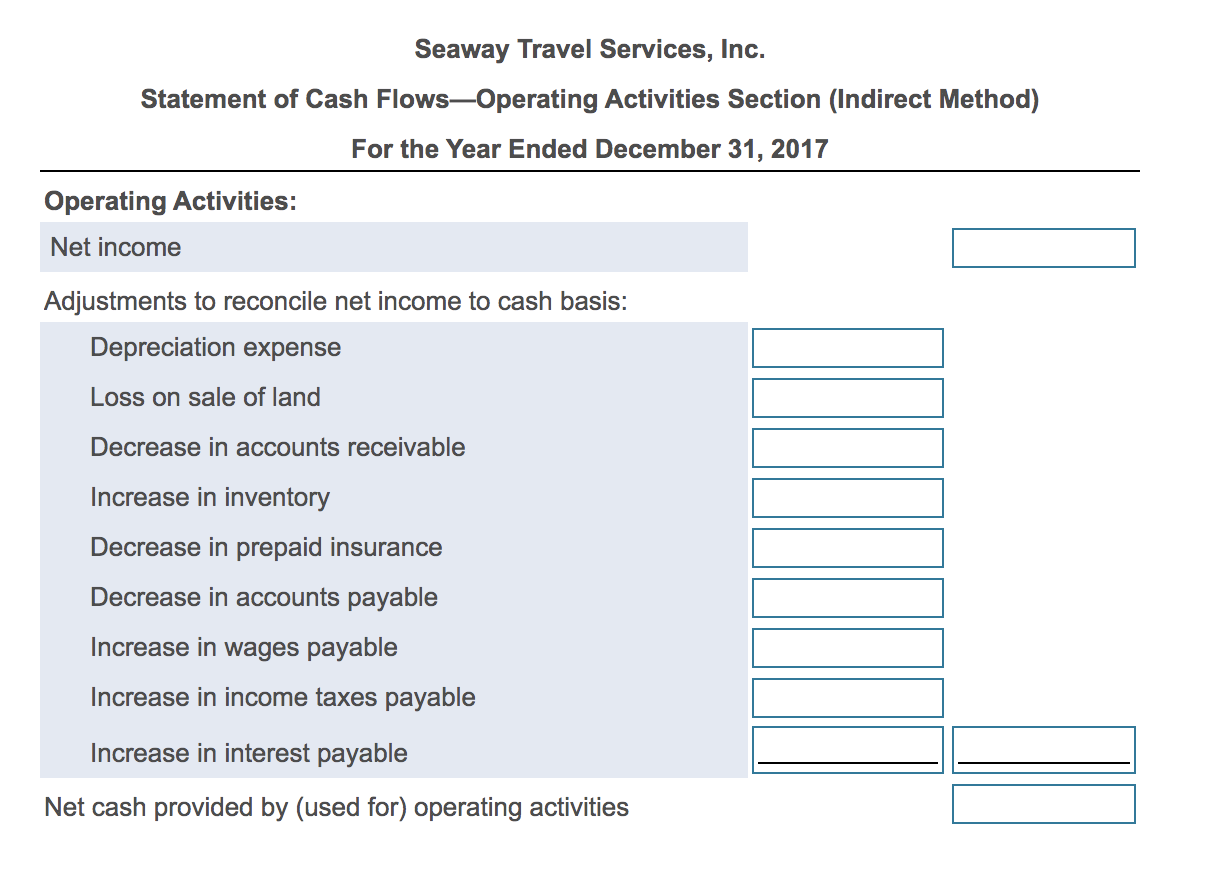

Question: Seaway Travel uses the indirect method for preparing the statement of cash flows. Prepare the operating section of the statement of cash flows for 2017.

Seaway Travel uses the indirect method for preparing the statement of cash flows. Prepare the operating section of the statement of cash flows for 2017. (Use parentheses or a minus sign for numbers to be subtracted or net cash outflow.)

Seaway Travel uses the indirect method for preparing the statement of cash flows. Prepare the operating section of the statement of cash flows for 2017. (Use parentheses or a minus sign for numbers to be subtracted or net cash outflow.)

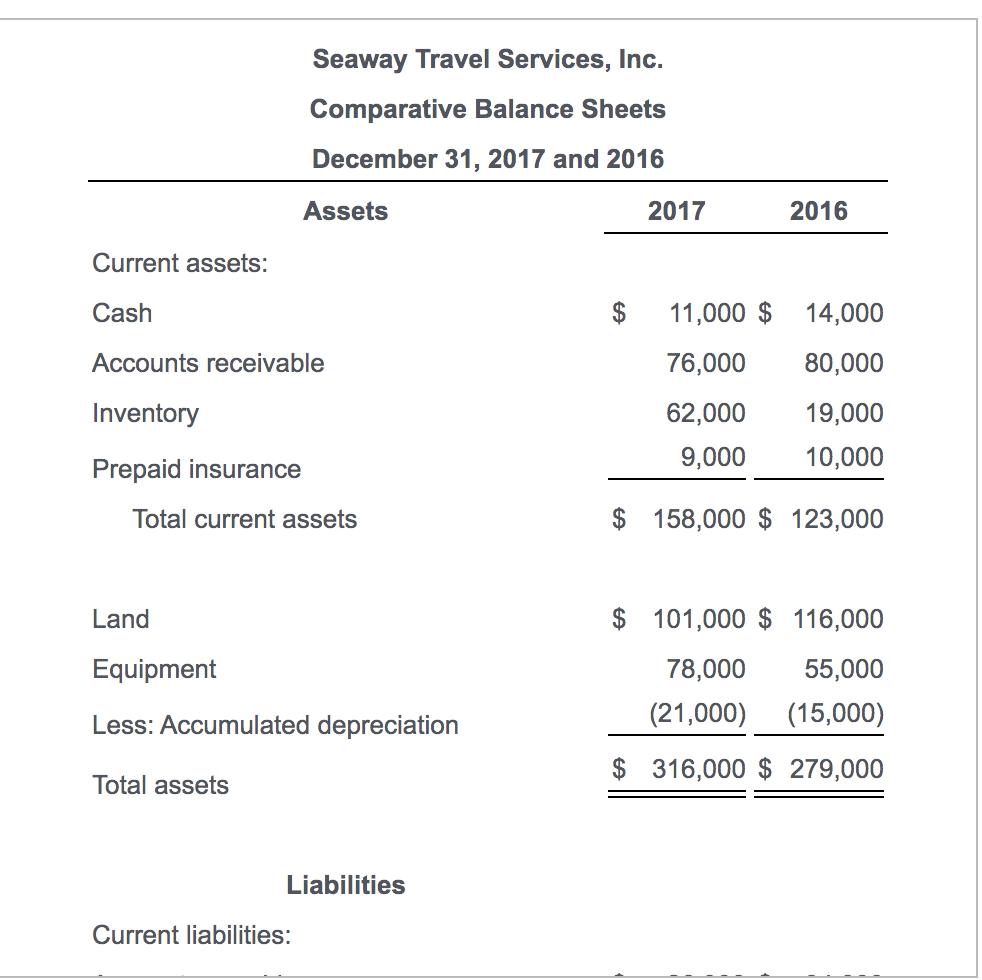

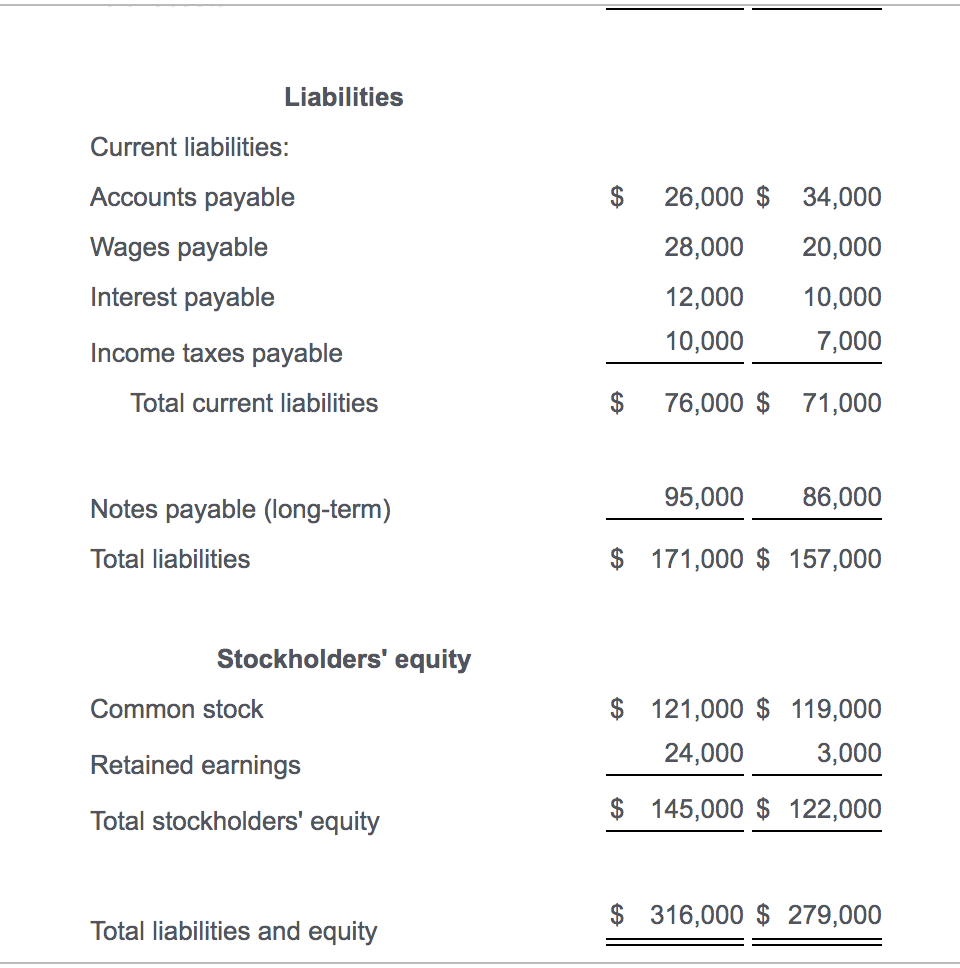

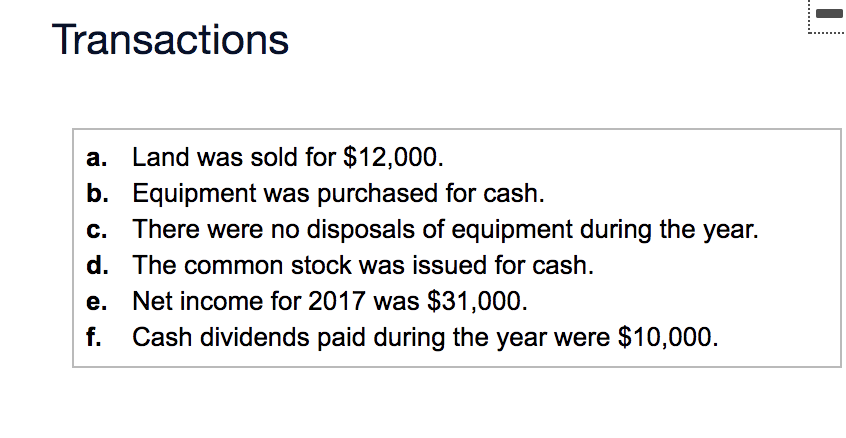

Seaway Travel Services, Inc. Statement of Cash FlowsOperating Activities Section (Indirect Method) For the Year Ended December 31, 2017 Operating Activities: Net income Adjustments to reconcile net income to cash basis: Depreciation expense Loss on sale of land Decrease in accounts receivable Increase in inventory Decrease in prepaid insurance Decrease in accounts payable Increase in wages payable Increase in income taxes payable Increase in interest payable Net cash provided by (used for) operating activities Seaway Travel Services, Inc. Comparative Balance Sheets December 31, 2017 and 2016 Assets 2017 2016 Current assets: Cash $ 11,000 $ 14,000 Accounts receivable 76,000 80,000 Inventory 62,000 9,000 19,000 10,000 Prepaid insurance Total current assets $ 158,000 $ 123,000 Land Equipment $ 101,000 $ 116,000 78,000 55,000 (21,000) (15,000) Less: Accumulated depreciation $ 316,000 $ 279,000 Total assets Liabilities Current liabilities: Liabilities Current liabilities: 26,000 $ 34,000 Accounts payable Wages payable Interest payable 28,000 20,000 12,000 10,000 10,000 7,000 Income taxes payable Total current liabilities $ 76,000 $ 71,000 Notes payable (long-term) 95,000 86,000 Total liabilities $ 171,000 $ 157,000 Stockholders' equity Common stock $ 121,000 $ 119,000 24,000 3,000 Retained earnings Total stockholders' equity $ 145,000 $ 122,000 $ 316,000 $ 279,000 Total liabilities and equity Transactions a. Land was sold for $12,000. b. Equipment was purchased for cash. c. There were no disposals of equipment during the year. d. The common stock was issued for cash. e. Net income for 2017 was $31,000. f. Cash dividends paid during the year were $10,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts