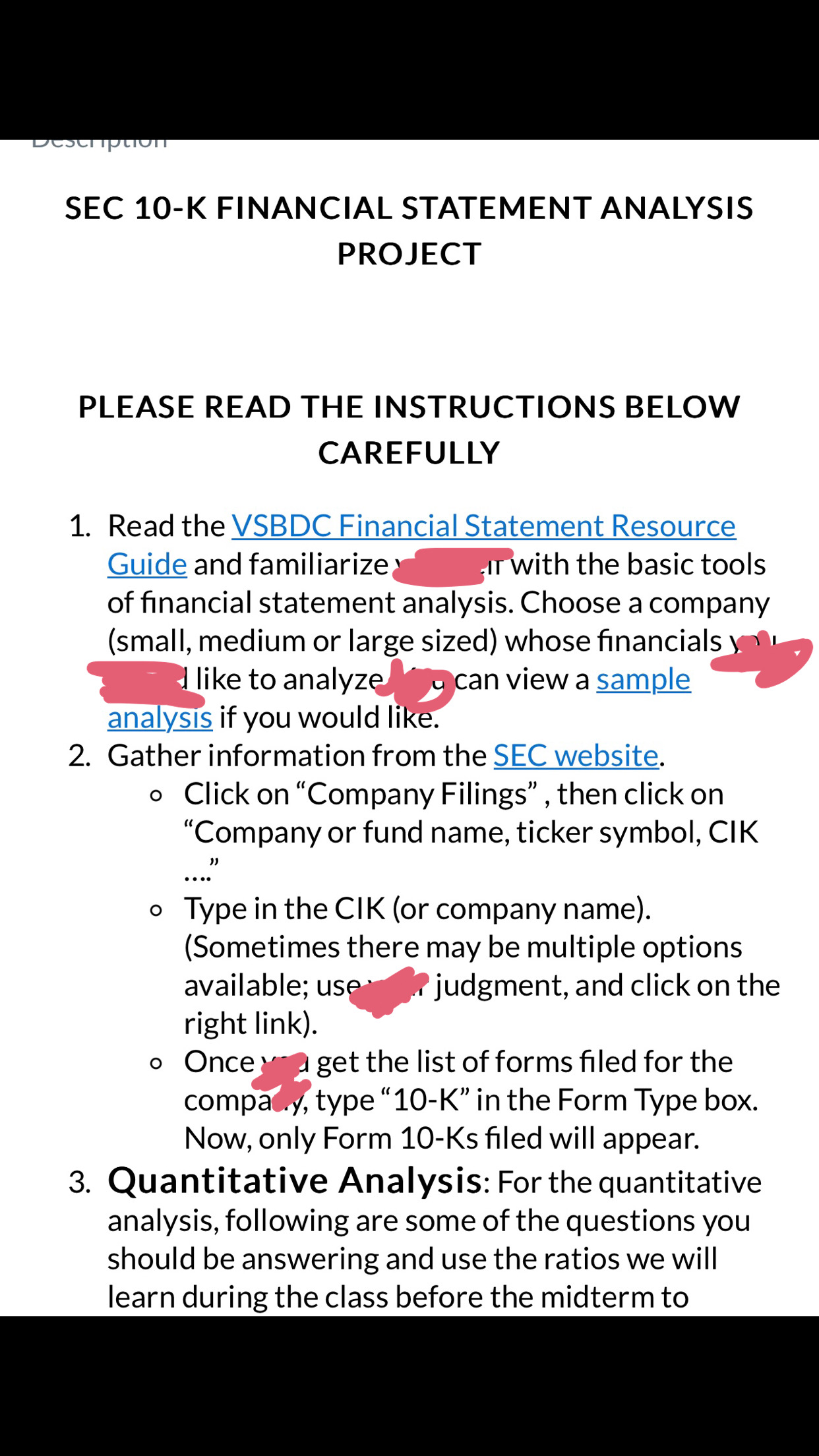

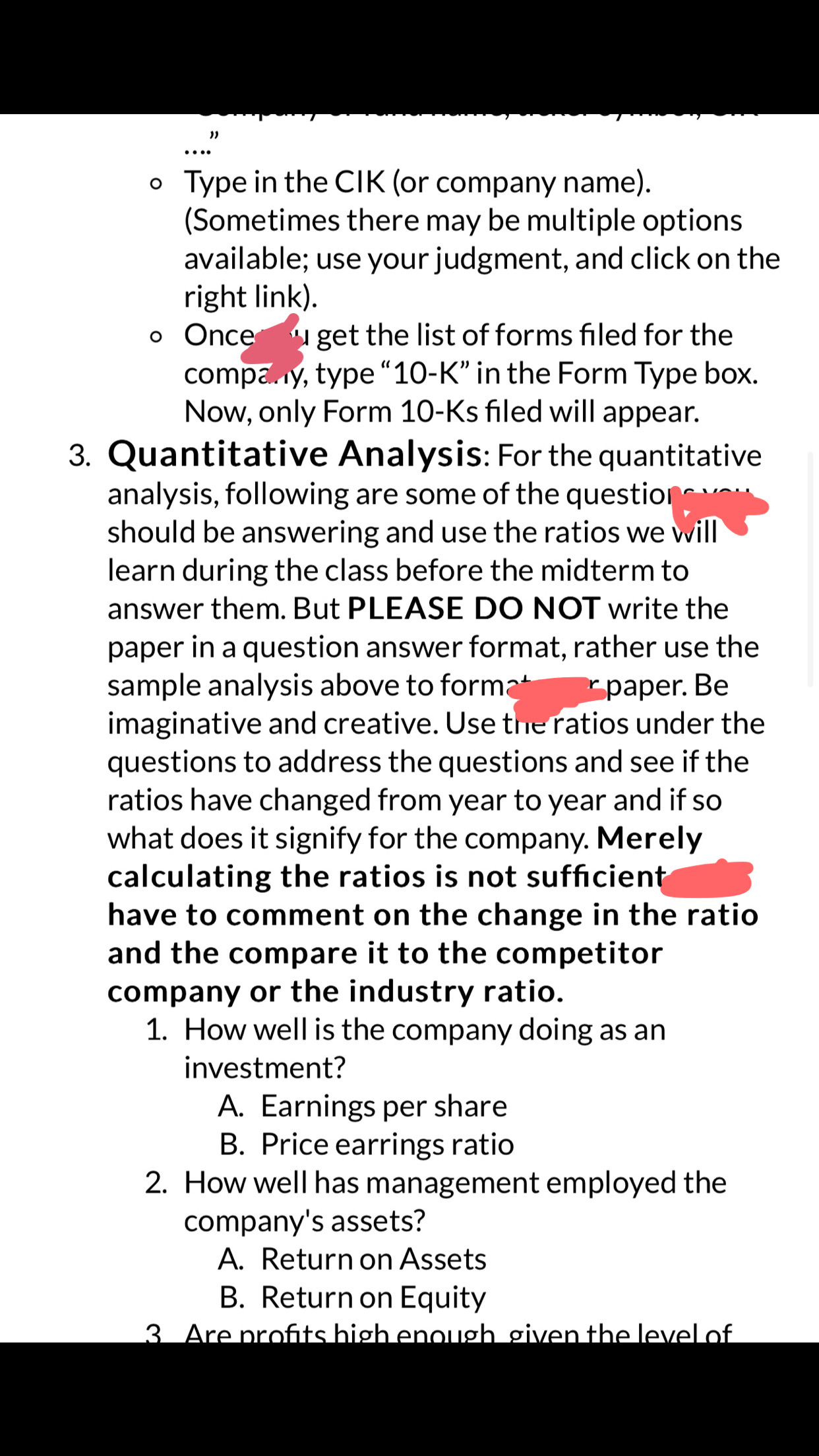

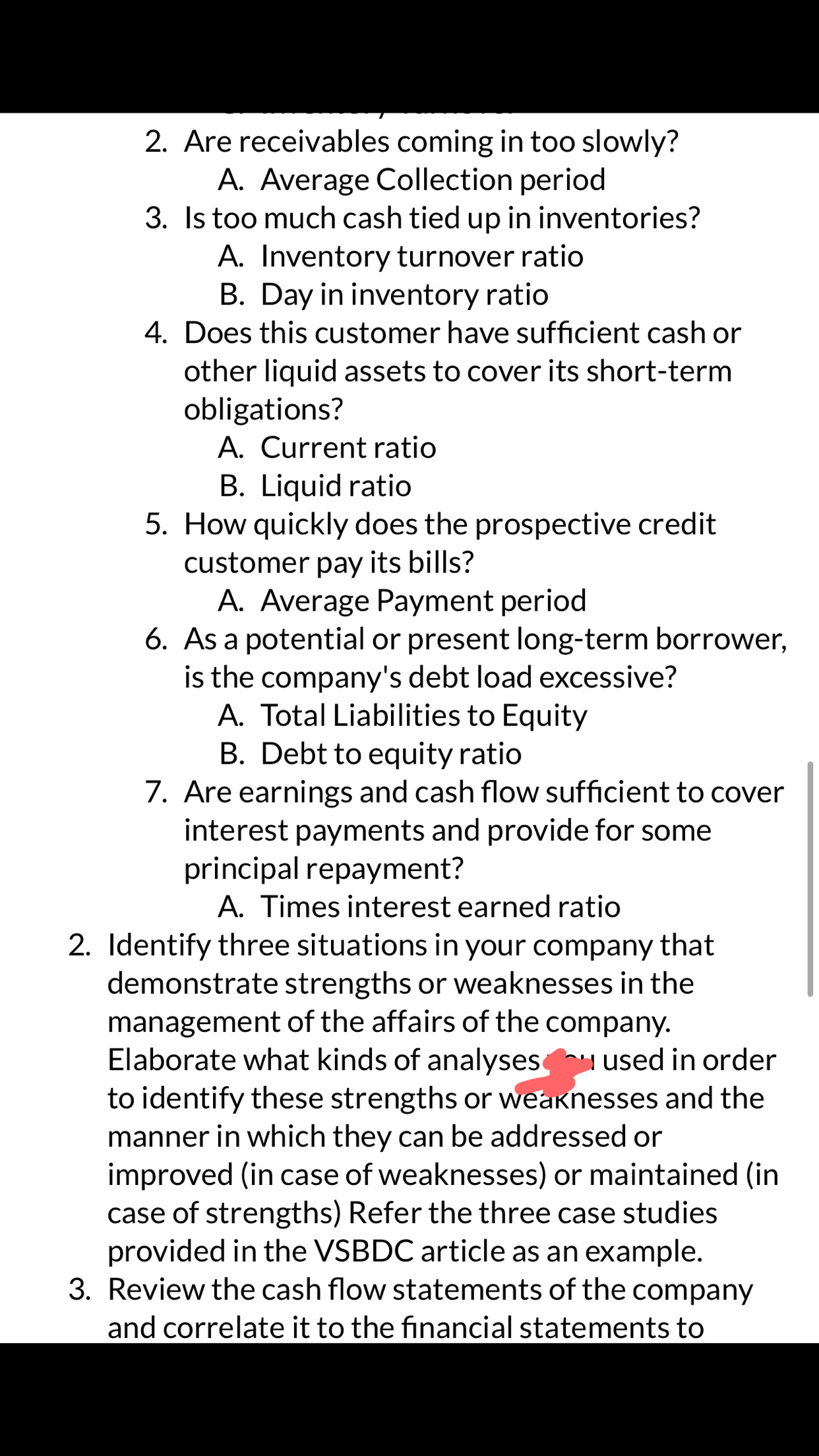

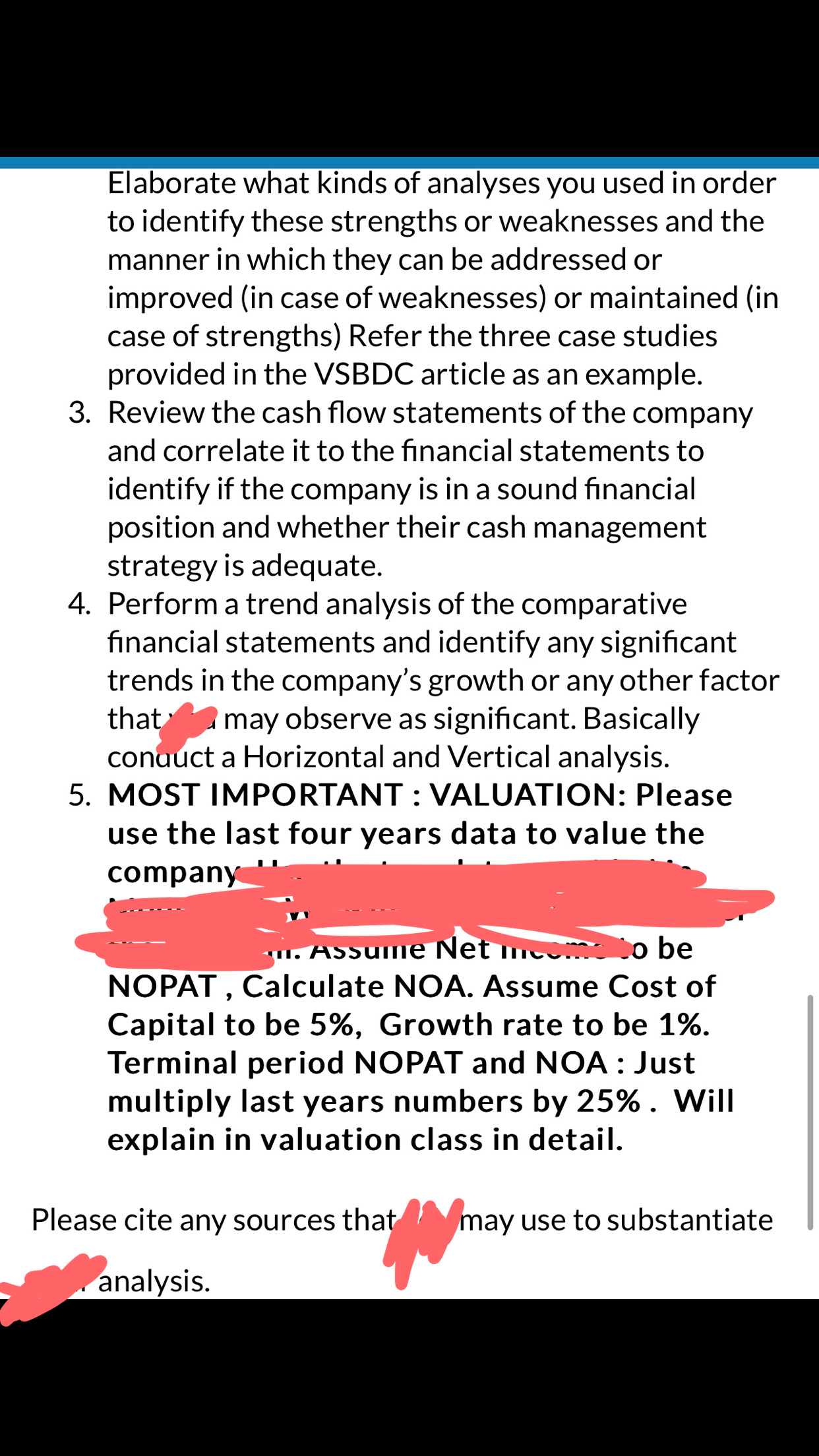

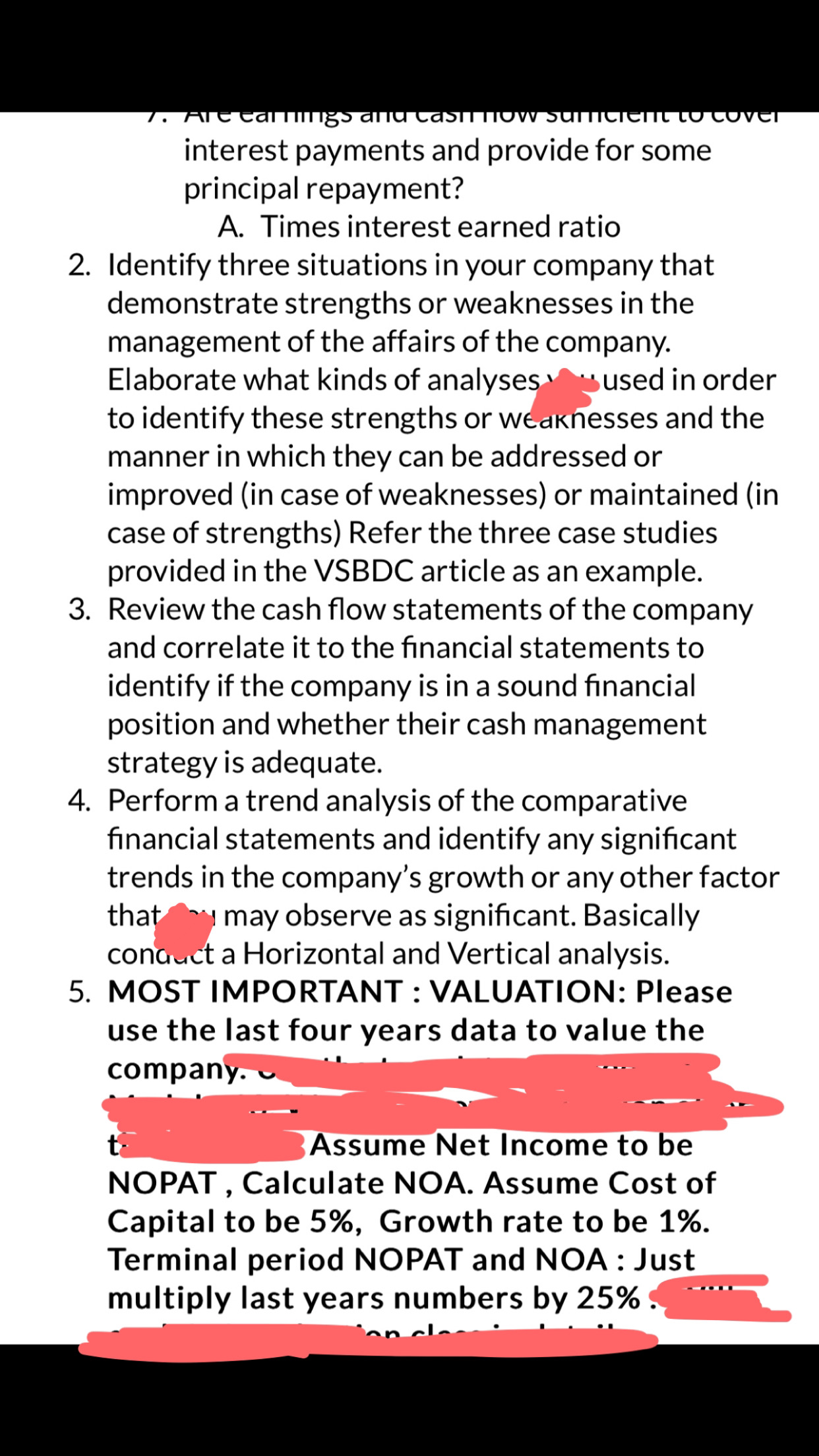

Question: SEC 10-K FINANCIAL STATEMENT ANALYSIS PROJECT PLEASE READ THE INSTRUCTIONS BELOW CAREFULLY 1. Read the VSBDC Financial Statement Resource Guide and familiarize IT with the

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock