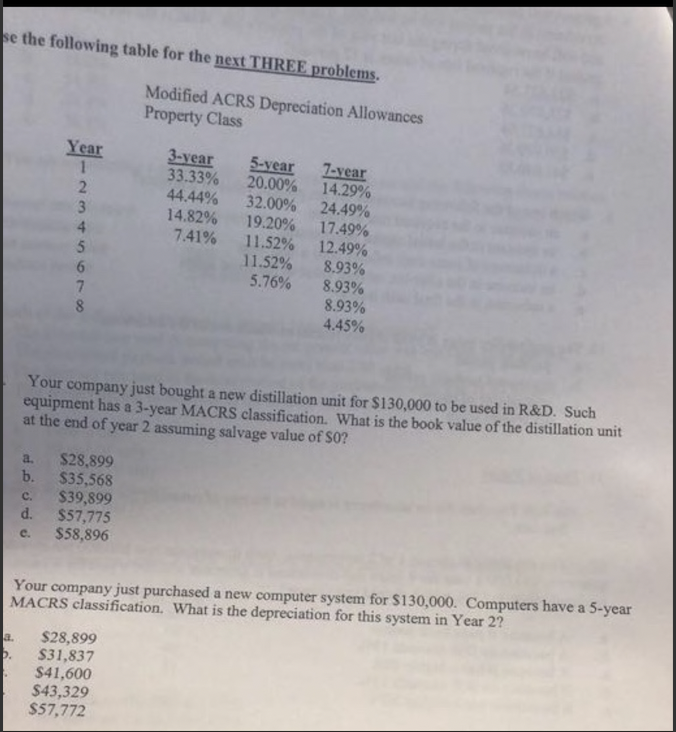

Question: se the following table for the next THREE problems. Modified ACRS Depreciation Allowances Property Class Year 1 2 3 4 5 6 7 8 3-year

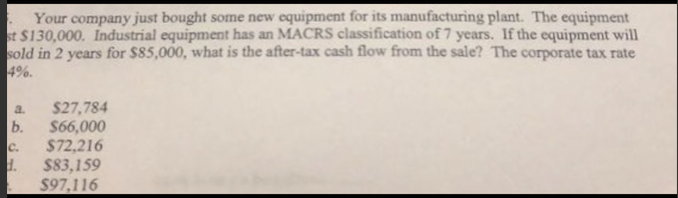

se the following table for the next THREE problems. Modified ACRS Depreciation Allowances Property Class Year 1 2 3 4 5 6 7 8 3-year 5-year 33.33% 20.00% 44.44% 32.00% 14.82% 19.20% 7.41% 11.52% 11.52% 5.76% 7-year 14.29% 24.49% 17.49% 12.49% 8.93% 8.93% 8.93% 4.45% Your company just bought a new distillation unit for $130,000 to be used in R&D. Such equipment has a 3-year MACRS classification. What is the book value of the distillation unit at the end of year 2 assuming salvage value of So? a. $28,899 b. $35,568 c. $39,899 d. $57,775 e. $58,896 Your company just purchased a new computer system for $130,000. Computers have a 5-year MACRS classification. What is the depreciation for this system in Year 2? a. $28,899 $31,837 $41,600 $43,329 $57,772 Your company just bought some new equipment for its manufacturing plant. The equipment $130,000. Industrial equipment has an MACRS classification of 7 years. If the equipment will sold in 2 years for $85,000, what is the after-tax cash flow from the sale? The corporate tax rate 4%. a b. c. 1. $27,784 $66,000 $72,216 $83,159 $97,116

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts