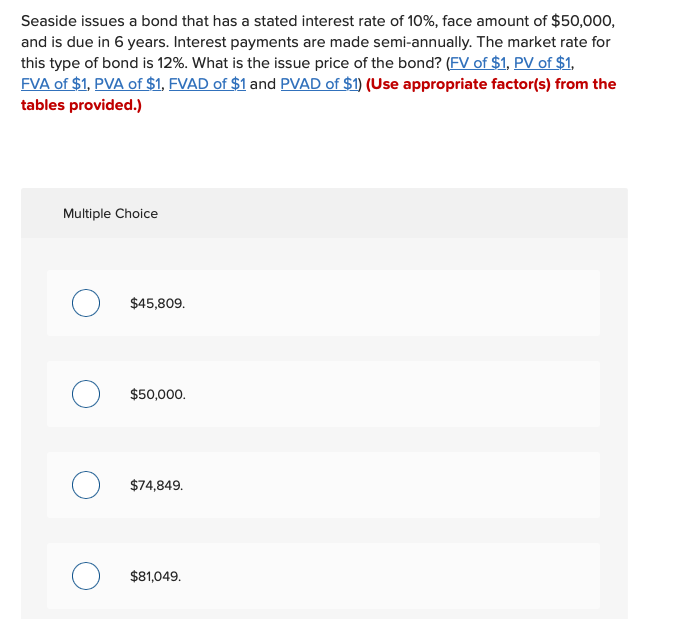

Question: Seaside issues a bond that has a stated interest rate of 10%, face amount of $50,000, and is due in 6 years. Interest payments are

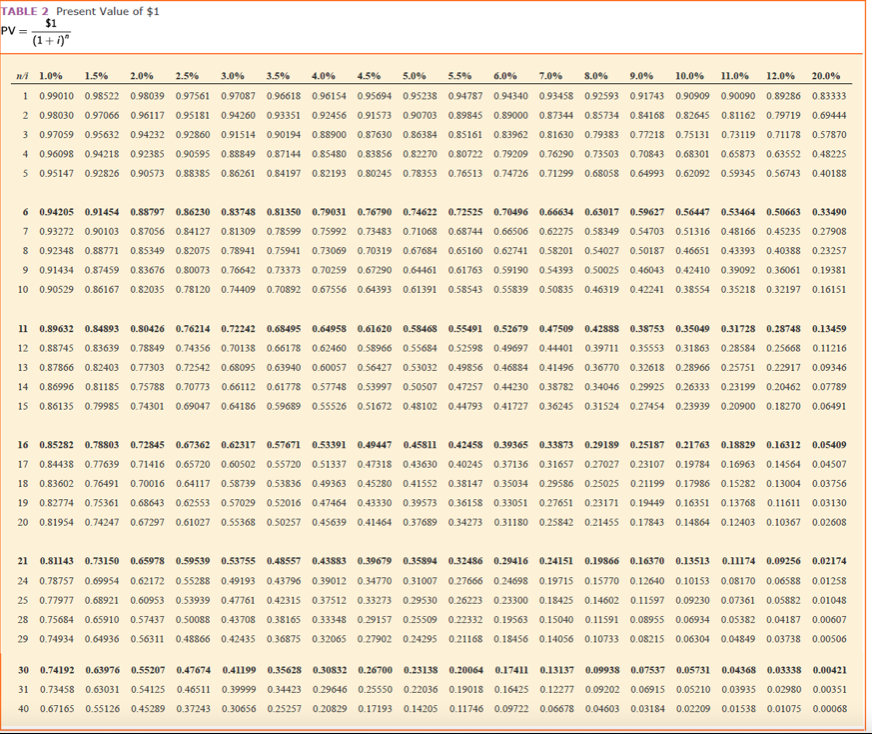

Seaside issues a bond that has a stated interest rate of 10%, face amount of $50,000, and is due in 6 years. Interest payments are made semi-annually. The market rate for this type of bond is 12%. What is the issue price of the bond? (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1 ) (Use appropriate factor(s) from the tables provided.) Multiple Choice $45,809. $50,000. $74,849. $81,049. TABLE 2 Present Value of $1 PV=$1

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock