Question: Search 32 insert -0 8 Draw Document1 - Saved to this PC Layout References Mailings Design Review View Help G - 5 $33,500 REVENUES Sales

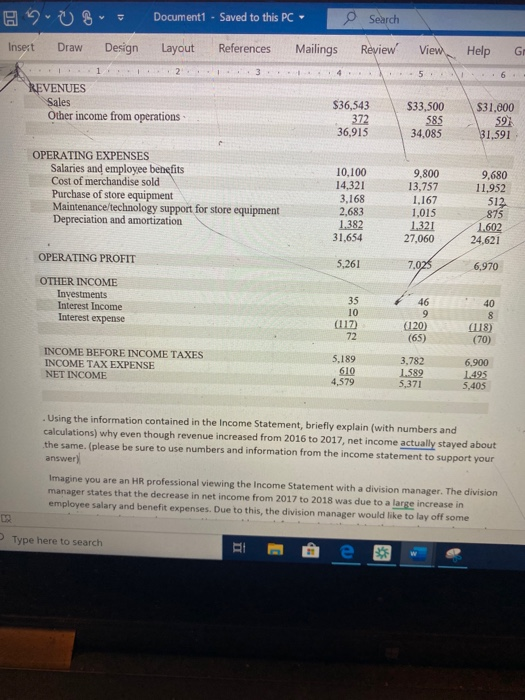

Search 32 insert -0 8 Draw Document1 - Saved to this PC Layout References Mailings Design Review View Help G - 5 $33,500 REVENUES Sales Other income from operations $36,543 372 36,915 585 $31,200 59 31,591 34,085 OPERATING EXPENSES Salaries and employee benefits Cost of merchandise sold Purchase of store equipment Maintenance/technology support for store equipment Depreciation and amortization 10,100 14,321 3.168 2.683 1.382 31,654 9,800 13,757 1,167 1,015 1.321 27.060 9,680 11,952 512 875 1.602 24,621 OPERATING PROFIT 5,261 7.025 6,970 40 OTHER INCOME Investments Interest Income Interest expense (117) (120) (65) (118) (70) INCOME BEFORE INCOME TAXES INCOME TAX EXPENSE NET INCOME 5.189 610 4,579 3,782 1.589 5,371 6.900 1.495 5,405 Using the information contained in the Income Statement, briefly explain (with numbers and calculations) why even though revenue increased from 2016 to 2017, net income actually stayed about the same. (please be sure to use numbers and information from the income statement to support your answer) Imagine you are an HR professional viewing the Income Statement with a division manager. The division manager states that the decrease in net income from 2017 to 2018 was due to a large increase in employee salary and benefit expenses. Due to this, the division manager would like to lay off some Type here to search

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts