Question: se The Two Beta Trap (8 Points) 1 Complete the table below by indicating whether the statement in the leftmost column is true (T) or

se

se

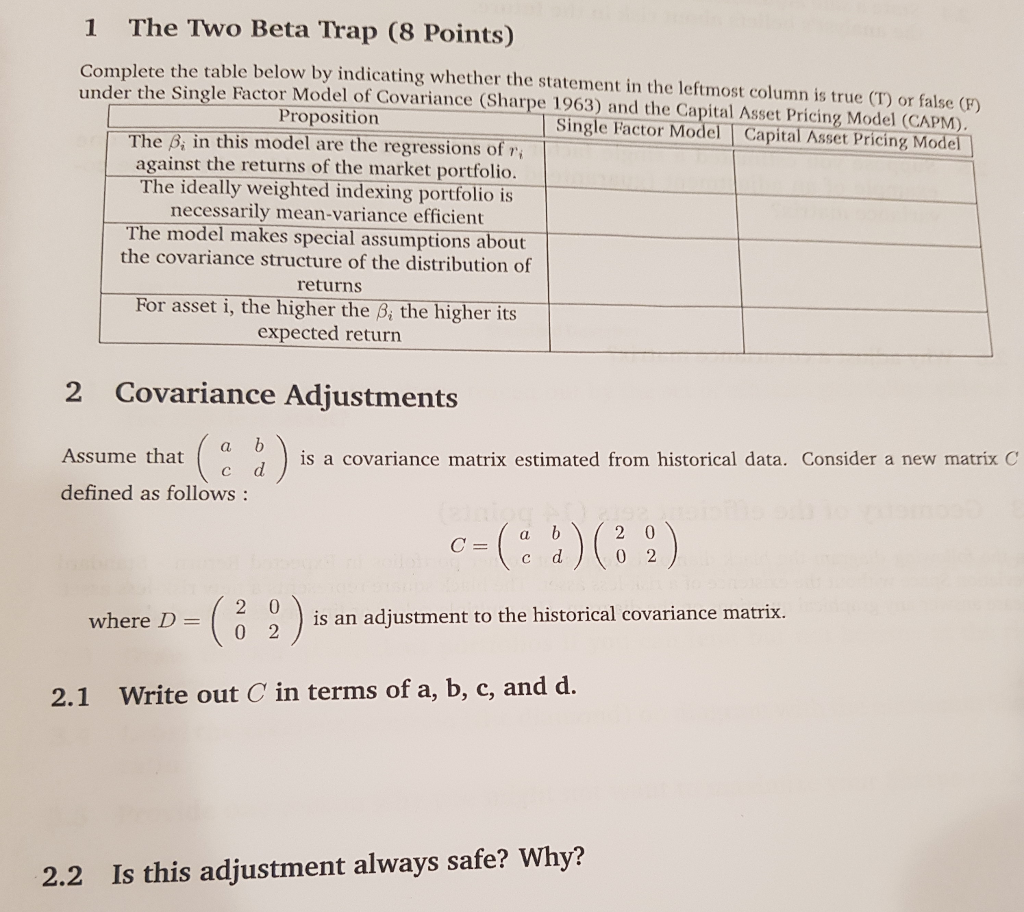

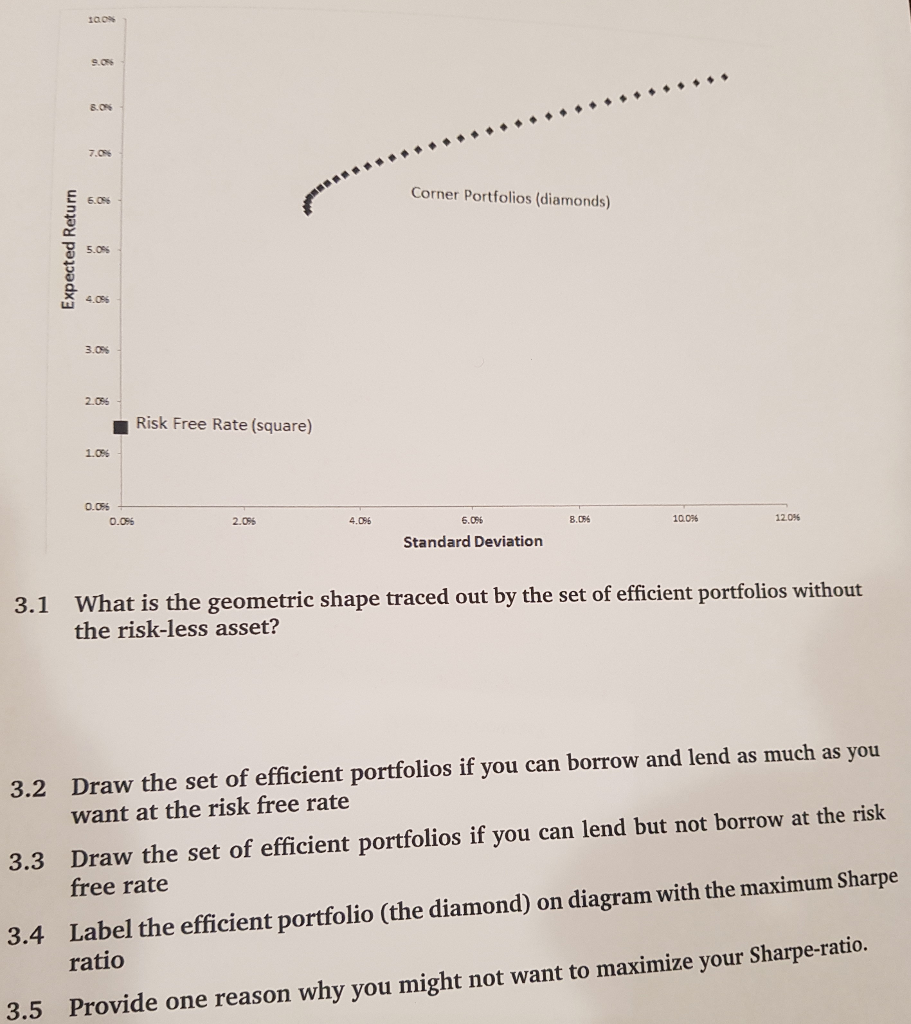

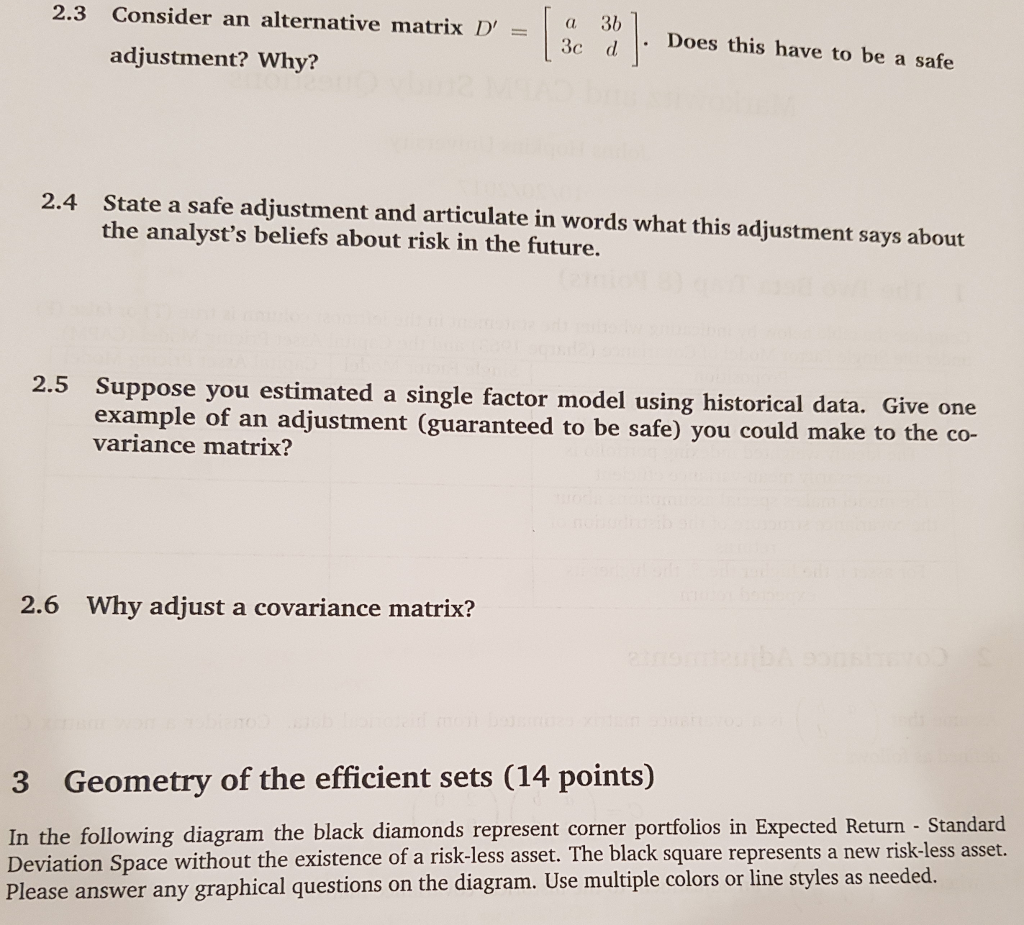

The Two Beta Trap (8 Points) 1 Complete the table below by indicating whether the statement in the leftmost column is true (T) or false (F) under the Single Factor Model of Covariance (Sharpe 1963) and the Capital Asset Pricing Model (CAPM) Proposition The in this model are the regressions of against the returns of the market portfolio. The ideally weighted indexing portfolio is necessarily mean-variance efficient Single Factor Model Capital Asset Pricing Model The model makes special assumptions about the covariance structure of the distribution of returns For asset i, the higher the Bi the higher its expected return 2 Covariance Adjustments Assume that Assume thatcd is a covariance matrix estimated from historical data. Consider a new matrix C defined as follows a b where D is an adjustment to the historical covariance matrix. 2.1 Write out C in terms of a, b, c, and d. 2.2 Is this adjustment always safe? Why? The Two Beta Trap (8 Points) 1 Complete the table below by indicating whether the statement in the leftmost column is true (T) or false (F) under the Single Factor Model of Covariance (Sharpe 1963) and the Capital Asset Pricing Model (CAPM) Proposition The in this model are the regressions of against the returns of the market portfolio. The ideally weighted indexing portfolio is necessarily mean-variance efficient Single Factor Model Capital Asset Pricing Model The model makes special assumptions about the covariance structure of the distribution of returns For asset i, the higher the Bi the higher its expected return 2 Covariance Adjustments Assume that Assume thatcd is a covariance matrix estimated from historical data. Consider a new matrix C defined as follows a b where D is an adjustment to the historical covariance matrix. 2.1 Write out C in terms of a, b, c, and d. 2.2 Is this adjustment always safe? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts