts in the designated cells below. Round all amounts to the nearest hundredth. Enter all amounts as positive values. For rows 3 and 6, select from the option list provided the effect on the ratio for each company. B D Item Company A Company B Company C 123 123 123 1 Current ratio .!! E AM E What effect will purchasing $100,000 2 of inventory on account have on the current ratio? 123 123 123 3 New current ratio 123 123 123 Quick ratio (prior to 4 inventory purchase) E What effect will using 50% of the cash balance to pay down 5 accounts payable have on the quick ratio? 123 123 123 6 New quick ratio ata Company A Assets Cash and cash equivalents Receivables, net Inventories Prepaid expenses Property, plant, and equipment, net Goodwill Intangible assets Deferred income tax asset Investments Total assets $ 32,730 46,365 67,515 69,275 295,435 92,000 68,865 44,955 75,900 $793,040 Liabilities and equity Accounts payable Accrued liabilities Current portion of long-term debt Long-term debt, less current portion Deferred income tax liability Total liabilities Shareholders' equity Common stock Additional paid-in capital Retained earnings Total equity Total liabilities and equity $ 122,720 71,690 48,460 179,500 31,050 $453,420 $ 230 102,050 237,340 $339,620 $793,040 123 - 5 Data Company B Assets Cash and cash equivalents Receivables, net Inventories Prepaid expenses Property, plant, and equipment, net Goodwill Deferred income tax asset Total assets $ 146,700 95,200 108,050 20,950 211,650 22,100 29,800 $634,450 Liabilities and equity Accounts payable Accrued liabilities Current portion of long-term debt Long-term debt, less current portion Deferred income tax liability Total liabilities Shareholders' equity Common stock Additional paid-in capital Retained earnings Total equity Total liabilities and equity $ 83,755 29,405 22,140 129,200 35,600 $300,100 $ 4,950 60,000 269,400 $334,350 $634,450 120 Company C Assets Cash and cash equivalents Receivables, net Property, plant, and equipment, net Intangible assets Investments Total assets $ 47,820 85,535 255,000 25,200 44,445 $458,000 Liabilities and equity Accounts payable Accrued liabilities Current portion of long-term debt Long-term debt, less current portion Deferred income tax liability Total liabilities Shareholders' equity Common stock Additional paid-in capital Retained earnings Total equity Total liabilities and equity $ 97,000 16,355 20,000 44,645 33,665 $211,665 $ 20,000 150,000 76,335 $246,335 $458,000 Ratios Accounts receivable turnover Current ratio Days' sales in accounts receivable Debt-to-assets ratio Sales (net) Average accounts receivable (net) Current assets Current liabilities Ending accounts receivable (net) Net credit sales - 365 Total liabilities Total assets Total liabilities Total stockholders' equity Cost of goods sold Average inventory Cash and cash equivalents + Short-term marketable securities + Receivables (net) Current liabilities Debt-to-equity ratio Inventory turnover ratio Quick ratio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts