Question: Sweet Sugar Company processes sugar beets into three products. During April the joint costs of processing were $24,000 Sugar can be sold at split

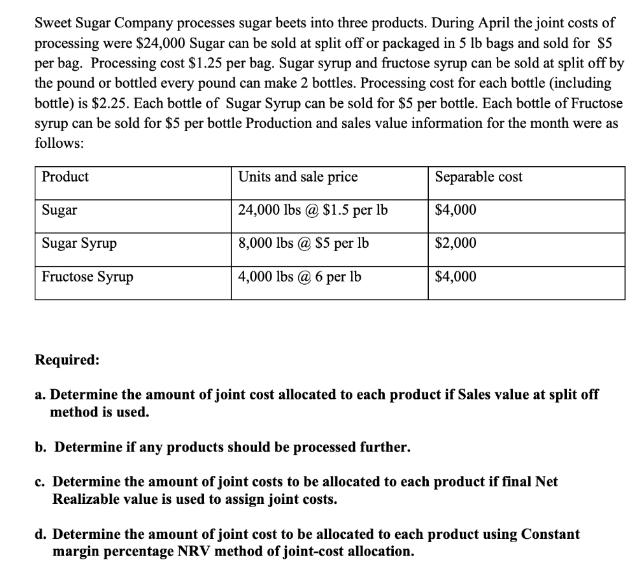

Sweet Sugar Company processes sugar beets into three products. During April the joint costs of processing were $24,000 Sugar can be sold at split off or packaged in 5 lb bags and sold for $5 per bag. Processing cost $1.25 per bag. Sugar syrup and fructose syrup can be sold at split off by the pound or bottled every pound can make 2 bottles. Processing cost for each bottle (including bottle) is $2.25. Each bottle of Sugar Syrup can be sold for $5 per bottle. Each bottle of Fructose syrup can be sold for $5 per bottle Production and sales value information for the month were as follows: Product Sugar Sugar Syrup Fructose Syrup Units and sale price 24,000 lbs @ $1.5 per lb 8,000 lbs @ $5 per lb 4,000 lbs @ 6 per lb Separable cost $4,000 $2,000 $4,000 Required: a. Determine the amount of joint cost allocated to each product if Sales value at split off method is used. b. Determine if any products should be processed further. c. Determine the amount of joint costs to be allocated to each product if final Net Realizable value is used to assign joint costs. d. Determine the amount of joint cost to be allocated to each product using Constant margin percentage NRV method of joint-cost allocation.

Step by Step Solution

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts