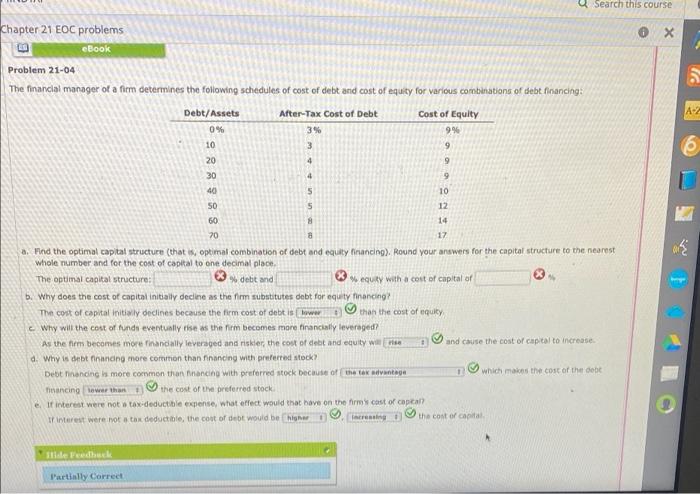

Question: Search this course Chapter 21 EOC problems eBook 0 x A-Z 9 88 $ % 85 Problem 21-04 The financial manager of a fim determines

Search this course Chapter 21 EOC problems eBook 0 x A-Z 9 88 $ % 85 Problem 21-04 The financial manager of a fim determines the following schedules of cost of debt and cost of equity for various combinations of debt financing Debt/Assets After-Tax Cost of Debt Cost of Equity 0% 3% 9% 10 3 9 20 9 30 40 5 10 5 12 60 14 20 8 17 a. Find the optimal capital structure that optimal combination of debt and equity financing). Round your answers for the capital structure to the nearest whole number and for the cost of capital to one decimal place The optimal capital structure: % debt and equity with a cost of capital or b. Why does the cost of capital initially decine as the firm substitutes debt for equity financing? The cost of capital initially declines because the firm cost of debt is low than the cost of equity Why will the cost of funds eventually rise as the firm becomes more financially leveraged? As the firm becomes more inandally leveraged and riskler, the cost of debt and equity wise and cause the cost of capital to increase d. Why is debt finanong more common than financing with preferred stock? Debt handing is more common than ancing with preferred stock because of the tax advantage 1 which makes the cost of the debe mancing tower than 1 the cost of the preferred stock e If interest were not tax deductible expense, what effect would that have on the cost of capital ir interest were not a tax deductible, the cost of debt would be higher Free the cost of capital Partially Correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts