Question: Sec B: Total 20 Marks: Compulsory Q4. JB plc operates a standard marginal cost accounting system. Information relating to product J, which is made in

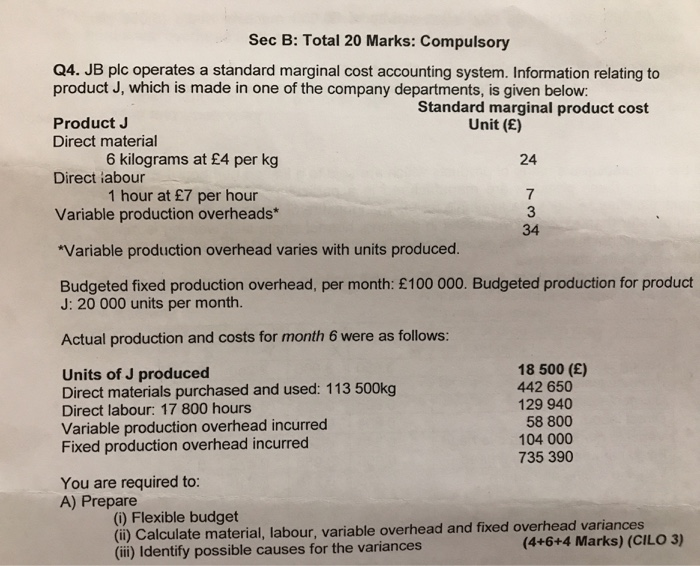

Sec B: Total 20 Marks: Compulsory Q4. JB plc operates a standard marginal cost accounting system. Information relating to product J, which is made in one of the company departments, is given below: Standard marginal product cost Product J Unit () Direct material 6 kilograms at 4 per kg Direct labour 1 hour at 7 per hour Variable production overheads* *Variable production overhead varies with units produced. Budgeted fixed production overhead, per month: 100 000. Budgeted production for product J: 20 000 units per month. Actual production and costs for month 6 were as follows: Units of J produced 18 500 (E) Direct materials purchased and used: 113 500kg 442 650 Direct labour: 17 800 hours 129 940 Variable production overhead incurred 58 800 Fixed production overhead incurred 104 000 735 390 You are required to: A) Prepare (0) Flexible budget (ii) Calculate material, labour, variable overhead and fixed overhead variances (iii) Identify possible causes for the variances (4+6+4 Marks) (CILO 3)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts