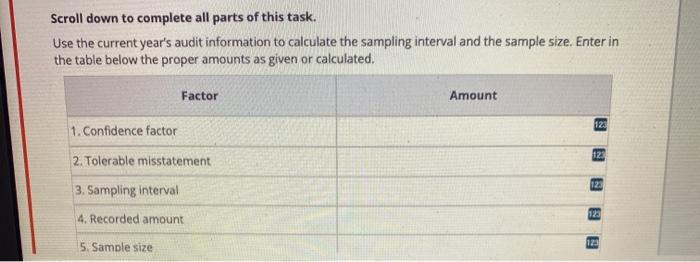

Question: Scroll down to complete all parts of this task. Use the current year's audit information to calculate the sampling interval and the sample size. Enter

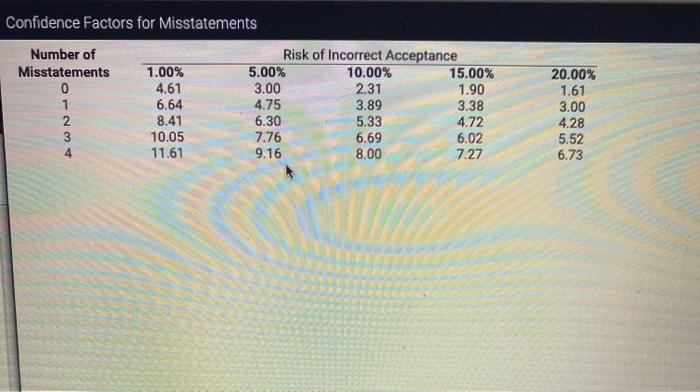

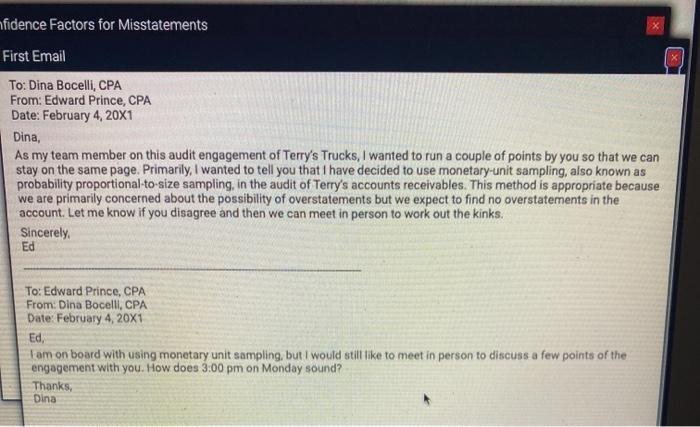

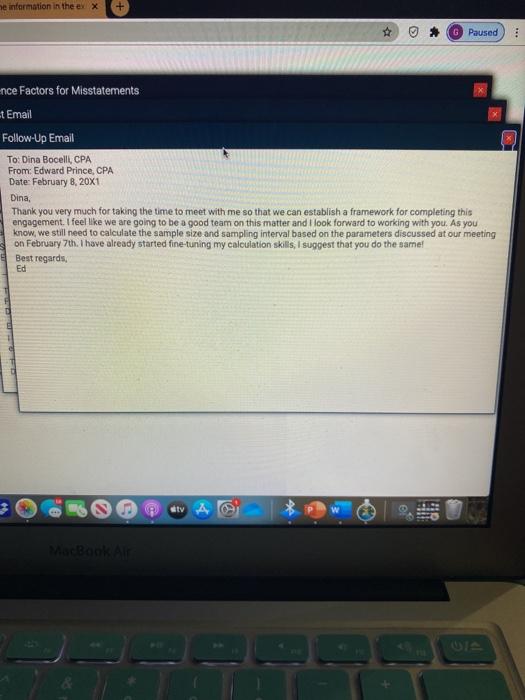

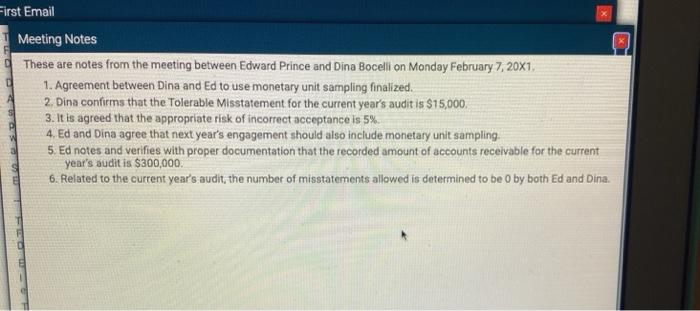

Scroll down to complete all parts of this task. Use the current year's audit information to calculate the sampling interval and the sample size. Enter in the table below the proper amounts as given or calculated. Factor Amount 123 1. Confidence factor 123 2. Tolerable misstatement 123 3. Sampling interval 123 4. Recorded amount 123 5. Sample size Confidence Factors for Misstatements Number of Risk of Incorrect Acceptance Misstatements 1.00% 5.00% 10.00% 15.00% 0 4.61 3.00 2.31 1.90 1 6.64 4.75 3.89 3.38 2 8.41 6.30 5.33 4.72 3 10.05 7.76 6.69 6.02 4 11.61 9.16 8.00 7.27 20.00% 1.61 3.00 4.28 5.52 6.73 X X fidence Factors for Misstatements First Email To: Dina Bocelli, CPA From: Edward Prince, CPA Date: February 4, 20X1 Dina, As my team member on this audit engagement of Terry's Trucks, I wanted to run a couple of points by you so that we can stay on the same page. Primarily, I wanted to tell you that I have decided to use monetary-unit sampling, also known as probability proportional-to-size sampling, in the audit of Terry's accounts receivables. This method is appropriate because we are primarily concerned about the possibility of overstatements but we expect to find no overstatements in the account. Let me know if you disagree and then we can meet in person to work out the kinks. Sincerely, Ed To: Edward Prince, CPA From: Dina Bocelli, CPA Date: February 4, 20X1 Ed, Tam on board with using monetary unit sampling, but I would still like to meet in person to discuss a few points of the engagement with you. How does 3:00 pm on Monday sound? Thanks, Dina se intormation in the ex x G Paused : x x nce Factors for Misstatements t Email Follow-Up Email To: Dina Bocell, CPA From: Edward Prince, CPA Date: February 8, 20X1 Dina Thank you very much for taking the time to meet with me so that we can establish a framework for completing this engagement. I feel like we are going to be a good team on this matter and I look forward to working with you. As you know, we still need to calculate the sample size and sampling interval based on the parameters discussed at our meeting on February 7th. I have already started fine-tuning my calculation skills, I suggest that you do the same! Best regards, Ed dtv @ First Email Meeting Notes These are notes from the meeting between Edward Prince and Dina Bocelli on Monday February 7, 20X1. 1. Agreement between Dina and Ed to use monetary unit sampling finalized. 2. Dina confirms that the Tolerable Misstatement for the current year's audit is $15,000 3. It is agreed that the appropriate risk of incorrect acceptance is 5% 4. Ed and Dina agree that next year's engagement should also include monetary unit sampling. 5. Ed notes and verifies with proper documentation that the recorded amount of accounts receivable for the current year's audit is $300,000 6. Related to the current year's audit, the number of misstatements allowed is determined to be o by both Ed and Dina. Scroll down to complete all parts of this task. Use the current year's audit information to calculate the sampling interval and the sample size. Enter in the table below the proper amounts as given or calculated. Factor Amount 123 1. Confidence factor 123 2. Tolerable misstatement 123 3. Sampling interval 123 4. Recorded amount 123 5. Sample size Confidence Factors for Misstatements Number of Risk of Incorrect Acceptance Misstatements 1.00% 5.00% 10.00% 15.00% 0 4.61 3.00 2.31 1.90 1 6.64 4.75 3.89 3.38 2 8.41 6.30 5.33 4.72 3 10.05 7.76 6.69 6.02 4 11.61 9.16 8.00 7.27 20.00% 1.61 3.00 4.28 5.52 6.73 X X fidence Factors for Misstatements First Email To: Dina Bocelli, CPA From: Edward Prince, CPA Date: February 4, 20X1 Dina, As my team member on this audit engagement of Terry's Trucks, I wanted to run a couple of points by you so that we can stay on the same page. Primarily, I wanted to tell you that I have decided to use monetary-unit sampling, also known as probability proportional-to-size sampling, in the audit of Terry's accounts receivables. This method is appropriate because we are primarily concerned about the possibility of overstatements but we expect to find no overstatements in the account. Let me know if you disagree and then we can meet in person to work out the kinks. Sincerely, Ed To: Edward Prince, CPA From: Dina Bocelli, CPA Date: February 4, 20X1 Ed, Tam on board with using monetary unit sampling, but I would still like to meet in person to discuss a few points of the engagement with you. How does 3:00 pm on Monday sound? Thanks, Dina se intormation in the ex x G Paused : x x nce Factors for Misstatements t Email Follow-Up Email To: Dina Bocell, CPA From: Edward Prince, CPA Date: February 8, 20X1 Dina Thank you very much for taking the time to meet with me so that we can establish a framework for completing this engagement. I feel like we are going to be a good team on this matter and I look forward to working with you. As you know, we still need to calculate the sample size and sampling interval based on the parameters discussed at our meeting on February 7th. I have already started fine-tuning my calculation skills, I suggest that you do the same! Best regards, Ed dtv @ First Email Meeting Notes These are notes from the meeting between Edward Prince and Dina Bocelli on Monday February 7, 20X1. 1. Agreement between Dina and Ed to use monetary unit sampling finalized. 2. Dina confirms that the Tolerable Misstatement for the current year's audit is $15,000 3. It is agreed that the appropriate risk of incorrect acceptance is 5% 4. Ed and Dina agree that next year's engagement should also include monetary unit sampling. 5. Ed notes and verifies with proper documentation that the recorded amount of accounts receivable for the current year's audit is $300,000 6. Related to the current year's audit, the number of misstatements allowed is determined to be o by both Ed and Dina

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts